To understand why we have to review a bit of history.

In 2013, I began warning of the risk to oil prices due to the ongoing imbalances between global supply and demand. Those warnings fell on deaf ears.

Nobody wanted to pay much attention to the fundamentals at a time when near-zero interest rates were pushing banks, hedge funds, and private equity firms, to chase the “yield” in the energy space. Naturally, with money flooding into the system, companies were forced to drill economically unproductive wells to meet investor demands, which drove supplies higher.

Disclaimer

This week’s #MacroView is a broader commentary on the more general issues of the oil market. However, given this backdrop of what oil prices will likely remain suppressed far longer than most currently imagine, some opportunities exist in the energy space.

We recently added positions in Exxon (XOM), Chevron (CVX), and the SPDR Energy ETF (XLE) to our portfolios. We believed the companies offered significant value before the crisis, and offer even more due to the sell-off in oil.

Based on our discounted cash flow model for XOM and CVX, we think both companies are 25% undervalued. The model assumes very conservative earnings projections for the next three years and a low EPS growth rate after that. In addition to trading at a steep discount, we think their strong balance sheets put these companies in a prime position to purchase sharply discounted energy assets in the months ahead.

These stocks, and the sector, will be volatile for a while, but we intend to add to these positions in the future and potentially hold them for a long time.

Now, for the rest of the story.

A Bit Of History

It didn’t take long for previous predictions to play out. In May of 2014, I wrote:

“It is quite clear the speculative rise in oil prices due to the ‘fracking miracle’ has come to its inglorious, but expected conclusion. It is quite apparent some lessons are simply never learned. “

Since then, OPEC engaged in repeated rounds of cutting production to support oil prices. While there was a short-term success from those actions, ultimately, U.S. “shale” producers outpaced those cuts with new supply. In September of 2017, we again reviewed the fundamentals warning investors of the risk.

“While there is hope production cuts will continue into 2018, a bulk of the current price gain has likely already been priced in. With oil prices once again overbought, the risk of disappointment is substantial.”

Then, as 2018 came to a close, I made an important observation:

“Prices of both energy-related shares and oil have been disappointing. The expected decline in oil prices is more important than just the relative decline in share prices of energy-related stocks. Energy prices are highly correlated with economic activity.“

That bit of history helps frame our reasoning behind the collapse in oil prices. Such remains a fundamental issue of supply and demand and suggests the economic impact from the virus-related shutdown may be more lasting.

The Link To Oil

Oil is a highly sensitive indicator relative to the expansion or contraction of the economy. Given that oil is consumed in virtually every aspect of our lives, from the food we eat to the products and services we buy, the demand side of the equation is a tell-tale sign of economic strength or weakness.

