Written by: AJ Rivers, CFA, FRM, CAIA and Matthew Scott

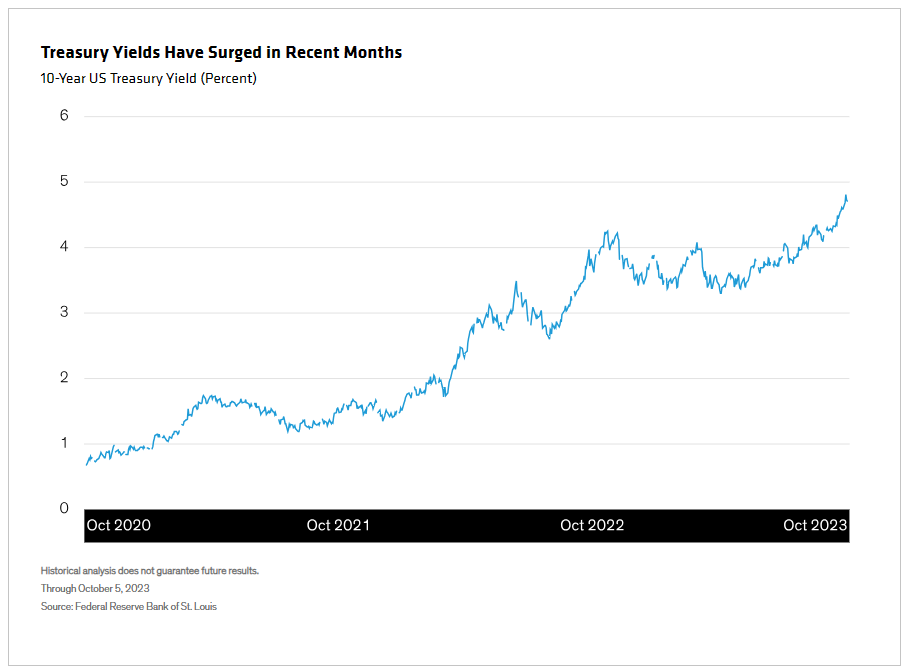

US Treasury yields have surged, with the 10-year yield briefly topping 4.8% and the 30-year yield breaching 5% (Display). Bond prices are now at 17-year lows, and investors are worried they could fall further. The latest catalysts? The ballooning budget deficit and an unexpectedly strong jobs report. Volatility may persist and yields may continue to climb over the near term, but we think slower economic conditions will eventually put the brakes on the rate climb. Here’s why.

Technical Conditions Are in the Driver’s Seat—for Now

Technical conditions—the dynamics of supply and demand—are out of balance in today’s bond market. That is, bond prices have succumbed to selling pressures because marginal buyers have so far failed to materialize. We see a number of contributing factors.

First, the sell-off has developed momentum thanks to a series of triggering events since early this year. In April, it was the resolution of the banking crisis. In May, the debt ceiling debate. June saw better-than-expected growth, and July concerns around Treasury supply. August saw reduced liquidity, as is typical of late summer. September brought breaches of technical support, with prices reaching new lows when quantitative strategies and momentum followers that trade based on technicals shorted the market. A dearth of counterparties exaggerated the effect on valuations.

Second, foreign buyers have been selling US debt in the continuation of a longer-term trend. China’s holdings of US Treasuries, for example, are down about $175 billion since last year. Japan, the largest non-US holder of Treasuries, has also been trimming its position.

Third, in the last couple of weeks, fund flows have begun to slow, following strong flows of more than US$200 billion into core and government bond funds year to date. This has put a crimp into marginal buying, since asset managers in aggregate are already long duration and have little dry powder left. Dealers have been slow to provide a backstop. And banks are reluctant to extend duration, with the regional banking crisis still in the rearview mirror.

Fundamentals Point to a “Braking” Point

To our mind, today’s macro picture doesn’t support an extended sell-off, which historically has accompanied a very different set of economic conditions. For example, fundamentals look quite different today than in October 2022, when yields reached prior peaks.

Then, the fed funds rate was at 2.5%. Today it’s at 5.5%. Then, the Federal Reserve had just begun its aggressive hiking cycle. Today, the Fed is likely finished raising rates—or close to it. Then, consumer price inflation (CPI) was at 8.2%. Today, it’s at 3.7%—with core CPI running 2.5% and approaching the Fed’s target. The consumer is softening, too.

The outlier among economic conditions is the labor market. September’s addition of 336,000 workers is the strongest since January. Clearly, the jobs market is still strengthening, albeit at a slower rate than in 2022. This means the Fed will need to see tangible evidence of slower growth to have confidence in the inflation outlook.

We don’t think we’ll have to wait forever. Higher yields mean tighter financial conditions, which in turn weigh on growth. We expect yields to trend lower as data weakens in the coming months.

Once the tide begins to turn, sidelined cash should flood back into the market, rapidly driving yields down and prices up. In the meantime, elevated yields are good for bond investors, since over time most of a bond’s return comes from its yield.

That’s why, with yields at once-in-a-generation highs, we believe the current bond rout is creating exceptional opportunity for tomorrow.

Related: How To Invest in Stocks for the Next Phase of China’s Evolution