I generally try to stay out of fights, especially when they become mud-wrestling contests, but the battle between the hedge funds and Reddit investors just too juicy to ignore. As you undoubtedly know, the last few days have been filled with news stories of how small investors, brought together on online forums, have not only pushed up the stock prices of the stocks that they have targeted (GameStop, AMC, BB etc.), but in the process, driven some of the hedge funds that have sold short on these companies to edge of oblivion. The story resonates because it has all of the elements of a David versus Goliath battle, and given the low esteem that many hold Wall Street in, it has led to sideline cheerleading. Of course, as with everything in life, this story has also acquired political undertones, as populists on all sides, have found a new cause. I don't have an axe to grind in this fight, since I don't own GameStop or care much about hedge funds, but I am interested in how this episode will affect overall markets and whether I need to change the ways in which I invest and trade.

Short Sales and Squeezes

I know that you want to get to the GameStop story quickly, but at the risk of boring or perhaps even insulting you, I want to lay the groundwork by talking about the mechanics of a short sale as well as how short sellers can sometimes get squeezed. When most of look at investing, we think of stocks that we believe (based upon research, instinct or innuendo) will go up in value and buying those stocks; in investing parlance, if you do this, you have a "long" position. For those of you tempted to put all of Wall Street into one basket, it is worth noting that the biggest segment of professional money management still remains the mutual fund business, and mutual funds are almost all restricted to long only positions. But what if you think a stock is too highly priced and is likely to go down? If you already own the stock, you can sell it, but if you don't have a position in the stock and want to monetize your pessimistic point of view, you can borrow shares in the stock and sell them, with an obligation to return the shares at a unspecified point in time in the future. This is a “short” sale, and if you are right and the stock price drops, you can buy the shares at the now "discounted" price, return them to the original owner and keep the difference as your profit.

Short sellers have never been popular in markets, and that dislike is widely spread, not just among small investors, but also among corporate CEOs, and many institutional investors. In fact, this dislike shows up not only in restrictions on short selling in some markets, but outright bans in others, especially during periods of turmoil. I don't believe that there is anything inherently immoral about being a pessimist on markets, and that short selling serves a purpose in well-functioning markets, as a counter balance to relentless and sometimes baseless optimism. In fact, mathematically, all that you do in a short sale, relative to a conventional investment, is reverse the sequence of your actions, selling first and buying back later.

It is true that short sellers face a problem that their long counterparts generally do not, and that is they have far less control over their time horizons. While you may be able to sell short on a very liquid, widely traded stock for a longer period, on most stocks, your short sale comes with a clock that is ticking from the moment you initiate your short sale. Consequently, short sellers often try to speed the process along, going public with their reasons for why the stock is destined to fall, and they sometimes step over the line, orchestrating concerted attempts to create panic selling. While short sellers wait for the correction, they face multiple threats, some coming from shifts in fundamentals (the company reporting better earnings than expected or getting a cash infusion) and some from investors with a contrary view on the stock, buying the stock and pushing the stock price up. Since short sellers have potentially unlimited losses, these stock price increases may force them to buy back shares in the market to cover their short position, in the process pushing prices up even more. In a short squeeze, this cycle speeds up to the point that short sellers have no choice but to exit the position.

Short squeezes have a long history on Wall Street. In 1862, Cornelius Vanderbilt squeezed out short sellers in Harlem Railroad, and used his power to gain full control of the New York railroad business. During the 20th century, short sales ebbed and flowed over the decades, but lest you fall into the trap of believing that this is a purely US phenomenon, the short sale with the largest dollar consequences was the one on Volkswagen in 2008, when Porsche bought enough shares in Volkswagen to squeeze short sellers in the stock, and briefly made Volkswagen the highest market cap company in the world. Until this decade, though, most short squeezes were initiated and carried through by large investors on the other side of short sellers, with enough resources to force capitulation. In the last ten years, the game has changed, for a number of reasons that I will talk about later in this post, but the company where this changed dynamic has played out most effectively has been Tesla. In the last decade, Tesla has been at the center of a tussle between two polarized groups, one that believes that the stock is a scam and worth nothing, and the other that is convinced that this is the next multi-trillion dollar company. Those divergent viewpoints have led to the former to sell short on the stock, making Tesla one of the most widely shorted stocks of all time, and the latter buying on dips. There have been at least three and perhaps as many as five short squeezes on Tesla, with the most recent one occurring at the start of 2020. With Tesla, individual investors who adore the company have been at the front lines in squeezing short sellers, but they have had help from institutional investors who are also either true believers in the company, or are too greedy not to jump on the bandwagon.

