The global bounce-back equity rally resumed, as the S&P 500 posted its best week since November by gaining 2.89%.

The narrative remained the same with accommodative monetary policy, subdued inflation, reduced trade tensions, and aggressive stimulus programs in China. The

economic datawas tepid as durable goods, new home sales, industrial production, and the Empire Manufacturing Index all came in slightly below expectations. January retail sales exceeded expectations, but December was revised down further (I still find the December data hard to believe). Prior to last week’s gains, the S&P 500 was exactly at the same level as one-year earlier while the Russell 2000 remains still slightly in the red.

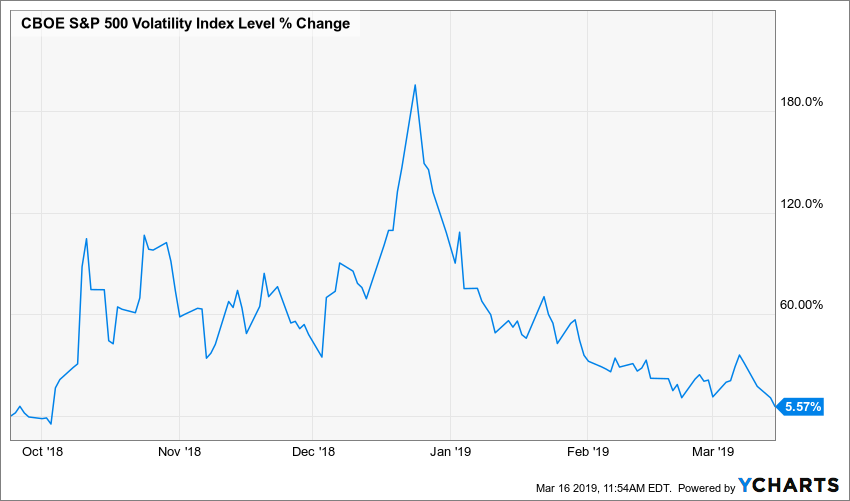

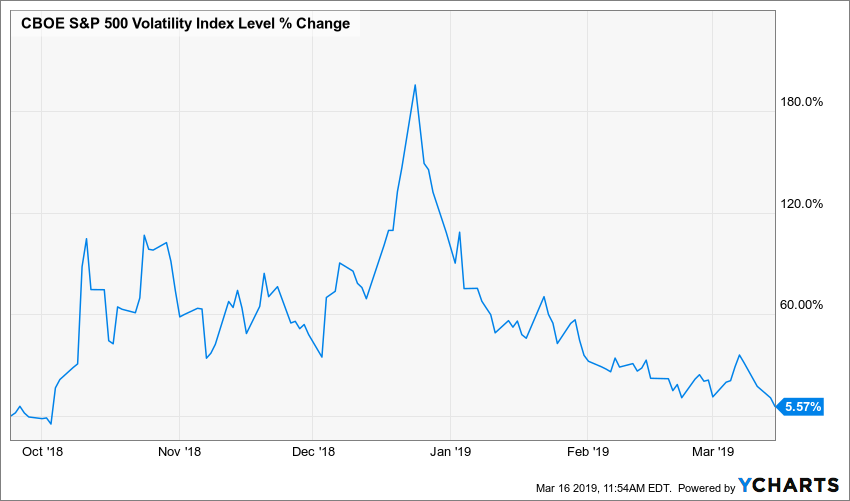

During that time frame large cap growth has outperformed small cap value by 7.64% with 4.51% of that performance disparity coming in the last month.The yield on the Ten-Year Treasury inched down 2 basis points to 2.59% to settle at its lowest level of 2019. These lower interest rates increase the attractiveness of growth stocks as the future value of their income streams are increased as the discount rate decreases. The flattening of the yield curve (the spread between the 10-year and 2-year Treasuries is only 16 basis points currently) creates a headwind for the financial sector which is disproportionately weighted in value indices (26.84% of Russell 2000 Value Index).I have stopped referencing the VIX (CBOE Volatility Index) because it only seems to take the current temperature without offering any predictive value. Nevertheless it seems worth pointing out that the VIX dropped 20% last week, and is now back to its level from October prior to the nasty sell-off.

This Week:

It’s March Madness! A shout out to Michelle Kuby who graduated from Bradley, the only university in Illinois to get a ticket to the dance. I’m going to predict that there are going to be lots of upsets as teams take about 25% of their shots from behind the 3-point line, which increases the odds of an underdog getting hot or a favorite getting cold.

