Written by: Jordan Jackson

As widely anticipated, the Federal Open Market Committee (FOMC) voted to leave the Federal funds rate unchanged at a target range of 5.25%-5.50% at its September meeting. The statement language was almost identical to the July meeting, maintaining the slightly hawkish language in “determining the extent of additional policy firming that may be appropriate”, keeping the door open for another rate increase this year.

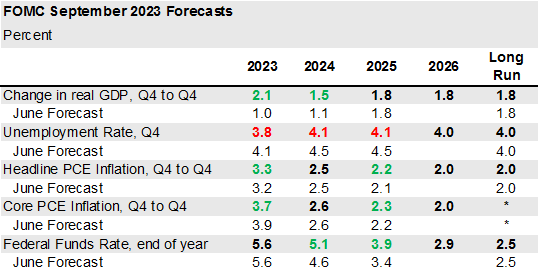

Turning to the Summary of Economic Projections (SEP), there were some notable hawkish changes:

- 2023 and 2024 real GDP forecast was revised up 1.1% and 0.4%, respectively to 2.1% and 1.5%.

- The unemployment rate was revised lower over the entire forecast period. The year-end forecast was revised to 3.8% and is expected to rise modestly to just 4.1% in 2024 and 2025.

- Headline PCE inflation was raised 0.1% to 3.3% while core PCE inflation was trimmed slightly to 3.7% for 2023, likely reflecting the recent rise in energy inflation but further improvement in housing services inflation.

- The median forecast for the Federal Funds target range or dot plot continues to signal one more rate increase this year and two fewer rate cuts in 2024, embracing the higher for longer narrative.

- The SEP also provided forecasts out to 2026, which generally show forecasts in line with the committee’s longer run target estimates.

The refreshed SEP suggests the committee intends to keep rates higher for longer given the impressive resilience the US economy has exhibited under higher rates. The upgraded growth and unemployment forecast suggests the committee sees only a short period of modest sub-trend growth next year followed by a more balanced economic environment into 2025 and beyond. Notably, real policy rates are forecasted to grow more restrictive over the course of 2024 perhaps signaling the median committee member views current policy as still not restrictive enough to meet the Fed’s inflation target.

While investors may scrutinize the median dot plot, they should recognize that there are a wide range of views across committee members. The most hawkish member sees a 2024 year-end Fed funds target range of 6-6.25% while the most dovish member forecasts a 4.25%-4.50% target range; that dispersion widens out further in 2025. Further out, the Fed projects that the Fed funds rate will remain above its longer run estimate of 2.5%. To some extent, this may be the first hint that an adjustment higher to the long-run projection could occur at a later meeting.

Equites sold off initially and 2-year yields reached a post GFC peak of 5.17%. While we still believe we are near peak rates, higher for longer potentially suggests a floor in any decline in rates. That said, pushing policy rates further into restrictive territory increases the risk of a more material hit to growth and inflation next year suggesting investors should still consider duration at this stage and maintaining a defensive posture within portfolios.

Source: Federal Reserve, J.P. Morgan Asset Management. Data are as of September 20, 2023.

Forecasts of 19 FOMC participations, median estimate. Green denotes an adjustment higher, red denotes an adjustment lower. * Longer-run projection for core PCE inflation are not collected.

Related: What Do Financial Conditions Tell Us About Future Growth?