Written by: David Lebovitz

"The past few weeks have seen incredible market action, as retail investors piled into highly shorted small cap equities in an effort to push back on the institutional investment community."

This forced investors who had shorted these names to cover their positions, in the process leading prices to new all-time highs. Many believe this is an example of froth, and potentially indicative of a broader bubble in asset prices. So what is going on with the retail investor? And is there a bigger issue at play?

Exuberance is not a new phenomenon in markets – Dutch tulips, the South Sea Bubble, tech stocks in 2000, or Japanese equities in the late 1980’s are examples that come to mind. But is the aggressive return of the retail investor an indication that systemic risks are building? This does not appear to be the case.

To an extent, these developments seem tied to the increasing accessibility of capital markets; commission-free trading, the ability to trade partial shares, and better access to information have all contributed to the current environment. Furthermore, one could argue that this dynamic has been amplified by the cocktail of quarantine and liquidity that has been served to many across the United States. However, it is important to differentiate between bubbles and Bubbles. Bubbles with a small “b” are similar to boiling a pot of water – bubbles reach the surface and pop, but the pot does not overflow. Bubbles with a capital “B” are a cause for greater concern; think about what happens if you try and boil a pot of milk.

If nothing else, the events over the past few weeks have highlighted that the retail investor is alive and well. If this behavior continues, perhaps investors will begin to view retail investor positioning in the same way they take into account the positioning of quantitative or systematic funds. However, it is important to recognize that excess liquidity has led asset prices in certain markets and sectors to become unhinged from their fundamentals. It is uncommon, but not unheard of, for the bursting of financial market bubbles to drag the broader economy into recession. That said, the current set of risks seem concentrated in specific areas of the capital markets. If this behavior becomes more widespread it will be a greater cause for concern, suggesting investors would be wise to watch how things develop over the coming months.

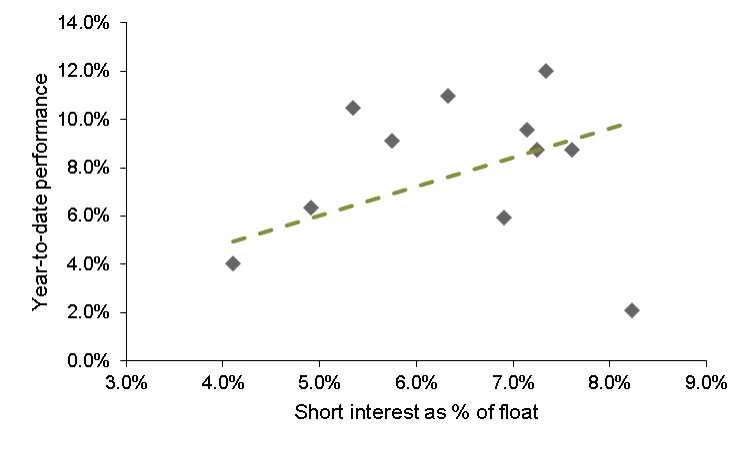

2021 has seen a positive relationship between short interest and performance

Russell 2000 sectors, short interest % float, YTD total return

Sources: SEC, Russell, FactSet, J.P. Morgan Asset Management.

Short interest % float and YTD performance is based on a simple average of each sector's constituents.

Data are as of January 28, 2021.