Written by: David Lebovitz

Public equity markets fell sharply in 2022, but despite facing the same challenges of rising interest rates, elevated inflation and increasing uncertainty, private equity markets saw far less of a drawdown. Part of the reason for this was that companies backed by private equity firms were able to generate earnings that allowed them to “grow” into existing valuations; public markets, on the other hand, saw earnings decline. However, with public equities sporting positive returns on a year-to-date basis, many investors are asking what, if anything, this might mean for private equity going forward.

Although private markets have been more immune to the challenges plaguing the public side of the equation, they have not escaped completely unscathed. Fundraising activity has slowed meaningfully relative to the pace seen in prior years, and the cost of leverage has risen. As a result, deal activity has slowed, and exit activity has been put on ice. With this as the backdrop, it would not be surprising to see a more notable re-rating in valuations later this year or in early 2024; this, in turn, will create opportunity for both primary and secondary market investors.

With that said, many are concerned that the lackluster fundraising environment could impair the ability of private equity investors to take advantage of these opportunities as they arise. However, private equity investors sit on nearly USD 1 trillion in dry powder, which suggests that they will be able to capitalize on any adjustment in valuations. A higher cost of capital will lead to greater differentiation between winners and losers both in terms of companies and managers, but it is important to keep in mind that some of the best returns have been associated with funds that were raised in more challenging economic and capital market environments.

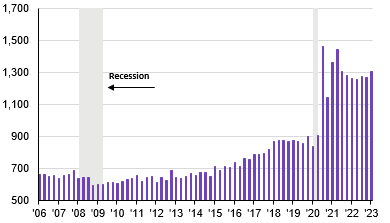

We also hear investors express concern about a shrinking private investment universe, and suggest that perhaps private equity investors are running out of new opportunities. However, applications for new business formation in the United States have increased notably since the pandemic began, with many of these businesses concentrated in both the services sector and technology. These businesses will all need funding in the years to come; with companies staying private longer and commanding higher valuations when they go public, we expect that private markets will play a key role in their growth and development over the longer-term.

U.S. applications for business formation

Seasonally adjusted, thousands

Source: Bureau of Labor Statistics, U.S. Census Bureau, J.P. Morgan Asset Management. Business formation data are as of 1Q23. Data are based on availability as of May 31, 2023.

Related: Have U.S. Equities Rallied Too Much?