Written by: Jordan Jackson

The nominal U.S. 10-year Treasury yield troughed in early April at 3.28% following the peak in regional bank stresses but have since moved higher by almost of full percentage point, settling at ~4.2% at time of writing. In our view, there are several reasons, both fundamental and technical, that have contributed to the move:

1. Still robust incoming data relative to weak leading indicators. While the probability of a soft landing has risen given the generally strong incoming data, the concern is that most leading indicators continue to point to recession.

The Conference Board’s Leading Economic Indicators Index1, which leads turning points in the business cycle by around 7 months has declined for 15 consecutive months—the longest streak since 2007-08—and is deeply negative year-over-year. Meanwhile, the coincident index2 has risen 0.6% since the start of the year. To the extent leading indicators are suppressing market forecasts, it’s not surprising we’ve seen an increase in incoming data surprising to the upside relative to expectations, putting upward pressure on yields.

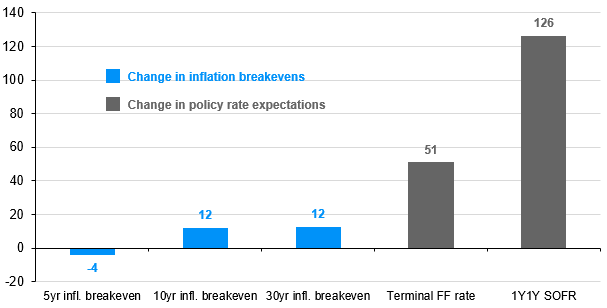

2. Pushing out rate cuts, not pulling forward more hikes. The Federal Reserve is discussing rate cuts next year in the context of gradually declining, though still above target, inflation. While some may see this as the Fed growing more tolerable of inflation, 5-year inflation breakevens are lower, while 10-year and 30-year inflation breakevens are a few basis points (bps) higher suggesting markets don’t anticipate the Fed will be more amenable to higher inflation.

Meanwhile, terminal rate3 pricing has drifted up by about 50 bps since the beginning of April, with the larger repricing being the 1y1y policy rate4 which is ~125 bps higher. Essentially, the driver of higher yields particularly in May and June was the market expecting the Fed to keep rates higher for longer, not just more hikes this year.

3. More U.S. Treasury supply. The U.S. Treasury boosted its estimate for federal borrowing in 3Q23 and 4Q23 to USD 1 trillion and USD 852 billion, respectively, bringing additional Treasury supply to the market. In addition, the Treasury is targeting a higher cash balance of USD 750 billion for the Treasury General Account (TGA) by year end5.

This additional supply is at a time when the Fed is shrinking its holdings of Treasuries, a process that effectively forces the government to sell more to the public.

4. Fitch downgrade of U.S. debt. While a surprise to many, the market reaction of Fitch’s downgrade to of U.S. Treasury debt was short-lived. The 10-year rose near the announcement; however, if increased credit risk and default fears spurred the sell-off, credit default swap (CDS) spreads on U.S. debt should have arguably widened further (+4 bps). Instead, they generally remain well-behaved.

5. Surprise policy adjustment from the Bank of Japan (BOJ). All things equal, the loosening of yield curve control (YCC) could weaken foreign demand for U.S. Treasuries. As Japanese rates rise, and their curve steepens relative to the U.S. Treasury curve, that makes JGBs more attractive to Japanese investors.

6. Mean reverting valuations. Our fundamental driven 10-year fair value model indicated the U.S. 10-year had been trading at a premium, suggesting that the recent sell-off reflects yields mean reverting to fair value.

In summary, improved prospects for economic growth and a Fed on hold for longer have contributed to the move higher in rates. In addition, more Treasury supply, potential softening demand from foreign investors and valuations likely added another layer of pressure on yields.

For investors, is now the time to add duration or will there be another move higher in rates? It is a tough call, but we see risked skewed to the downside for yields. We’re likely to stabilize at current levels, followed by cooling inflation and growth dynamics biasing yields lower. Given the level of rates and income bonds now provide, it would benefit investors to leg into duration with yields above 4%.

Markets expecting higher for longer policy rates have pushed yields higher, not a shift in long-run inflation expectations

Change between 4/05/23 to 8/14/23, basis points

Source: Bloomberg, Federal Reserve, J.P. Morgan Asset Management. Data are as of August 14, 2023.

Related: Will U.S. Investment Grade Credit Spreads Remain Tight Amid Economic Uncertainty?