Written by: Gabriela Santos

After a sharp drop in 2020, global inflation is rising due to recovering energy, surging goods and normalizing services prices. This reflation signals building momentum in the global economy, a support for credit and equities, especially of cyclical regions like Europe, Japan, and EM ex-North Asia. Most central banks will likely remain patient, but certain EM central banks have begun to raise rates or signal normalization. Short-term, these local EM bond prices have suffered, but once the normalization path is priced in, higher yields and more supported currencies present an opportunity for improving yield.

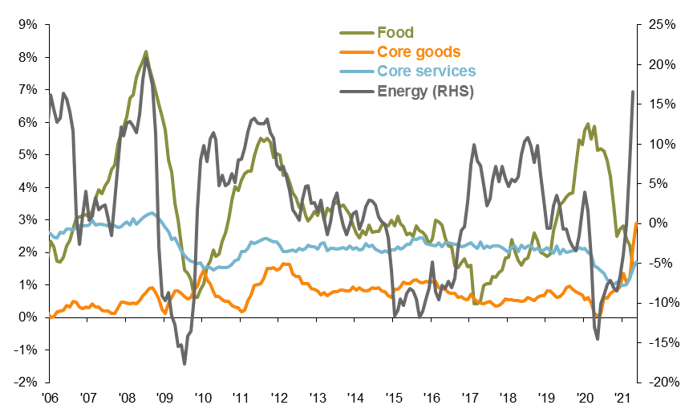

After averaging 1.6% in 2020 and falling to 0.9% in November, global headline inflation moved up to 2.7% in April. Three components have been driving up global prices:

- Energy: After starting 2020 at $68 a barrel, Brent crude prices collapsed to $25 in April 2020 due to the closure of global activity. Since then, they recovered to near $70 in April 2021 due to improving demand from the transportation sector as economies reopen and restrained supply from oil producers. As a result, April global energy prices popped 17% year-over-year.

- Goods: After averaging only 0.5% over the past 20 years, core goods prices dropped a further 40bps last year. As improving demand has met supply bottlenecks in various goods industries, April core goods prices surged 2.9%.

- Services: Normally quite stable at a 20-year average of 2.4%, services prices suffered a steep deceleration of 110bps last year as the pandemic hit services industries particularly hard. As economies have progressively reopened, services prices have started to normalize, moving up from 1.0% early in the year to 1.7% in April.

As the year progresses, demand and supply imbalances should normalize in commodities, goods and services, bringing global inflation rates back to normal. However, the reason behind this move up in prices is key: the global recovery is gaining steam, which should translate to strong earnings growth this year, especially of more cyclically-oriented companies. More cyclical global equity markets stand to benefit the most, an argument for adding exposure to Europe, Japan and EM ex-North Asia.

Central banks in developed markets and many emerging ones will view the move up in global inflation through this positive lens, remaining on hold this year. However, certain EM central banks (such as Russia and Brazil) have begun to raise rates due to spottier track records of anchoring inflation. China is also prioritizing normalizing policy this year, but due not to consumer price inflation but to financial stability concerns. While investors price in the normalization path ahead, the move up in local yield curves pressures local bond prices; however, once expectations are priced in, higher local bond yields and more supported currencies provide investors an opportunity to add yield. Chinese fixed income is further ahead in this process, offering anchored yields year-to-date and a yield pick-up of 170bps over Treasuries.

As economies reopen, global energy, goods, and services prices are rising

Year-over-year % change

Source: J.P. Morgan Global Economic Research, J.P. Morgan Asset Management. Data are as of June 23, 2021.

Related: Where Are the U.S. Equity Opportunities and How Are Investors Positioned?