Written by: Eric Winogradand Kevin P. Tomassetti, CFA

Household expenditures account for more than two-thirds of US gross domestic product, making consumers the backbone of the US economy. It’s not surprising, then, that the household sector has kept the economy afloat in 2023—even on turbulent economic seas. Whether it was war in Ukraine, high inflation, interest-rate hikes or banking turmoil, nothing has managed to upend the economic ship—mainly because households have kept spending.

How have they managed to power through, and should we expect them to continue?

Insulated from the Worst of the Downturn So Far

Until now, strong household finances emerging from the pandemic combined with a strong labor market in the ensuing expansion have insulated households from the worst of the economic downturn.

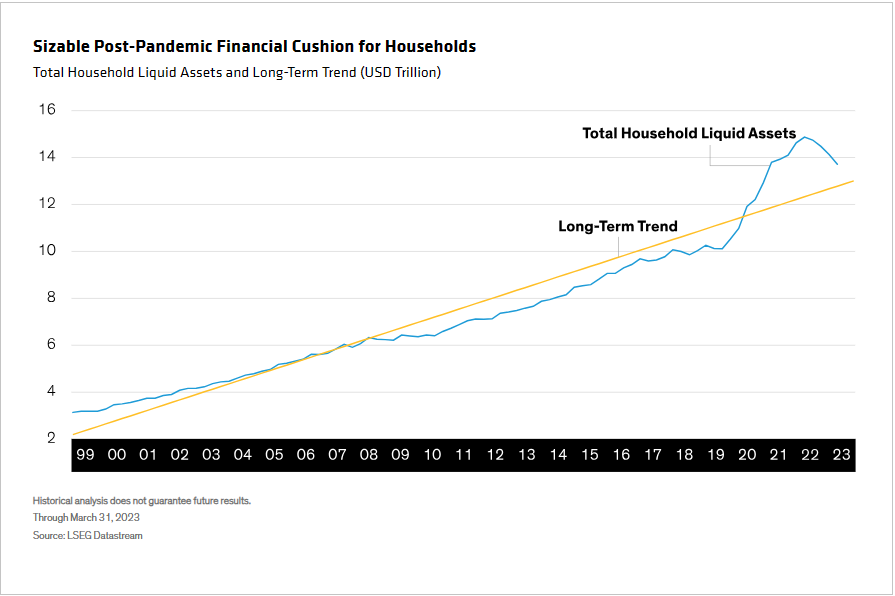

During the depths of the COVID-19 pandemic, a mix of government stimulus and forced savings pushed the value of household liquid assets (checking accounts and time deposits, primarily) well above its long-term (Display). Strong capital-market performance and rising home prices bolstered consumers’ balance sheets, too. The net result: a sizable financial cushion to tap into as the US emerged from the pandemic.

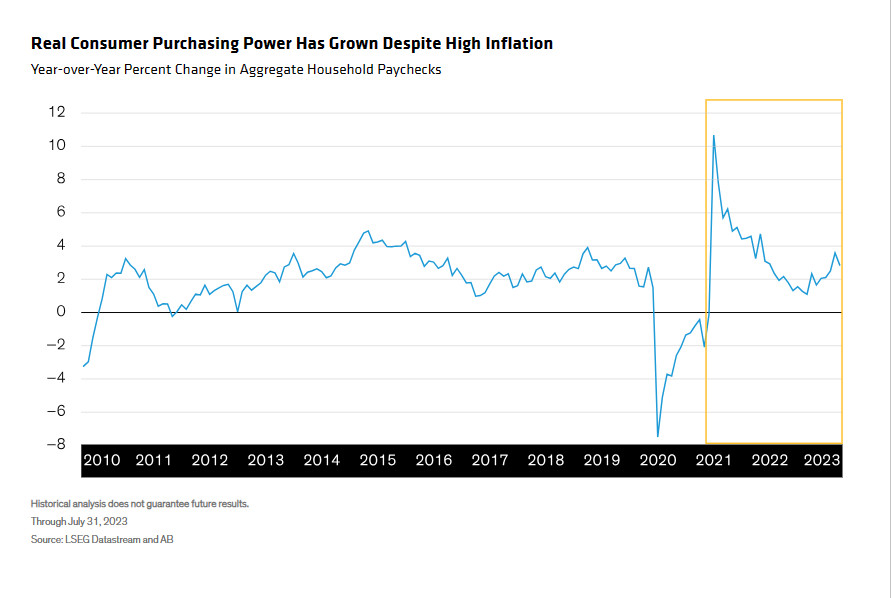

The robust US labor market has also played a key role, confounding all expectations (including ours!) that it would weaken as interest-rate hikes started to bite. Instead, US companies continued bringing in workers, to the tune of a net average of more than 200,000 every month. Wages continued climbing, easily outpacing the historical norm. As a result, even after adjusting for high inflation rates, the overall growth in the purchasing power of household income has remained relatively normal in the past couple of years (Display).

Households Likely to Pull Back Somewhat

Given the solid savings and income metrics we’re seeing, it’s no surprise that households have been able to continue consuming the past few quarters without really missing a beat. However, there are a few reasons why we expect this to change.

For one thing, we’re seeing signs that the labor market is finally beginning to soften. Wage growth has started to slow, and the pace of hiring is gently decelerating—trends we expect to continue. We also believe that households have used up most of the excess savings they built up during the pandemic: liquid asset balances have declined almost back to their long-term trend.

Even beyond the basics, other factors will likely weigh on consumption going forward. Student loan repayments, suspended for roughly three years, are set to resume for most borrowers at the beginning of October. And after being delayed by weather events in the winter and spring, household and business taxes for California residents are due October 16. That will take another bite out of household finances.

None of these factors should suggest that we expect an imminent collapse in consumption. But we do expect households to pull back a bit going forward, as the strength of their collective balance sheet begins to wane.

A Holding Pattern for Overall Spending and “Trading Down”

We’re already seeing initial signs of this transition, with overall spending levels largely unchanged recently. Beneath this holding pattern is a shifting mix in buying: goods purchases are falling back toward pre-pandemic norms while services spending remains strong. Appliances and grills may have ruled in the stay-at-home world; today, they’re increasingly giving way to airline tickets and hotel stays.

Consumers are also starting to “trade down,” opting for less expensive alternatives in their buying decisions. This could mean forgoing a higher-end restaurant in favor of a quick-service chain. Or it could translate into a growing preference for store-brand packaged goods over brand names. All of these signals point to a consumer sector that’s becoming more price- and spending-conscious.

All things considered, this environment will probably result in a modest increase in signs of stress, such as credit-card charge-offs and loan delinquencies. Still, we think there’s enough left in the consumer’s tank that the coming slowdown will be mild rather than severe.

The key variable to monitor is the labor market: history tells us that as long as income comes in, American households are likely to spend it.

Related: Argentina May Be Headed Down the Dollarization Path