The Story (so far)

This story is still evolving, but the best way to see it is to pick one company, GameStop, and see how it became the center of a feeding frenzy. Note that much of what I say about GameStop could be said about AMC and BB, two other companies targeted in the most recent frenzy.

A Brief History

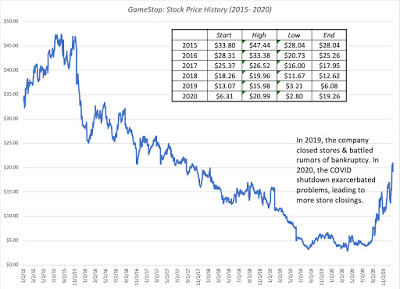

GameStop is a familiar presence in many malls in the United States, selling computer gaming equipment and games, and it built a business model around the growth of the gaming business. That business model ran into a wall a few years ago, as online retailing and gaming pulled its mostly young customers away, causing growth to stagnate and margins to drop, as you can see in this graph of the company’s operating history:

Leading into 2020, the company was already facing headwinds, with declining store count and revenues, and lower operating margins; the company reported net losses in 2018 and 2019.

The COVID Effect

In 2020, the company, like most other brick and mortar companies, faced an existential crisis. As the shutdown put their stores out of business, the debt and lease payments that are par for the course for any brick-and-mortar retailer threatened to push them into financial distress. The stock prices for the company reflected those fears, as you can see in this graph (showing prices from 2015 through the start of 2021):

Looking at the graph, you can see that if GameStop is a train wreck, it is one in slow motion, as stock prices have slid every year since 2015, with the added pain of rumored bankruptcy in 2019 and 2020.

A Ripe Target and the Push Back

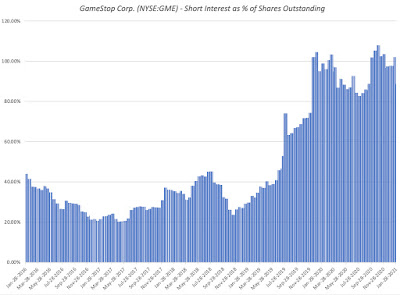

While mutual funds are often constrained to be hold only long positions, hedge funds have the capacity to play both sides of the game, though some are more active on the short side than others. While short sellers target over priced firms, adding distress to the mix sweetens the pot, since drops in stock prices can put them into death spirals. The possibility of distress at GameStop loomed large enough that hedge funds entered the fray, as can be seen in the rising percentage of shares held by short sellers in 2020:

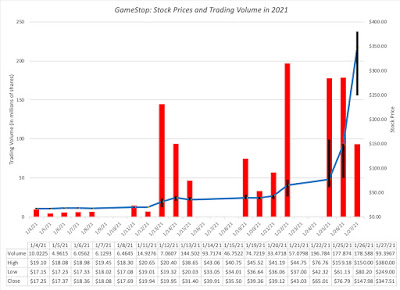

Note that short seller interest in GameStop first picked up in 2019, and then steadily built up in 2020. Even prior to the Reddit buy in, there were clearly buyers who felt strongly enough to to push back against the short sellers, since stock prices posted a healthy increase in the last few months of 2019. To show you how quickly this game has shifted, Andrew Left, one of the short sellers, put out a thesis on January 21, where he argued that GameStop was in terminal decline, and going to zero. While his intent may have been to counter what many believed was a short squeeze on the stock in the prior two days, it backfired by drawing attention to the squeeze and drawing in more buyers. That effect can be seen in the stock price movements and trading volume in the last few days:

This surge in stock prices was catastrophic for short sellers, many of whom closed out (or tried to close out) their short positions, in the process pushing up prices even more. Melvin Capital and Citron, two of the highest profile names on the short selling list, both claimed to have fully exited their positions in the last few days, albeit with huge losses. On January 27 and 28, regulators and trading platforms acted to curb trading on GameStop, ostensibly to bring stability back to markets, but traders were convinced that the establishment was changing the rules of the game to keep them from winning. GameStop, which had traded briefly at over $500/share was trading at about $240 at the time this post was written.

A Value Play?

