Written by: David Lebovitz

During the darkest days of the pandemic, consumers were able to consume goods but not services. This is very different from what is typically observed during periods of economic stress – nearly all of the reduction in consumer spending during the financial crisis came from a reduction in spending on goods, whereas during COVID, 67% of the reduction in spending came from services. Reopening the economy made it easier to consume services, but consumers continued gobbling up goods at a rapid clip.

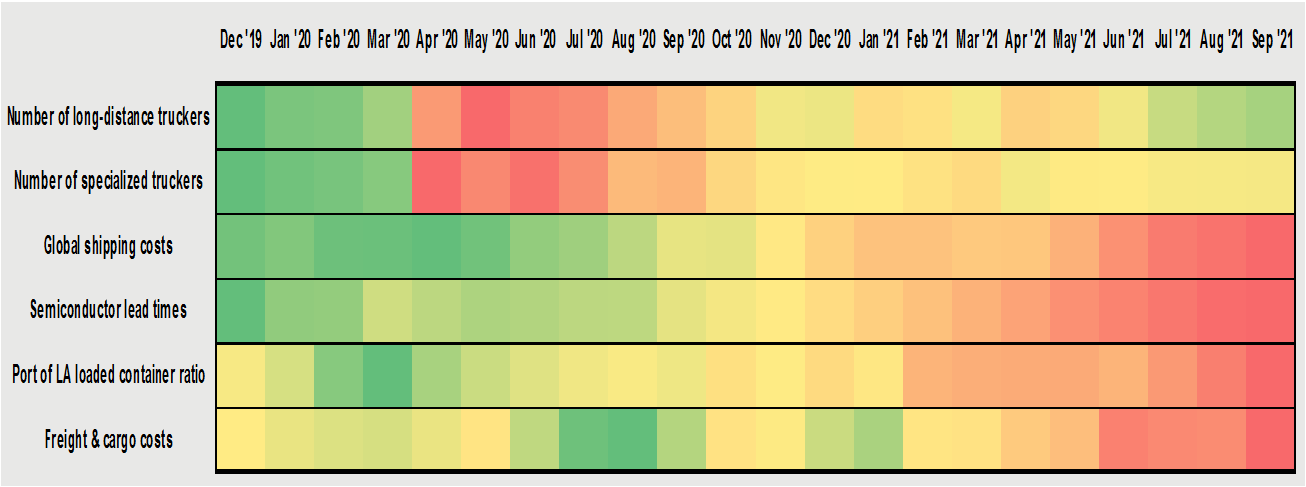

As inventories were drawn down it became increasingly difficult to rebuild them. Southeast Asia has seen many governments maintain a zero-COVID policy, leading factories to temporarily shut down whenever a worker tests positive. Furthermore, entire crews are forced to quarantine outside of port if somebody on a shipping vessel tests positive for COVID, and even once cargoes are unloaded it can be difficult to find workers to transport these goods to their final destination. Below are some numbers that help quantify what is happening:

- Freight and cargo costs have jumped more than 50% since the pandemic began

- The ratio of loaded containers to empty containers at the port of Los Angeles stood a 1.6X in September (its lowest reading in the past 20 years)

- The cost of shipping a 40ft container rose 28.5% in 3Q20 and 137.9% since the start of the year

- The number of specialized truckers in the United States has fallen by 22,000 since December 2019; the number of long-distance truckers has fallen 14,000 over that same time period

Semiconductors have come into focus as one of the best examples of the supply constraints faced by the global economy. In normal times, manufacturing a simple semiconductor wafer takes an average of twelve weeks. However, this can take up to twenty weeks for more advanced chips. Additionally, once the chips are manufactured, they must then go through a process known as assembly, test, and packaging (ATP) which can take another six weeks.

It is unclear how long it will take for the semiconductor shortage to resolve itself, but it looks set to remain an issue well into next year. As we noted in our 3Q21 earnings bulletin, automakers have highlighted that chip shortages weighed on production in 2H21, and companies in the industrial sector acknowledged that while things are improving, semiconductor supplies are still constrained. With semiconductor companies working to increase production and capacity, the consensus view seems to be that chip shortages will persist through the first half of 2022 before beginning to improve during the second half of the year.

Supply chain issues should persist into next year

Monthly, Dec. 2019 - present

Source: Bureau of Labor Statistics, Drewry, Susquehanna Financial Group, Port of Los Angeles, FactSet, J.P. Morgan Asset Management. Global shipping costs: Drewry World Container Index; Freight & cargo costs: PPI selected commodities - Arrangement of freight and cargo. Number of long-distance and specialized truckers are as reported by the BLS and represent all employees within each category; September 2021 is a forecasted value. Semicondcutor lead time is the time between ordering a chip and delivery. The Port of LA loaded container ratio is calculated by dividing the total number of loaded containers by the total number of empty containers. All data are as of October, 30, 2021.