Written by: Jack Manley

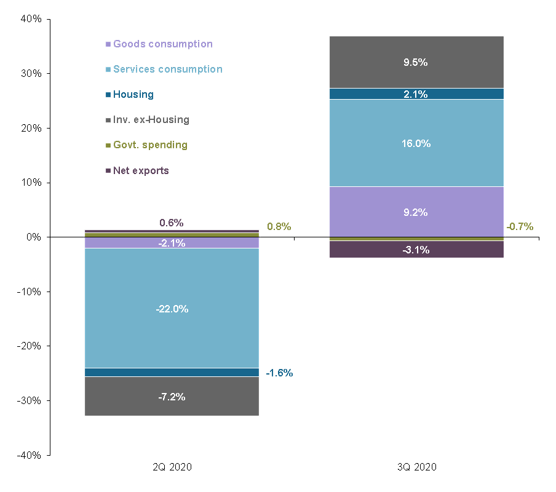

The 3Q 2020 GDP print revealed the full strength of the U.S. economic rebound in the aftermath of one of the worst recessions in living memory with an increase of 1.3 trillion USD (an annualized 33.1%), the best quarter on record. While the strength of the report comes as no surprise given the re-opening activities of the past six months, many investors may still wonder: what made 3Q growth so strong? Looking at the underlying components, it is clear that the recovery has generally been broad-based. Consumption, the largest part of the economy, contributed 25 percentage points to the 33% growth increase, chiefly through a strong but partial bounce back in services after a collapse in 2Q, with particular strength in health care, food services and accommodations.

On the goods front, motor vehicle and apparel sales were also bright spots. Private investment also ticked up substantially, with residential and equipment investment boosting growth alongside a surge in private inventories, likely a result of companies restocking after pandemic-related demand depleted stocks in the first half of the year; still, these are comparatively small parts of the economy. Not all components of the economy contributed to the recovery, though. Government investment, particularly federal, detracted from growth thanks to the absence of additional fiscal stimulus; and net exports, already a detractor from GDP because of a large U.S. trade deficit, fell on a stronger recovery in imports than exports.

Still, investors must remember that this record-high GDP print comes immediately after a record-low one, a loss of 1.7 trillion USD or -31.4% annualized in 2Q, itself following a 200 billion USD fall in 1Q. As it stands now, real GDP is still roughly 670 billion USD, or 3.5%, below the 4Q 2019 level, and still lower than where it would have been without the pandemic. With new cases increasing, the rate of growth will slow considerably until a vaccine is manufactured and widely distributed. Thereafter, growth should surge as consumers eagerly pour money into the economy. Until then, though, investors should recognize that there is still a long road to recovery and continue to exercise caution.

3Q growth was the strongest ever, but 2Q growth was the weakest ever

Real GDP growth by component, QoQ saar

Related: How Will the U.S. Election Impact International Markets?