Written by: Marc Odo | Swan Global Investments

Addressing the Combination of Withdrawals, Inflation, and Timing

In previous blog posts, we discussed the impact of “curveballs” on retirement planning:Curveball One: Timing

The first curveball was the impact of timing in the post “ Timing is Everything? Or is It?” We explored how the success or failure of an investment plan is due in large part to when an initial investment was made, a seemingly random variable. Over the time horizon analyzed, the ending value of a $100,000 investment in the S&P 500 after ten years could have been as high as $343,033 or as low as $87,006, based solely upon which January 1st the individual opted to make the initial investment. The take-away is that if you can’t predict it, it makes it very difficult to plan for it.Curveball Two: Withdrawals

The second curveball is the impact of taking withdrawals from an investment plan, discussed in “ Suffering from Withdrawals?” As investors shift from the accumulation to distribution stages of their life cycle, the negative consequences of large bear markets become much more pronounced. Market drawdowns are no longer opportunities to “buy on a low.” Instead, retirees are forced to liquidate their holdings during times of market weakness. The take-away from that post is withdrawing funds from a sinking market makes it all the more difficult to recover losses.Impact of Combination of Withdrawals, Inflation, and Timing

In this blog post, we combine these two analyses into what we call a “ WIT Analysis.”

Source: Zephyr StyleADVISOR

This explores the combined impact of withdrawals, inflation, and timing on an investment.The intent in using a WIT analysis is to examine how an investment plan might look after a decade in the real world if a retiree is forced to take withdrawals and had the bad luck of investing at the wrong time.Setting the Scene

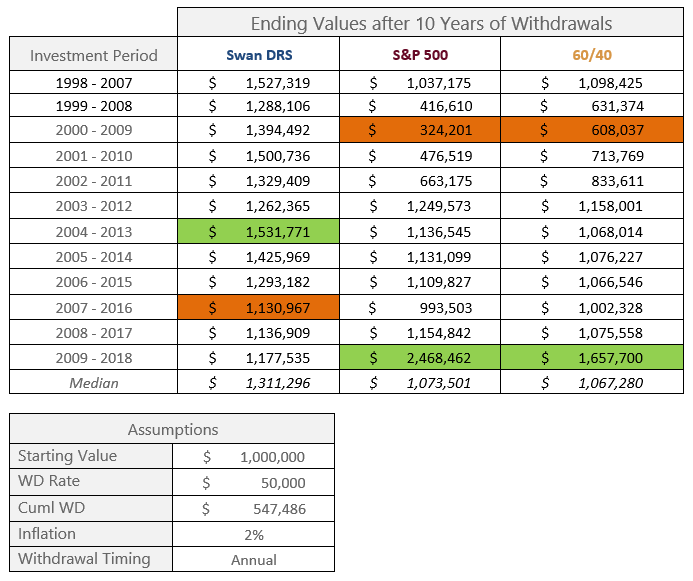

Like we did in previous posts, we assume an initial investment of $1,000,000 in one of three options:

Source: Zephyr StyleADVISOR. The Barclays U.S. Aggregate Bond Index and the S&P 500 Index are unmanaged indices and cannot be invested into directly. Past performance is no guarantee of future results. DRS results are from the Select Composite, net of fees, as of 12/31/2018.

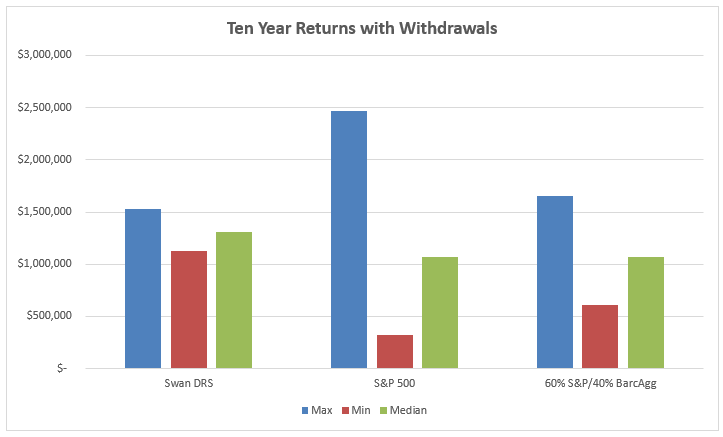

How Do Our Three Investment Options Stack Up?

After ten years and $547,486 of withdrawals, the median investment in the S&P 500 still had a remaining value of $1,073,501. However, that average masks a lot of variability:

Source: Zephyr StyleADVISOR. The Barclays U.S. Aggregate Bond Index and the S&P 500 Index are unmanaged indices and cannot be invested into directly. Past performance is no guarantee of future results. DRS results are from the Select Composite, net of fees, as of 12/31/2018.