If you’ve run into difficulties lately finding the best gold stocks to invest in, you’re not alone.

Sentiment has been down. But there are still some very

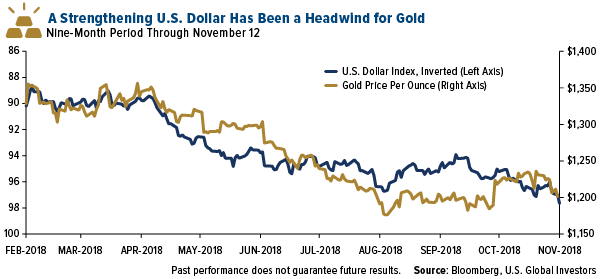

attractive opportunities out there in the goldfields, one of which I want to share with you.First, a quick recap: The price of gold tested support of $1,200 an ounce on Monday as the U.S. dollar strengthened to a 16-month high, propelled by expectations of additional interest rate hikes. A stronger greenback, remember, weighs on gold as well as a number of other commodities, including oil, since they’re priced in dollars. I’ve inverted the dollar’s values in the chart below so it’s easier to see this relationship.

click to enlarge

click to enlarge

Gold miners have felt the pressure, too. In the 12-month period as of November 12, the FTSE Gold Mines Index, which reflects the

stock performanceof producers from around the world, lost 17.66 percent.This may have made it challenging for some gold investors to find promising stocks. As such, assets have dropped. Gold and precious metal ETFs in North America saw net outflows of 58 metric tons in 2018 through October 31, according to the World Gold Council (WGC).But selling now is the wrong move, I believe. Gold stocks appear to be highly undervalued relative to the S&P 500 Index, and a sharp drop in the market could strongly boost demand for the yellow metal. This means it might be time to consider accumulating.

Meet Menē, Gold Jewelry Disruptor

For investors who wish to increase their exposure to gold, I believe our

Gold and Precious Metals Fund (USERX) is an attractive option with a history of strong performance. USERX is actively managed, meaning we rely on fundamentals and on cultivating relationships with management teams to decide which companies go in and out of the fund.One of those companies, the one I hinted at earlier, is a newcomer to the industry—Menē Inc.You might not have heard the name Menē yet, but you could soon enough, especially if you’re in the market for fine jewelry.Founded in 2017 by Roy Sebag, co-founder of gold financial services firm Goldmoney, and Diana Widmaier-Picasso, granddaughter of—you guessed it—Pablo Picasso, Menē ’s mission is to disrupt the gold jewelry market by selling directly to the consumer and pricing its merchandise fairly and transparently. Unlike traditional sellers like Tiffany & Co. and Cartier, which sometimes have high premiums, Menē prices its jewelry based on the changing value of gold. It then charges a 15 percent to 20 percent design and production fee on top of that.What also sets the company apart is that its jewelry—from earrings to necklaces, bracelets to charms—is made of 24-karat gold or platinum. No alloys, no insets of diamonds or other stones. That’s done to help the pieces retain their value over time.Here at U.S. Global Investors, we believe gold is money and a timeless investment. Menē , which takes its name from the Aramaic word for “money,” has clearly run with that idea, going so far as to trademark the phrase “investment jewelry.”It’s a business model that seems to have resonated with consumers and investors alike. In its first 10 months of operation, Menē did as much as $7 million in sales in more than 53 countries, as of October 2018.Related:

India’s Booming Economy Expected to Firm Up Gold Demand Active Management Can Help You Invest in Attractive Companies Before the Street Does

The reason I tell you this is to highlight our potential ability to find and invest in little-known yet promising companies before they become overvalued. In the case of Menē, we managed to get in even earlier, before shares in the company were made available to the public.Menē went public on the Toronto Stock Exchange (TSX) earlier this month. But thanks to active management and our industry relationships, we were able to buy shares privately seven months ago. So even before its stock was available to retail investors, Menē accounted for 2.46 percent of the

Gold and Precious Metals Fund (USERX) as of September 30.For the one-year, five-year and 10-year periods, USERX beat its benchmark, the FTSE Gold Mines Index, as of September 30, 2018. You can see its performance

here.USERX holds an incredible four-star rating overall from Morningstar as of September 30 in the Equity Precious Metals category. It also holds four stars for the three-year, five-year and 10-year periods, based on risk-adjusted returns.

Learn more by visiting the Gold and Precious Metals Fund (USERX) now!