A casino has a 0.5% edge on the Blackjack table and rakes in, like, bazillions of dollars a year, yet an 89% historical positive market outcome will still cause investors to scoff or even walk away.

No one likes it when the markets are down for a month…let alone three. But as long-time readers know, I like to look at the probabilities of things happening rather than the possibility.

So, let’s do that for a moment.

Is it POSSIBLE we could see a deepening correction from the last three months? Yes. Totally possible. But that’s a guess, there are no facts about the future and a gut feeling is not an appropriate indicator.

Is it PROBABLE? Well fortunately we can look at a lot of past data to do better than a guess.

As you can see from the chart below from Ryan Detrick of Carson Group, when the S&P 500 is down in October, November sees a higher return 72% of the time and for the last two months of the year it is higher 89% of the time.

But that means 2 times out of ten, the S&P 500 is not higher.

So, it’s possible the rest of the year will follow the last three months, but also not probable.

I’ll bring this back to one of my favorite comparisons – Vegas.

People pack the Blackjack tables with systems and hunches and rules on when to hit, not hit, split, you name it…all in the face of the casino have a 0.5% edge.

Read that again: the casino has a 0.5% edge on the Blackjack table and rakes in like bazillions of dollars a year. Yet an 89% historical positive outcome will still cause investors to scoff or even walk away.

Face palm.

“But Dave, my gut is telling me something bad is on the horizon.” Ok, fine, (Hint: there is ALWAYS something bad on the horizon) but here’s more from Ryan.

There have only been six times in history where August, September and October were all down. Only one of the six times had the final two months post a negative return.

Market pullbacks mentally suck. They make you doubt your strategies and rethink your planning. They trigger your survival instincts to kick in and influence decision making that is generally not going to end up being favorable.

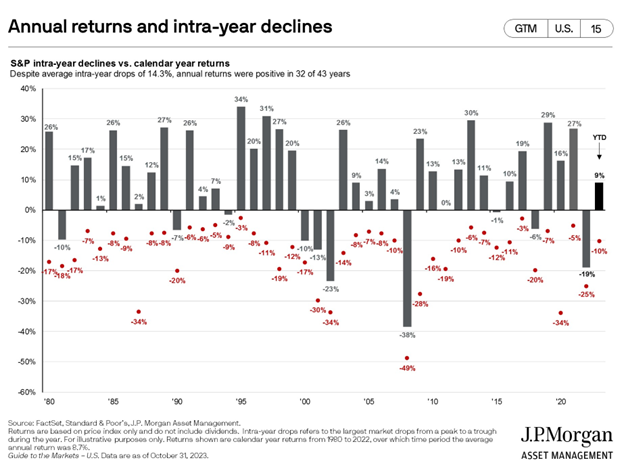

In the below chart from JPMorgan, you can see that 32 of the past 43 years have seen positive annual market returns DESPITE an average intra-year drop of -14.3%.

October and the last three months may seem awful, but in reality, they are perfectly normal.

You can protect yourself with having cash to spend and live from while the market is in a sell off, which keeps you from exchanging temporary paper losses into real losses.

Opinions are the difference between advisors giving real advice and value vs. advisors trying to sell you something.

Giving people unfiltered opinions and straightforward advice is our value proposition. We know our clients want us to give it to them straight, they want to know where we stand, and they want to know we have a clear point of view without pretending we can tell the future.

If you aren’t getting it straight, don’t know where your advisor stands, aren’t getting a clear point of view, or are getting recommendations based on forecasts of the future that can’t be made, reach out to me. While not everyone can be a Monument client, we can help anyone who needs a better advisor find one, we know a lot of really good advisors out there to fit all needs.