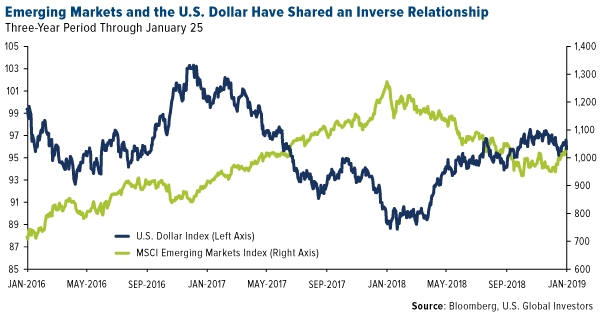

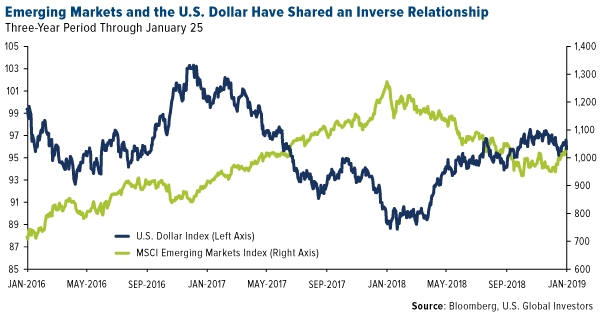

Our fully-interactive Periodic Table of Emerging Markets has been updated for 2018! Check it out by clicking here! Last year was admittedly a tough one for emerging markets. A number of currencies were under considerable pressure, with some of them falling to record or near-record lows against the strong U.S. dollar.

Global tradetensions, threats of sanctions, rising U.S. interest rates and higher oil prices—before they began to crater in October, that is—also contributed to the selloff. From its 52-week high set in January 2018, the MSCI Emerging Markets Index sunk into bear market territory by the end of October.

click to enlarge

click to enlarge

But since then the investment case for emerging markets has vastly improved, and global investors are betting big that the U.S. dollar will ease on

less aggressive monetary tightening. This would relieve some of the pressure on emerging economies that must pay higher prices on imports from the U.S. when the dollar is strong. As of January 24, emerging market

equity fundshave seen positive inflows of over $3 billion for a remarkable 15 consecutive weeks.

Mobius and Gundlach Bullish on Emerging Markets

Some big-name investors have lately recommended that now might be the time to consider emerging markets, among them Mark Mobius and DoubleLine Capital founder and gold advocate Jeffrey Gundlach.Speaking with Bloomberg this month, Mobius said he favors India, Brazil and Turkey as they’ve had a “terrific recovery” since the currency meltdown last year. Within a portfolio’s emerging markets allocation, he recommends 30 percent in India; 30 percent in Latin America, including Brazil, Argentina, Chile and Mexico; 30 percent in Eastern Europe countries such as Poland, Turkey and Romania; and the rest in China and other parts of Asia.Some of Mobius’ picks were among the most banged up in 2018, as you can see in our updated

Periodic Table of Emerging Markets. Turkey’s Borsa Istanbul 100 Index (BIST 100) was down around 41 percent for the year, priced in U.S. dollars. Argentina’s MERVAL Index fared even worse, losing slightly more than half its value on out-of-control inflation and interest rates as high as 60 percent—the highest in the world.Related:

