Written by: David Lebovitz

In prior posts, we have touched on some of the structural forces that have weighed on inflation over the past few decades. However, with recent inflation reports surprising to the upside and wage growth showing signs of life, there is a risk that inflation ends up being stickier than many expect. But how could that occur? And what does it mean for earnings?

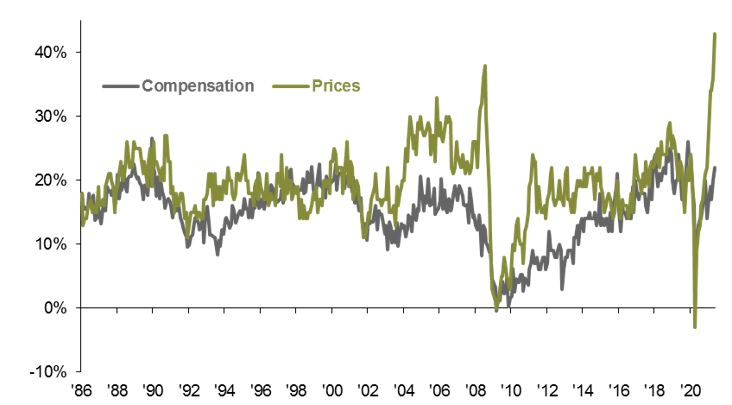

According to the most recent NFIB Small Business Survey, 22% of businesses are planning to increase compensation in the next three months. Rising wages in isolation drag on corporate profits, as margins get pressured and earnings growth slows. This means that to preserve earnings, a company can generate stronger revenues or reduce costs. One way to boost revenues is by increasing prices, which is exactly what businesses plan to do.

This stands in contrast to what was seen in the aftermath of the financial crisis, when companies found it very difficult to increase prices and compensation in lockstep. However, this dynamic seems to have shifted, as 43% of businesses are planning to respond to higher wages by increasing selling prices. Not only does this represent the largest share of respondents planning to increase prices in the history of the series, it comes at a time when a number of large corporations have already begun to increase wages for some of their lowest-paid employees.

How things evolve going forward will have a direct impact on both inflation and corporate profitability. Companies will be able to defend profit margins if they are able to increase prices to offset any increase in costs, but as a result, inflation may end up being stickier than many currently expect. This could pull forward Federal Reserve tightening, and subsequently weigh on earnings growth. On the other hand, if businesses find that an increase in prices has a negative impact on demand, you may see them refocus on managing costs as a way of boosting the bottom line. The potential for higher corporate taxes next year only complicates this dynamic.

The bottom line is that if inflation begins to rise, interest rates will rise, and valuations will come under pressure. So far, 2021 has been characterized by range bound valuations and rising earnings estimates, which has allowed the equity market to trend higher during the first half of the year. Where things go from here will continue to depend on the trajectory of earnings – investors should use profits as a guide when positioning equity portfolios for a post-pandemic world.

Businesses are responding to higher wages with higher prices

Net percent of businesses increasing compensation and prices

Sources: NFIB, FactSet, J.P. Morgan Asset Management. Data are as of June 9, 2021.