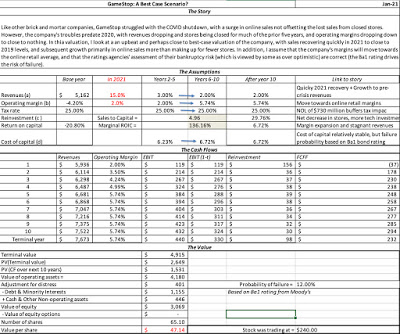

When you have a pure trading play, as GameStop has become over the last few weeks, value does not even come into play, but there are investors, who pre-date the Redditors, who took counter positions against the short sellers, because they believed that the value of the company was higher. At the risk of ridicule, I will value the company, assuming the most upbeat story that I can think of, at least at the moment:

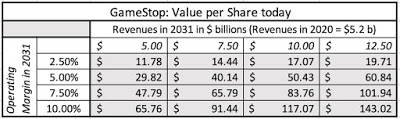

Note that this valuation is an optimistic one, assuming that probability of failure remains low, and that GameStop makes it way back to find a market in a post-COVID world, while also improving its margins to online retail levels. If you believe this valuation, you would have been a strong buyer of GameStop for much of last year, since it traded well below my $47 estimate. After the spectacular price run up in the last two weeks, though, there is no valuation justification left. To see why, take a look at how much the value per share changes as you change your assumptions about revenues and operating margins, the two key drivers of value.

Even if GameStop is able to more than double its revenues over the next decade, which would require growth in revenues of 15% a year for the next five years, and improve its margins to 12.5%, a supreme reach for a company that has never earned double digit margins over its lifetime, the value per share is about half the current stock price. Put simply, there is no plausible story that can be told about GameStop that could justify paying a $100 price, let alone $300 or $500.

The Backstory

To put the GameStop trading frenzy in perspective, let's start with the recognition that markets are not magical mechanisms, but represent aggregations of human beings making investment judgments, some buying and some selling, for a variety of reasons, ranging from the absurd to the profound. It should therefore not come as a surprise that the forces playing out in other aspects of human behavior find their way into markets. In particular, there are three broad trends from the last decade at play here:

- A loss of faith in experts (economic, scientific, financial, government): During the 20th century, advances in education, and increasing specialization created expert classes in almost every aspect of human activity, from science to government to finance/economics. For the most part, we assumed that their superior knowledge and experience equipped them to take the right actions, and with our limited access to information, we often were kept in the dark, when they were wrong. That pact has been shattered by a combination of arrogance on the part of experts and catastrophic policy failures, with the 2008 banking crisis acting as a wake up call. In the years since, we have seen this loss of faith play out in economics, politics and even health, with expert opinion being cast aside, ignored or ridiculed.

- An unquestioning worship of crowd wisdom, combined with an empowering of crowds: In conjunction, we have also seen the rise of big data and the elevation of "crowd" judgments over expert opinions, and it shows up in our life choices. We pick the restaurants we eat at, based on Yelp reviews, the movies we watch on Rotten Tomatoes and the items we buy on customer reviews. Social media has made it easier to get crowd input (online), and precipitate crowd actions.

- A conversion of disagreements in every arena into the personal and the political: While we can continue to debate the reasons, it remains inarguable that public discourse has coarsened, with the almost every debate, no matter in what realm, becoming personal and political. I can attest to that from just my personal experiences, especially when I post on what I call "third rail" topics, specifically Tesla and Bitcoin, in the last few years.

As I look at the GameStop episode play out, I see all three of these at play. One reason that the Redditors targeted GameStop is because they viewed hedge funds as part of the "expert" class, and consequently incapable of getting things right. They have used social media platforms to gather and reinforce each others' views, right or wrong, and then act in concert quickly and with extraordinary efficiency, to move stock prices. Finally, even a casual perusal of the comments on the Reddit thread exposes how much of this is personal, with far more comments about how this would teach hedge funds and Wall Street a lesson than there were about GameStop the company.

The End Game

I am a realist and if you are one of those who bought GameStop or AMC in recent days, I know that there is only a small chance that you will be reading this post, since I am probably too old (my four children remind me of that every day), too establishment (I have been teaching investing and valuation for 40 years) and too expert to be worth listening to. I accept that, though if you are familiar with my history, you should know that I have been harsh on how investing gets practiced in hedge funds, investment banks and even Omaha. The difference, I think, between our views is that many of you seem to believe that hedge funds (and other Wall Streeters) have been winning the investment sweepstakes, at your expense, and I believe that they are much too incompetent to do so. In my view, many hedge funds are run by people who bring little to the investment table, other than bluster, and charge their investors obscene amounts as fees, while delivering sub-standard results, and it is the fees that make hedge fund managers rich, not their performance. It is for that reason that I have spent my lifetime trying to disrupt the banking and money management business by giving away the data and the tools you need to do both for free, as well as pretty much everything I know (which is admittedly only a small subset) about investing in my classes. My sympathies lie with you, but I wonder what your end game is, and rather than pre-judge you, I will offer you the four choices:

- GameStop is a good investment: That may be a viable path, if you bought GameStop at $40 or $50, but not if you paid $200 or $300 a share. At those prices, I don’t see how you get value for your money, but that may reflect a failure of my imagination, and I encourage you to download my spreadsheet and make your own judgments.