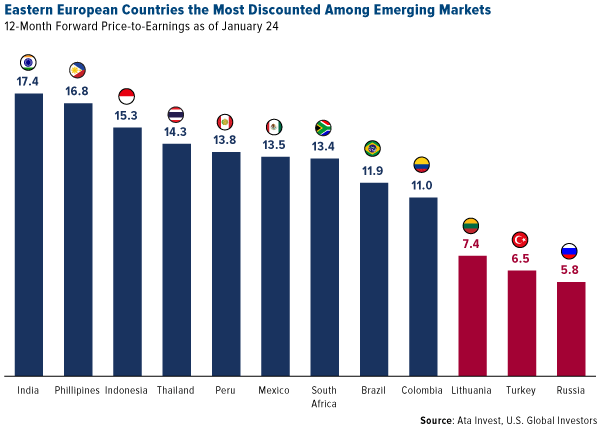

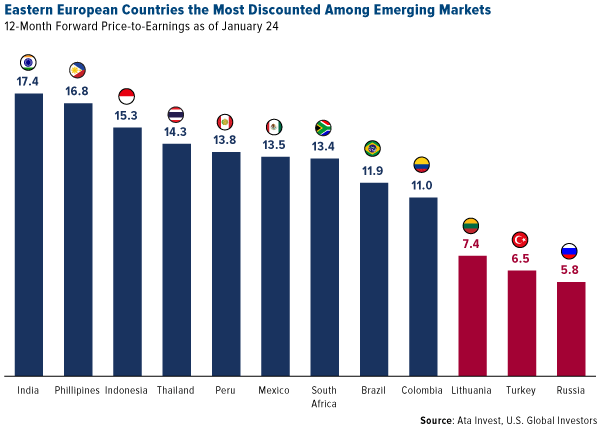

Commodities and Gold Set to Soar in 2019 Eastern Europe Trading at Attractive Valuations

The best performing emerging economy in 2018 was Russia, which slipped only 1.5 percent. The country not only proved to be the most resilient to higher U.S. rates and trade war fears, but it also has both attractive dividend rates and strong valuation support. As you can see below, Russian stocks were trading at a very low 5.8 times earnings, a discount of nearly 50 percent against MSCI’s index of 24 emerging economies. Fellow Eastern European countries Turkey and Lithuania also had very attractive valuations, trading at 6.5 times earnings and 7.4 times earnings.

click to enlarge

click to enlarge

On an annualized basis, Russia has been a good bet for the 10-year period as well, delivering 9.21 percent on average through December 31, 2018.What’s more, Central and Eastern European (CEE) economies are projected to grow 3.4 percent this year. That’s slower than in 2018, but stronger than Western Europe and the U.S.Besides a weaker U.S. dollar, CEE countries should benefit this year from more favorable monetary policy. A number of central banks are expected to cut rates in 2019, including Turkey’s, which could lower them from 24 percent to 18 percent, according to Credit Suisse. Russia is also expected to ease, though likely by only 50 basis points.

Sberbank: “Outstanding Profitability” and an Attractive Dividend Yield

In a note this week, equity research firm BCS Global Markets forecasts that Russia’s RTS Index of 50 stocks will end 2019 at 1,450. Today the index is trading around 1,196, meaning there could be a more than 20 percent upside. Slava Smolyaninov, BCS’s deputy head of equity research, writes that the first half of the year looks promising on “attractive dividends, multi-year low valuations, lifting of sanctions on Rusal, a pause in global tightening and potential trade conflict resolution.”The firm’s favorite picks include banks, especially Sberbank, which “ranks first as the most undervalued name with outstanding profitability… and one of the highest dividend yields in the sector”—an estimated yield of 8.9 percent for the 12-month period.

Curious to learn more? Check out 10 years of annual emerging market returns by clicking here! The U.S. Dollar Index is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners. The MSCI Emerging Markets Index captures large and mid-cap representation across 24 Emerging Markets (EM) countries. With 1,125 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The Borsa Istanbul 100 Index is a capitalization-weighted index composed of National Market companies except investment trusts. The MERVAL Index (MERcado de VALores, literally Stock Market) is the most important index of the Buenos Aires Stock Exchange. It is a price-weighted index, calculated as the market value of a portfolio of stocks selected based on their market share, number of transactions and quotation price. The RTS Index is a free-float capitalization-weighted index of 50 Russian stocks traded on the Moscow Exchange, calculated in the US dollars.There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2018: Sberbank of Russia PJSC.All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

click to enlarge

click to enlarge  click to enlarge

click to enlarge