Written by: Jordan Jackson

The general consensus from the business community is for a U.S. recession, albeit shallow, over the next 12-18 months. As of the second quarter, data from the Conference Board’s Measure of CEO Confidence suggest 87% of CEOs are preparing for a brief and modest recession within the next 4-6 quarters1. Interestingly, this is little changed from the 85% of respondents in the fourth quarter of last year. To a large extent, resilience in the labor market and some stabilization in the housing market may have delayed the expected slowdown by a quarter or two, but given the incoming data has yet to reflect the weakness in leading indicators, investors are looking for signs as to where the recession could come from.

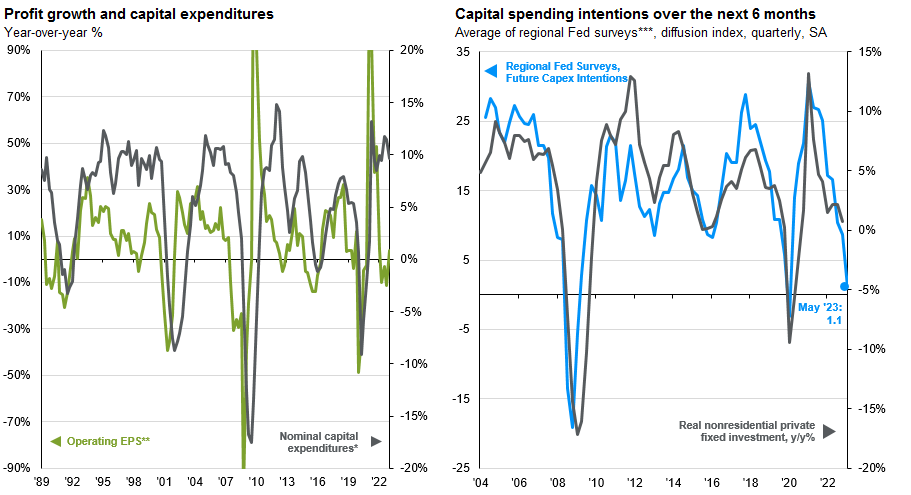

A new addition to the upcoming 3Q23 Guide to the Markets highlighted below, paints a sobering outlook for business capital spending, which accounts for almost 15% of economic growth. The combination of slower economic growth, higher interest rates and tightening credit conditions are likely to weigh on CapEx and could be the thing that tips the U.S. economy into a mild recession.

As shown, two important leading indicators of business spending: year-over-year growth in operating earnings per share (EPS) and survey measures from regional Federal Reserve (Fed) Banks2, both signal slowing in business investment in the quarters ahead. A decline in operating EPS leading to weak spending makes intuitive sense, when companies are earning less, they’re less inclined to put money into business investments, and vice versa. Moreover, Fed surveys also yield a tight fit with business spending and further corroborates businesses are planning to pull back on spending in the coming months.

To be clear, a recession is still a close call. Moreover, consumption remains the lion's share of economic activity and elevated wages due to persistent excess demand for labor could keep real personal consumption afloat helping to offset weak business investment. That said, as companies look to defend margins amid higher costs and slower growth, this will likely lead to weaker business spending first, followed by layoffs contributing to broader weakness in the labor market.

Source: BEA, FactSet, Federal Reserve Bank, Standard & Poor's, J.P. Morgan Asset Management. *Capital expenditures reflect seasonally adjusted nominal gross private domestic fixed investment (nonresidential) data from the BEA. **Historical operating EPS growth is adjusted to account for periods with outlier growth rates. ***Average includes the Chicago Fed, Philly Fed, Richmond Fed, Dallas Fed, Kansas City Fed and NY Fed manufacturing surveys of future capital expenditures. Data are as of June 27, 2023.

1The Conference Board Measure of CEO Confidence™ is a barometer of the health of the U.S. economy from the perspective of U.S. chief executives. The Measure of CEO Confidence™ is based on CEOs' perceptions of current and expected business and industry conditions. A total of 139 CEOs participated in the Q2 survey, which was fielded from April 10th through April 24th.

2The regional five Federal Reserve surveys include the Philly Fed, Richmond Fed, Dallas Fed, Kansas City Fed, and NY Fed. The surveys ask businesses what their plans are for capital expenditures over the next 6 months.

Related: What Trends Are Persisting Across Alternative Investments?