Written by: David Lebovitz and Nimish Vyas

Energy prices rose steadily through the end of summer and into the fall, as continued demand was met with more constrained supply due to Saudi and Russian production cuts. While higher oil and gas prices are a direct tax on the consumer, they are a tailwind for energy sector revenues and profits. This fundamental support has been reflected in performance, with the energy sector +3.9% year-to-date, making it the best performing sector outside of technology, consumer discretionary and communication services.

At first glance, the jump in energy equities may seem like a temporary phenomenon, but a variety of economic factors could support the sector’s performance over the longer-term. To start, energy companies have changed their approach in recent years, transitioning away from a business model focused on volume to one focused on profits and cash flows. This renewed focus on capital discipline and delivering shareholder returns will likely stay in place, keeping oil breakeven prices high and dissuading firms from introducing more supply.

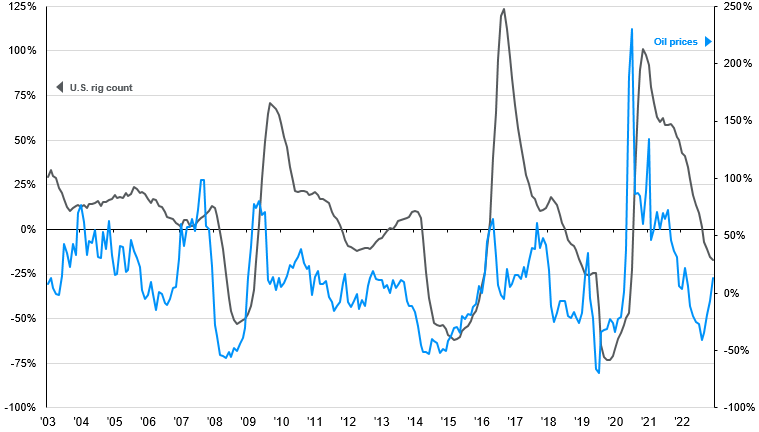

Furthermore, a “higher for longer” interest rate environment will restrict new investment focused on wells and rigs, and despite political pressure to rein in energy prices, the U.S. shale industry is unlikely to expand production. This hesitancy has been further illustrated in the details of recent M&A transactions, where large drillers have taken over smaller firms and retired legacy rigs instead of continuing operations. Evidence of this is clear, as the total U.S. rig count is down ~20.4% from the December 2022 peak.

Higher breakevens and limited production is a powerful combination and should support robust cash flows and dividends from energy companies going forward. In fact, the energy sector is currently sporting a shareholder yield of 8.2% (dividends + buybacks), with the next highest yielding sector being financials at 4.8%. Lastly, with oil inventories so low, any additional supply introduced by Saudi and Russia in the coming months could be interpreted as a sign of increasing demand and support price appreciation in the energy sector. Clearly, there are reasons to be energized about the opportunity in energy.

U.S. rig count and WTI crude oil prices

Year-over-year % change in total rig count and WTI crude oil prices, last 20 years, monthly

Source: FactSet, J.P. Morgan Asset Management. All data are as of October 23, 2023.