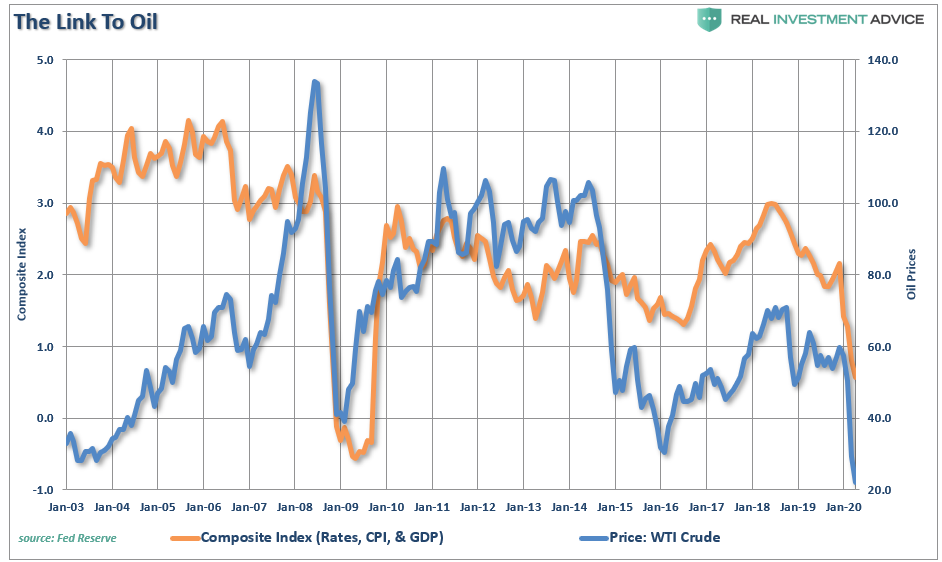

The chart below combines interest rates, inflation, and GDP into one composite indicator to provide a more evident comparison to oil prices.

“As such, it is not surprising that sharp declines in oil prices have been coincident with downturns in economic activity, a drop in inflation, and a subsequent decline in interest rates.”

With economic weakness gaining traction globally, it is hard to justify an improving outlook for oil on either a fundamental or technical basis. The charts for WTI remain bearish, and the fundamentals are still driven by basic economics: “Too much supply. Too little demand.”

Can’t Stop Drilling

In 2016, when I first started to discuss the future problems stemming from the “oversupply” of oil, I noted the relationship between cheap credit and oil production. To wit:

“This surge in supply is a direct result of the innovations in oilfield extraction techniques, or ‘fracking,’ combined with a surge in liquidity provided by the Federal Reserve. The chart below shows the relationship between oil prices and the increase of the Federal Reserve’s balance sheet."

The induction of liquidity into the financial system by the Federal Reserve translated into an effective “land rush” for “fracking” companies. Cheap credit, high demand for yield, and loose lending standards, led to the inevitable consequence of a malinvestment boom. The eventual outcome of a sector laden with “zombie companies,” which have been kept alive by cheap debt, is a surge in failures over time. As Mish Shedlock noted earlier this week:

“61 percent of firms would remain solvent in the next year if the WTI price of oil would stay at $30 per barrel, and 64 percent of firms would remain solvent if the WTI price of oil would stay at $40.”

But herein lies the problem.

Compounding The Problem

The companies that took on the debt, or equity, to drill must keep drilling to generate revenue. As supply increases, prices decline, leading to further drilling losses in wells, which were only marginally profitable to begin with. Companies then have to take on more debt to remain operational, further increasing supply, in hopes that prices will eventually rise.

While logic would suggest companies actively reduce the supply to increase prices, operators are unable to “shut-in” production due to the loss of needed operating revenues, but also the underlying land leases. Therefore, they are forced to continue the drilling process, further exacerbating the supply problem.

The current levels of supply create longer-term issues for prices globally. Compounding the problem is weaker global demand due not to just the “economic shutdown,” but ongoing issues related to demographics, energy efficiencies, and debt.

The issue remains supply, with domestic production offsetting any “cuts” by OPEC.

The oversupply issue is also why we shouldn’t consider “bailing out” energy companies.

Don’t Bailout Energy Companies

President Trump recently tweeted that he would use an “executive order” to provide funding to “our great energy industry.” This would be a mistake, and only exacerbate the problems of price, supply, and economic growth.

As noted above, oil companies must produce oil to generate revenues with which to operate. For many smaller energy companies, shutting in production is simply not an option as it would immediately lead to credit defaults and bankruptcies.

However, this is what is needed. Allowing non-profitable, poorly managed, and overly indebted companies to “fail,” both reduces the supply of oil and strengthens the health of the overall industry.

In 2008, when prices crashed, the quantity of oil available in the market had hit an all-time low, while global demand was at an all-time high. The fear of “peak oil” was rampant in news headlines and the financial markets. The financial crisis quickly realigned prices with demand.

Supply & Demand

The supply-demand imbalance, combined with suppressed commodity prices in 2008, was the perfect cocktail for a surge in prices as the “fracking miracle” came into focus. The rise of supply alleviated the fears of oil company stability, and investors rushed back into the sector to profit from the resurgence in profitability.

Currently, the supply-demand imbalance has once again reversed. Even before the “COVID-19” virus impact, which crushed demand, supply was already at the highest levels on record. Oil had already been in an extended slump as global demand growth remained weak.

