Written by: Tracy Nolte | Advisor Asset Management

It is probably too dramatic to label the events of the past two months as a “flight to quality.” That phrase elicits more anxiety than is necessary when instead, we think what we have witnessed is more like a pause in risk-taking. Flights to quality tend to be more dramatic. They widen corporate spreads swiftly, propagating from the lower rungs of the credit stack with a panic repricing of credit that is often disconnected from fundamentals. Flights to quality also tend to occur simultaneously with equity repricing and while we did witness a 2.88% selloff in the S&P 500 during July and a 1.77% selloff in August, these events were short-lived and were not concurrent with a dramatic repricing or excessively widening of credit.

Given the lack of violence in the most recent bout of volatility, the recent tone from market activity in the past few weeks has been less about the unrepentant removal of risk, but perhaps more akin to a combination of profit taking with selective buying.

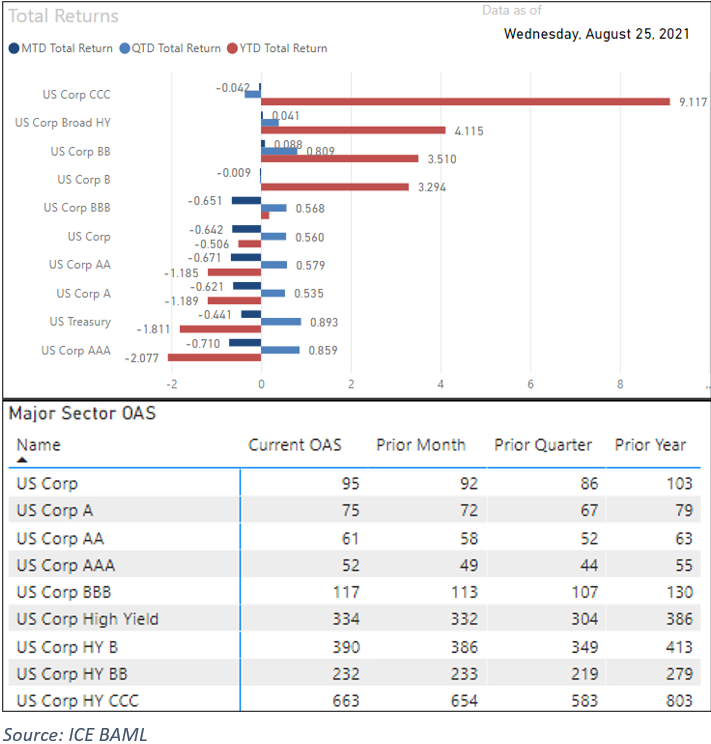

As shown in the graph to the below, returns from AAA-rated down to the Single-B slices of the stack have, at the very least, generated slightly positive returns for the quarter. TIPS (Treasury Inflation-Protected Securities) have generated 1.98% while nominal Treasuries added 0.89% during the same period, though total return is positive for all but the lowest rung in the stack. While returns for the current quarter favored less risky fixed income assets, the graph on below also shows that the risk-on posture of investors over the breadth of the year has been a hallmark of fixed income investing during 2021.

We continue to feel the primary focus for investors should be the allocation of credit and interest rate risk relative to where they feel the economy, fiscal, and monetary policy are heading. In our opinion, changes to credit and interest rate exposure are not simple switches which should be turned off and on in response to the slightest uncertainty or bout of volatility. Rather, these two risks are more akin to raising or lowering the volume on a radio. The changes are done over time and they are done incrementally. We believe the changes should consider the breadth of the information available instead of being a reaction to the information which may be simply the “story of the day.”

Clearly some of the uncertainty during the quarter is related to the FOMC (Federal Open Market Committee). As I write, the FOMC is conducting their annual conference at Jackson Hole. Last year was a pivotal moment for the FOMC when Chairman Powell highlighted material changes to the FOMC’s preemptive inflation targeting policy. This year most eyes are focused on what the FOMC may or may not say about tapering their purchases. When will they start to taper? How quickly will they taper? How soon after they begin tapering will they decide to raise rates?

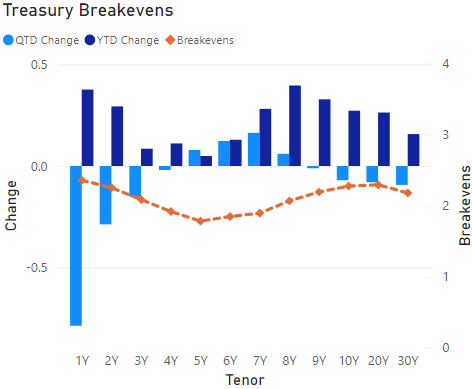

There is some uncertainty surrounding these questions, but given the FOMC’s current focus, we feel some of the uncertainty may be much ado about nothing. Certainly, these questions are important and extremely relevant to the outlook for the economy, but we feel that Chairman Powell is intent on avoiding the same fate which befell the Bernanke Fed. As a result, the taper will likely be gradual, clearly communicated, and the FOMC will remain flexible with regards to their execution and their ability to change their minds. We also feel, and inflation expectations have converged to this view, that the FOMC appears to be in no rush to become more restrictive with the policy rate.

The committee will likely continue to wait for clear and consistent indications of sticky inflation before moving rates higher in our opinion. We feel that they wish to also avoid the policy missteps of 2018, which loosely paraphrases Chairman Powell’s comments from Jackson Hole last year.

Source: U.S. Federal Reserve

It is also a good sign as to the state of the economy that the FOMC should begin to have divergent views related to tapering and to the future direction of rates. While divergent opinions may introduce some uncertainty in the markets, the committee members divergence of opinion indicates that the economy is finding firm footing. While we still cast a wary eye toward the uncertainty surrounding the effects of the Delta variant, it is this firm footing which causes us to continue to feel that rates, inflation, and broader economic activity are firmly mid-cycle. Our investment focus continues to favor cyclical exposure in credit, while being marginally defensive to interest rate risks. Cliff Corso, AAM’s President and Chief Investment Officer, highlighted the divergent set of views from the FOMC committee members in his comments preceding the prior FOMC meeting in June. Given this outlook, we continue to view volatility as an opportunity.