Written by: Scott Colyer | Advisor Asset Management

We often hear the term, “follow the money,” in reference to authorities investigating criminal activities. The same technique is often used on Wall Street to discern which trends have substance and staying power from those that are merely emotional or speculative and less durable. Detecting large flows in or out of an industry often serves as an early indication of things to come. I think a quick look at some recent flows and changes to flows is certainly worthwhile given the scalding rally we have experienced over the past year or so.

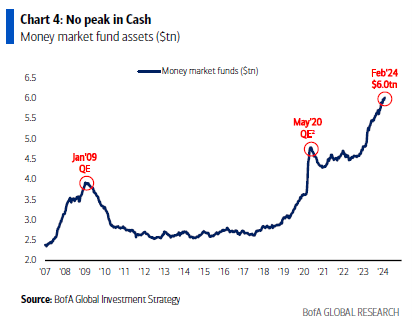

Most assume that given the rise in equity indices that the equity market is the recipient of the biggest wave of money in motion. Likewise, analysts constantly cite that the record amount of money in the money market is a potential catalyst for higher equity prices because they assume that money is waiting to enter the stock market. Sometimes assumptions can be misleading.

Bank of America’s Michael Harnett notes that at the beginning of February we saw some significant flows that many would not expect. In the February 8 edition of the “Flow Show,” Harnett reports that money market funds have not stopped growing and, in fact, now exceed $6 trillion. While that money could be waiting to enter the equity market, one thing is very different today than it has been over the past 15 years: money markets have yield. We would argue that the assumption that cash parked in money market funds is there simply waiting to buy stocks is incorrect. Those funds are still yielding around 5% for the first time since before the Global Financial Crises. This is a significant return on an asset that has very little risk to it, especially if you use government money market funds. There are generally low fees and money can be accessed daily without penalty. Could it be that investors are enjoying these attractive returns without the risk of the stock market?

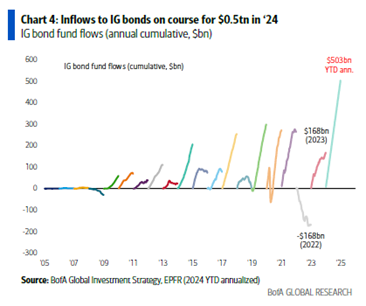

The next surprise is the volume of flows that continue to move into fixed income assets. Harnett notes a huge $12.3 billion inflow into investment grade corporate bonds during the week of February 8, followed by $10.3 billion during the week of February 15, and most recently $10.2 billion the week ending February 22. Again, money has generally not been rewarded in fixed income assets for over 15 years. The Federal Reserve (Fed) sharply increased interest rates in 2023 as it continued the inflation fight and fixed income investors have been rushing to lock in these rates.

All in all, inflows into investment grade bonds are on course to be $500 billion in 2024. That is a big number. It is not so hard to understand when we remember that the largest generation of Americans are in retirement age and, after a long winter, can finally achieve some yields that make up more and more of a percentage of their assets as they age.

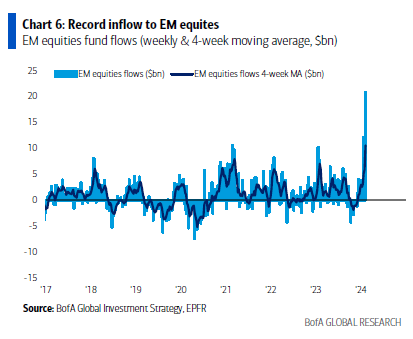

The last — and perhaps most compelling — investment flow to note is an “all-time record” inflow during the first week of February into Emerging Market (EM) equities. During that week over $20.8 billion flowed into EM, mostly going to Chinese equities. Many people see nothing but risk in China; we see potential returns much greater than the perceived risk. China is fully focused on re-inflating their markets. Their central bank has lower interest rates and reserve requirements for bank lending. They are shutting down short sellers. They have replaced their head of market regulation. Worth an allocation of funds? We think so. There is increased risk here, but we believe it is warranted given what China is striving to accomplish and the steep discount those equities are selling at versus the rest of the world.

One last observation. Last week we saw the first net inflows into materials and energy since September 2023. Now, one week does not a trend make, but we will continue to monitor these two groups that have been essentially “dead money” since September 2023. Remember, we don’t ever want to try to time the markets. Our comments here are not meant to suggest that could or should use money markets to time the stock market. We believe investors should be fully invested all the time with investments in line with their risk tolerances. However, with the U.S. markets close to their peak historic valuations, we believe it might be time to explore locking in quality yields and allocating some funds outside of the U.S.

Related: NVIDIA Dominance: Living in a Tech World Shaped by Innovation