The supply-demand problem must be allowed to revert to more prosperous levels, and bailing out the industry only curtails the process from occurring. Since oil production, at any price, is the major part of the revenue streams of energy-related companies, it is already unlikely there will be any real cuts to output in the near-term.

Without allowing companies to fail, oil supply remains high, which continues to put downward pressure on prices. By not allowing the dynamics of capitalism to operate, the entire industry remains burdened and struggling for profitability.

The Demand Disruption

Then there is the demand side of the equation.

The problem with dropping demand, of course, is that it exacerbates the “supply glut” leading to a continued suppression in oil prices. Now, it is also leading to a “storage problem” with supplies overwhelming the storage available.

As Howard Marks recently noted:

“It’s not a panic. The move is completely rational. The ultimate complication is that storing oil costs money, and storage facilities aren’t unlimited. Right now storage is scarce and thus expensive, so it’s not worth it to buy oil today and store it. The cost of storing exceeds the value today; thus the price is negative.”

The problem, however, is there are significant headwinds to higher oil prices which will remain long after the “virus” ends:

- Weak economic global growth due to continued increases in debt.

- Slow and steady growth of renewable/alternative sources of energy

- Improving efficiencies in energy consumption (EV’s, hybrids, solar, wind, etc.)

- Technological improvements in energy production, storage and transfer, and;

- A rapidly aging global demographic

All this boils down to a long-term, secular, and structurally bearish story.

The Economic Impact

The fundamental tailwinds for substantially higher prices are still vacant. OPEC won’t keep cutting production forever, the global economy remains weak, and efficiencies are suppressing demand.

The obvious ramification of the plunge in oil prices is the energy sector itself. The loss of revenue eventually leads to cuts in production, declines in capital expenditure plans (which comprise roughly 1/4th of all CapEx expenditures in the S&P 500), freezes or reductions in employment, not to mention the declines in revenue and profitability.

Given the oil industry is very manufacturing and production intensive, breaks of price trends tend to be liquidation events that harms both the manufacturing and CapEx spending inputs of the GDP calculation. The chart below shows the 6-month average, of the 6-month rate of change, in oil prices as compared to CapEx spending in the economy. (I have used early estimates for Q1-GDP to show the coincident decline)

Of course, once CapEx is reduced, the need for employment also declines. While employment reductions may begin with the energy companies, eventually, the downstream suppliers are impacted by slower activity. As job losses rise, incomes decline, which then filters into the general economy.

Importantly, when it comes to employment, the majority of the jobs “created” since the financial crisis has been lower wage-paying jobs in retail, healthcare, and other service sectors of the economy. Conversely, the jobs created within the energy space are some of the highest wage paying opportunities available in engineering, technology, accounting, legal, etc.

Each job created in energy-related areas has had a “ripple effect” of creating 2.8 jobs elsewhere in the economy from piping to coatings, trucking and transportation, restaurants, and retail.

Conclusion

Given that oil prices are a reflection of global economic demand, falling oil prices have a negative feedback loop in the economy as a whole. The longer oil prices remain suppressed, the negative impacts on employment, reductions in capital expenditures, and declines in corporate profitability will continue to outstrip any small economic benefit gained through consumption.

While many are hoping for a “V-shaped” recovery, after reopening the economy, this will likely not be the case. The “virus” was only the anticipated catalyst that triggered the economic recession.

That “exogenous” event, which we repeatedly warned of, made the decline in oil prices inevitable.

Unless there is a reduction in supply, the longer-term issues will continue to weigh on energy companies into the future. Ultimately, producers will opt into making cuts, or market dynamics will make the cuts for them. Making a choice is always much less painful than having no choice at all.

However, if the government decides to bailout energy companies in an attempt to keep the capitalistic process of weeding the weak from occurring, our thesis of reduced production, higher oil prices, and increased profitability will be corrupted.

Related: Market MacroView: This Time Might Be Different