Written by: Jack Manley and Sahil Gauba

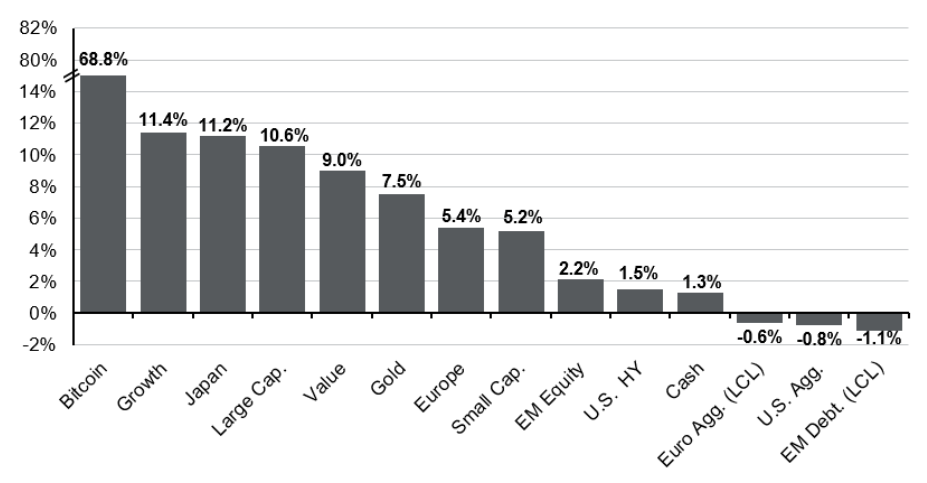

2023’s so-called “everything rally” was confusing to many market watchers, given the pessimistic macro outlook at the beginning of last year. Now, a quarter into 2024, the rally has clearly continued: risk assets like equities, high yield bonds and cryptocurrencies (notably Bitcoin) gained; and defensive asset performance was mixed, with bonds down but gold, oddly, surging.

What was behind these market moves? To understand them, it is important to unpack some of the things that helped to define the first quarter of 2024.

- Global economic resilience continued: The final estimate of 4Q23 U.S. GDP showed that the U.S. economy grew faster than expected, up 3.1% for the year compared to trend growth of 2.0%. Moreover, cooling inflation and 12 consecutive months of positive real wage growth improved consumer sentiment, which now sits just five points shy of its long-term average. Despite this, gold rallied, perhaps playing catch-up after its sluggish performance in 2021 and 2022. Outside of the U.S., Eurozone inflation similarly cooled, while Japanese 4Q23 GDP growth was also revised higher and the Bank of Japan formally ended negative interest rate policy, reflecting strong economic momentum.

- Equity market strength broadened out: Against this macro backdrop, global stocks rallied. In fact, markets in the U.S., Japan, Germany, France and Latin America all hit all-time highs in 1Q24. In the U.S., these all-time highs came alongside greater market breadth, with more companies participating in gains than in 2023. Internationally, a broad pick-up in PMIs across Europe, Japan and some emerging markets point to continued improvement in business sentiment, boding well for future market returns.

- Duration dove on changing rate expectations: At the start of the year, markets were expecting a total of 175 bps of interest rate cuts, a significant divergence from the Federal Reserve’s December “dot plot”. A massive course correction has happened since then, spurred by economic resiliency. As a result, longer-duration bonds suffered. High yield, however, did quite well, a reflection of confidence in the economic outlook and a lower sensitivity to interest rates. Encouragingly, the Fed did not adjust the “dot plot” for 2024 at its March meeting, making another course correction unlikely.

All told, the first quarter was an interesting start to what will surely continue to be an eventful year. Lingering geopolitical uncertainty and an upcoming U.S. presidential election, coupled with the divergence in performance across assets, underscores the importance of diversification in a fundamentally uncertain world.

1Q 2024 asset class returns

Total returns

Source: Bloomberg, FactSet, MSCI, Russell, Standard & Poor’s, J.P. Morgan Asset Management.

Large cap: S&P 500, Small cap: Russell 2000, Growth: Russell 1000 Growth, Value: Russell 1000 Value, EM Equity: MSCI EM Equity (USD), Europe: MSCI Europe Equity (USD), Japan: MSCI Japan Equity (USD), U.S. Agg: Bloomberg US Aggregate, High Yield: Bloomberg U.S. HY Index, Cash: Bloomberg 1-3m Treasury, EM Debt (LCL): Bloomberg EM Local Currency Government, Euro Agg. (LCL): Bloomberg Euro Aggregate Government Treasury, Gold: NYMEX Gold near term, Bitcoin: CoinMarketCap.

Data are as of March 31, 2024.