- GameStop remains a good trade: You may believe that given your numbers (as individual investors), you can sell the stock to someone else at a higher price, but to whom? You may get lucky and be able to exit before everyone else tries to, but the risk that you will be caught in a stampede is high, as everyone tries to rush the exit doors at the same time. In fact, the constant repetition of the mantra that you need to hold to meet a bigger cause (teach Wall Street a lesson) should give you pause, since it is buying time for others (who may be the ones lecturing you) to exit the stock. I hope that I am wrong, but I think that the most likely end game here is that AMC, GameStop and Blackberry will give back all of the gains that they have had from your intervention and return to pre-action prices sooner rather than later.

- Teach hedge funds and Wall Street a lesson: I won't patronize you by telling you either that I understand your anger or that you should not be angry. That said, driving a few hedge funds out of business will do little to change the overall business, since other funds will fill the void. If this is your primary reason, though, just remember that the money you are investing in GameStop is more donation to a cause, than an investment. If you are investing tuition money, mortgage savings or your pension fund in GameStop and AMC, you are impoverishing yourself, trying to deliver a message that may or may not register. The biggest threat to hedge funds does not come from Reddit investor groups or regulators, but from a combination of obscene fee structures and mediocre performance.

- Play savior: It is possible that your end game was selfless, and that you were trying to save AMC and GameStop as companies, but if that was the case, how has any of what’s happened in the last two weeks help these companies? Their stock prices may have soared, but their financial positions are just as precarious as they were two weeks ago. If your response is that they can try to issue shares at the higher prices, I think of the odds of being able to do this successfully are low for two reasons. The first is that planning a new share issuance takes time, requiring SEC filings and approval. The second is that the very act of trying to issue new shares at the higher price may deflate that price. In a perverse way, you might have made it more difficult for GameStop and AMC to find a pathway to survive as parts of larger companies, by pushing up stock prices, and making them more expensive as targets.

If you are in this game, at least be clear with yourself on what your end game is and protect yourself, because no one else will. The crowds that stormed the Bastille for the French Revolution burned the prison and killed the governor, but once done, they turned on each other. Watch your enemies (and I know that you include regulators and trading platforms in here), but watch your friends even more closely!

Market Lessons

If you are not a hedge fund that sold short on the targeted stocks, or a trader who bought in on other side, are there any consequences for you, from this episode? I do think that we sometimes read too much into market events and episodes, but this short period has some lessons.

- Flattening of the Investment World: Borrowing a term from Tom Friedman, I believe that the investment world has flattened over the last few decades, as access to data and powerful tools widens, and trading eases. It should come as no surprise then that portfolio managers and market gurus are discovering that they no longer are the arbiters of whether markets are cheap or expensive, and that their path of least resistance might come from following what individual investors do, rather than lead them. In a prior post, I pointed to this as one reason why risk capital stayed in the game in 2020, confounding many long-term market watchers, who expected it to flee.

- Emptiness of Investment Expertise: Professional money management has always sold its wares (mutual funds, hedge funds, investment advice) as the products of deep thinking and serious analysis, and as long as the processes stayed opaque and information was scanty, they were able to preserve the delusion. In the last few decades, as we have stripped away the layers, we have discovered how little there is under the surface. The hand wringing on the part of money managers about the momentum trading and absence of attention to fundamentals on the part of Redditors strikes me as hypocritical, since many of these money managers are themselves momentum players, whose idea of fundamentals is looking at trailing earnings. My prediction is that this episode and others like it will accelerate the shift from active to passive investing, especially on the part of investors who are paying hefty fees, and receiving little in return.

- Value ≠ Price: I won’t bore you again with my distinction between value and price, but it stands me in good stead during periods like this one. During the last week, I have been asked many times how I plan to change the way I value companies, as a result of the GameStop story, and my answer is that I don’t. That is not because I am stuck in my ways, but because almost everything that is being talked about (the rising power of the individual investors, the ease of trading on apps like Robinhood, the power of social media investing forums to create crowds) are factors that drive price, not value. It does mean that increasing access to data and easing trading may have the perverse effect of causing price to vary more, relative to value, and for longer periods. My advice, if you are an investor who believes in fundamentals, is that you accept this as the new reality and not drive yourself in a frenzy because you cannot explain what other people are paying for Tesla, Airbnb or Zoom.

In the next few weeks, I predict that we will hear talk of regulatory changes intended to protect investors from their own excesses. If the regulators have their way, it will get more difficult to trade options and borrow money to buy shares, and I have mixed feelings about the efficacy of these restrictions. I understand the motivation for this talk, but I think that the best lessons that you learn about risk come from taking too much or the wrong risks, and then suffering the consequences.