Written by: Jack Manley

With 2023 nearly in the rear-view mirror, many investors may be fatigued from what has been a tumultuous, largely unpredictable year. In many ways, 2023 can be used as evidence that asset allocators must learn to “expect the unexpected”: the U.S. economy avoided a recession, the Federal Reserve pushed interest rates higher, growth equity continued to outperform relative to value and the international recovery was largely lackluster.

Given all of this, when looking forward, many investors are asking a natural question: what is going to happen in 2024?

The outlook for next year can be summarized into three key themes.

- Converging global growth: Tighter lending standards, weaker job gains and lower savings should result in a slowdown in the U.S. economy, though a recession still seems unlikely given the resilience of the labor market and a very strong consumer. Japan, too, should see a pullback in consumption, dragging on output. Meanwhile, economic laggards of 2023 like Europe and China have the potential to accelerate, with European growth supported by cooling inflation boosting real incomes and Chinese growth underpinned by robust policy support. This in turn is supportive of international assets, which still have room for multiple expansion.

- Stepping out of cash and embracing active management: U.S. investors are overweight cash thanks to the perceived attractiveness of yields in instruments like Certificates of Deposit (CDs). With interest rates likely to move lower next year, this cash overweight is a risk. In fact, history has shown that high quality intermediate-duration fixed income has always outperformed cash in the 12 months following peak rates, and that large cap U.S. stocks have mostly outperformed, too. However, given significant dislocations in both stock and bond markets today, simply owning the indices will not suffice. Prudent security selection across asset classes, styles and sectors will be critical in an environment where the “beta-trade” has likely run its course.

- The growing importance of alternatives: With the U.S. equity market more structurally sensitive to interest rates, public market investors looking for uncorrelated sources of return will struggle. Moreover, as interest rates move lower next year, yield in fixed income will once again be harder to come by. For this reason, alternatives will likely play an important role in portfolios. Infrastructure assets can dampen portfolio volatility through low correlations to public equities; real estate can protect against structurally higher inflation with a strong income stream; and private equity and hedge funds can thrive in a market where index returns may be diminished.

All told, the investing landscape remains a challenge, and predicting the winners and losers in periods of uncertainty is nearly impossible. Instead, investors should diversify and lean on active management, stepping out of cash and into risk to take advantage of the anticipated changes ahead.

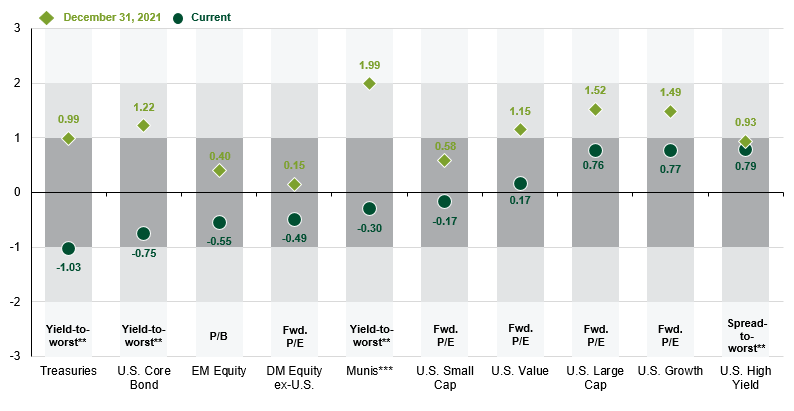

Asset class valuations

Z-scores based on 25-year average valuation measures*

Source: Bloomberg, BLS, CME, FactSet, MSCI, Russell, Standard & Poor’s, J.P. Morgan Asset Management.

U.S. Large Cap: S&P 500, U.S. Small Cap: Russell 2000, EM Equity: MSCI EME, DM Equity: MSCI EAFE, U.S. Value: Russell 1000 Value, U.S. Growth: Russell 1000 Growth, U.S. High Yield: J.P. Morgan Domestic High Yield Index, U.S. Core Bond: Bloomberg US Aggregate, Treasuries: Bloomberg U.S. Aggregate Government – Treasury, Munis: Bloomberg Municipal Bond. *Averages for U.S. High Yield and U.S. Small Cap are since January 1999 and November 1998, respectively, due to limited data availability. **Yield-to-worst and spread-to-worst are inversely related to fixed income prices. ***Munis yield-to-worst is based on the tax-equivalent yield-to-worst assuming a top-income tax bracket rate of 37% plus a Medicare tax rate of 3.8%. Data are as of December 11, 2023.