The stock marketwill also be open for trading, with the FOMC decision on Wednesday in focus. Given the 0% chance of a rate hike at this meeting, the dot plot and balance sheet expectations will be of particular interest.Related:

The Prospects of an Impending Global Recession Stocks on the Move:

PetIQ Inc. (PETQ) +11.3%: PetIQ is a manufacturer and distributor of health and wellness products for dogs and cats. The company offers veterinarian-grade pet Rx medications, OTC flea and tick preventatives, vitamins treats, nutritional supplements, and hygiene products. The Company reported record fourth quarter net sales of $111.0 million, an increase of 114%; organic net sales growth was 70%, and adjusted EBITDA was $6.5 million compared to $3.6 million, an increase of 82%. Cord Christensen, PetIQ’s Chairman and Chief Executive Officer commented, “2018 was a transformational year for PetIQ with the completion of two strategic acquisitions to help us build a larger and more diversified animal health organization. We have worked diligently to execute on our Follow the Pets strategy by further enhancing our core pet health and wellness capabilities, strengthening new and existing partnerships across all sales channels through complementary veterinarian product and service offerings, and integrating VIP, which together, resulted in the significant growth of our business. We believe these efforts better position us to continue to grow the animal health and wellness category, fulfilling our mission to make pets’ lives better through improved access to affordable pet health care.” PETQ is a 0.65% holding in the North Star Opportunity Fund.

Truett-Hurst Inc. (THST) -24.87%: Truett-Hurst Inc operates in the wine industry. It produces and sells wines and other select beverage alcohol products made from wine. It operates through its direct to consumer division. Direct to consumer sales occur through its tasting rooms and wine clubs. The company owns its tasting room and winery in the Dry Creek Valley of Sonoma County, California. The Company notified NASDAQ of its intent to voluntarily delist and withdraw the registration of its Class A common stock with the SEC. The Company intends to file a Form 25 with the SEC on or about March 18, 2019. The Company expects the last trading day for its common stock on NASDAQ will be on or about March 28, 2019. The Company expects that the Class A common stock would be quoted on an over-the-counter market, such as the OTC Pink market, once trading in the Class A common stock on the NASDAQ is suspended following the effectiveness of the Form 25. We are surprised by the severe reaction of the share price as this plan was previously disclosed in their recent tender offer. THST is a 0.63% holding in the North Star Micro Cap Fund.

Oil-Dri Corp of America (ODC)+10.36%: Oil-Dri develops, manufactures, and markets sorbent products made primarily from clay. Its absorbent offerings, which draw liquid up, include cat litter, floor products, toxin control substances for livestock, and agricultural chemical carriers. The Company reported fiscal second-quarter net income of $2.3 million, after reporting a loss in the same period a year earlier, on revenues that increased 1% to $69.9 million. Daniel S. Jaffee, President and CEO, stated, “Our financial results are disappointing but reflect short-term growing pains and industry-wide challenges. While some of the negative impacts were anticipated, some were not. However, as I have stated previously, I am confident that our long-term strategies are working. We are gaining traction in our focused markets, and as Head Coach of the Oil-Dri Team, I can assure you we have every intention of staying the course and winning over the long run. ODC is a 2.54% holding in the North Star Dividend Fund.Portfolio holdings are subject to change and should not be considered investment advice.North Star Investment Management Corp. is the Advisor for the North Star Family Mutual Funds.

During that time frame large cap growth has outperformed small cap value by 7.64% with 4.51% of that performance disparity coming in the last month.The yield on the Ten-Year Treasury inched down 2 basis points to 2.59% to settle at its lowest level of 2019. These lower interest rates increase the attractiveness of growth stocks as the future value of their income streams are increased as the discount rate decreases. The flattening of the yield curve (the spread between the 10-year and 2-year Treasuries is only 16 basis points currently) creates a headwind for the financial sector which is disproportionately weighted in value indices (26.84% of Russell 2000 Value Index).I have stopped referencing the VIX (CBOE Volatility Index) because it only seems to take the current temperature without offering any predictive value. Nevertheless it seems worth pointing out that the VIX dropped 20% last week, and is now back to its level from October prior to the nasty sell-off.

During that time frame large cap growth has outperformed small cap value by 7.64% with 4.51% of that performance disparity coming in the last month.The yield on the Ten-Year Treasury inched down 2 basis points to 2.59% to settle at its lowest level of 2019. These lower interest rates increase the attractiveness of growth stocks as the future value of their income streams are increased as the discount rate decreases. The flattening of the yield curve (the spread between the 10-year and 2-year Treasuries is only 16 basis points currently) creates a headwind for the financial sector which is disproportionately weighted in value indices (26.84% of Russell 2000 Value Index).I have stopped referencing the VIX (CBOE Volatility Index) because it only seems to take the current temperature without offering any predictive value. Nevertheless it seems worth pointing out that the VIX dropped 20% last week, and is now back to its level from October prior to the nasty sell-off.