Written by: Jacob Johnston | Advisor Asset Management

We have generalized over the years that equity risk and returns are a function of two main drivers: earnings and interest rates. Earnings provide a base or foundation while interest rates, as a proxy for liquidity, suggest a valuation or multiple assigned to the earnings base.

Earnings (profitability) can be increasing or decreasing. Interest rates (liquidity) can be accommodative or restrictive. An environment in which earnings are decreasing while interest rates are restrictive would be challenging. One would expect lower returns with higher volatility. On the other hand, an environment in which earnings are increasing while interest rates are accommodative would be more constructive and assume higher returns with lower volatility. Often it is somewhere between.

Apply this framework to recent years:

2021 — constructive: The S&P 500 grew earnings 39% as the U.S. economy recovered from the pandemic. The Federal Funds Target Rate was essentially zero throughout the year. The VIX (CBOE Volatility Index) averaged 20. The S&P 500 total return was 29% while the “average stock” as measured by the S&P 500 Equal Weight Index gained 30%.

2022 — challenged: The S&P 500 delivered significant earnings growth; however inflationary pressures forced the Federal Reserve to tighten monetary policy by raising interest rates 425bps (basis points). The VIX averaged 26. The S&P 500 fell 18% and the average stock fell 11%.

2023 — challenged: Earnings for the S&P 500 were essentially flat. The Federal Reserve continued to tighten monetary policy by raising interest rates an additional 100bps; the VIX averaged 17. The S&P 500 gained 26% and the average stock rose 14%.

Source: AAM

Looking Ahead

In March, the Federal Reserve updated the Summary of Economic Projections for each year from 2024 to 2026 and over the longer run. In general, the Fed is projecting higher growth, higher inflation, and fewer rate cuts than the previous forecast at the end of 2023. This is likely due, in part, to the U.S. economy holding up much better than expected throughout the current tightening cycle. While inflation remains above the 2% target, it is much more palatable with underlying economic growth. Growth provides the Fed aircover to be patient with any easing, setting up the holding pattern that has become consensus as the market prices in both a later start to Fed rate cuts and fewer cuts this year. However, the Fed dot plot continues to show gradual easing beginning in 2024 and continuing through 2026.

*Median, as of March 2024 | Source: Federal Reserve Board

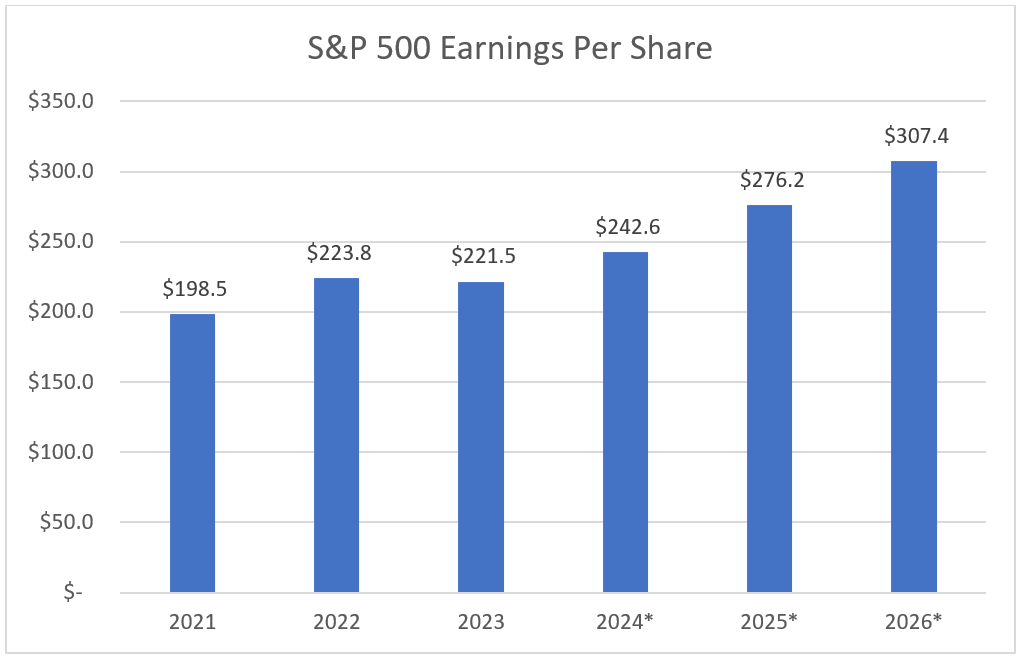

FactSet estimates S&P 500 earnings growth of 11% year-over-year in 2024. Early estimates for earnings growth in 2025 and 2026 are currently 14% and 11%, respectively. This suggests a compound annual growth rate of 11.99% over the next three years.

*Estimate | Source: AAM, FactSet. As of 5/9/24 | Past performance is not indicative of future results.

Headwinds to Tailwinds

Add it all up, and after two years of a challenging setup of either decreasing earnings, restrictive monetary policy, or both we look ahead to a very different situation. The U.S. economy is showing few signs of a slowdown. Earnings are estimated to grow significantly. The Fed has indicated a lower interest rate environment could be appropriate which may further support earnings and valuations.

We propose the combination of underlying economic strength with potential easing on the horizon has at least contributed to the positive returns to start the year. The S&P 500 has gained 9.3% year to date (price basis, as of 5/9/24) and is approaching its all-time high. Every segment of the style box is in positive territory. Ten out of 11 sectors are positive, and the average stock has gained 5% — a robust annualized rate of 16%. Participation has broadened out to almost every corner of the equity market. While there certainly is the potential for some bumps along the way, the two main drivers of equity returns have shifted from headwinds to tailwinds, in our opinion, creating a more constructive setup going forward.

Related: Maximizing Workplace Safety: Essential Tips for Office Environments