Consumer confidence undershoot didn‘t bring down stocks as the retreat in yields (away from the reflation trades) didn‘t spook value stocks, and only lifted tech. It‘s true that XLK isn‘t firing on all cylinders, and the semiconductors‘ lag is just as concerning as Russell 2000 underperformance – so much for explaining the risks in stocks.

But as I wrote on Friday:

(…) Inflationary pressures building up aren‘t spooking the markets, there is no forcing the Fed‘s hand through rising yields. The bond vigilantes seem a distant memory as yields are trading well below their historical band, stunningly low given the hot inflation data. I‘m not saying red hot because the monthly CPI figure came in line with expectations, providing relief to the transitory camp. But last week‘s ISM services PMI and yesterday‘s PPI paint a very different story (to come).

My call about summer lull in bonds before these slowly but surely make their way higher (the 10-year to 1.80%), is turning out just as well as the inflation expectations‘ continued rebound. The cheap magic of Fed‘s June jawboning is losing its luster. Stocks steady and making marginally higher ATHs practically daily, uneven credit markets, gold holding up well following Monday‘s hit job, oil and copper trading in narrow ranges while the crypto uptrend goes on – fresh profits harvested across the markets yesterday, and growing today.

Regarding the taper noises many Fed speakers made during the week (it isn‘t just about Dallas), some form of taper looks indeed coming, even though they would have a hard time pulling it off against decelerating economy and massive fresh spending. Mission impossible if you will. Still, they make the appearance of wanting to try – wouldn‘t tanking markets and fresh calls to do something be a perfect excuse to expanding balance sheet solidly again? But they must at least internally in the Eccles building understand that a move against inflation is long overdue, and perhaps a repetition of June FOMC wouldn‘t do the trick this time.

Again, today’s report will be shorter than usual, and focus on select charts so as to drive position details of all the five publications.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

Tech continues catching up with value overall holding ground, and that means S&P 500 is ever so slightly ahead over Nasdaq these days. But once another phase of rising yields returns, look for the divergence between the two to reappear.

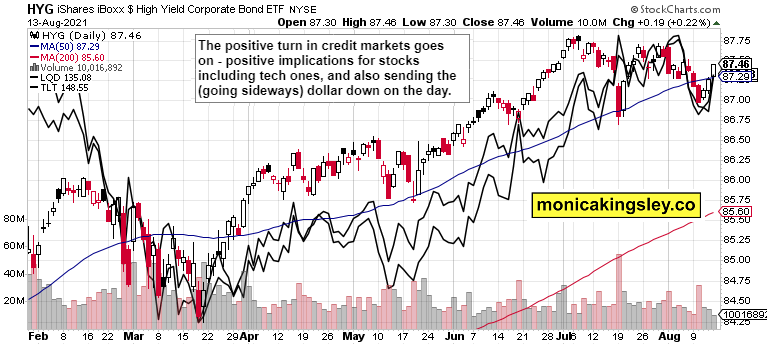

Credit Markets

Credit markets upturn continues, and on lowest volume in recent months – suspicious, but not enough given the lackluster moves elsewhere. Bond performance was still positive for stocks‘ fragile rally.

Gold, Silver and Miners

Miners‘ weakness that I wrote about on Friday, was indeed deceptive. The yellow metal surged higher, surpassed only by silver (the white metal was the odd one out with its Thursday‘s fake weakness). What a welcome bullish turn of events driven by retreating dollar and nominal yields, with the weakening consumer confidence casting a shadow over the economy too.

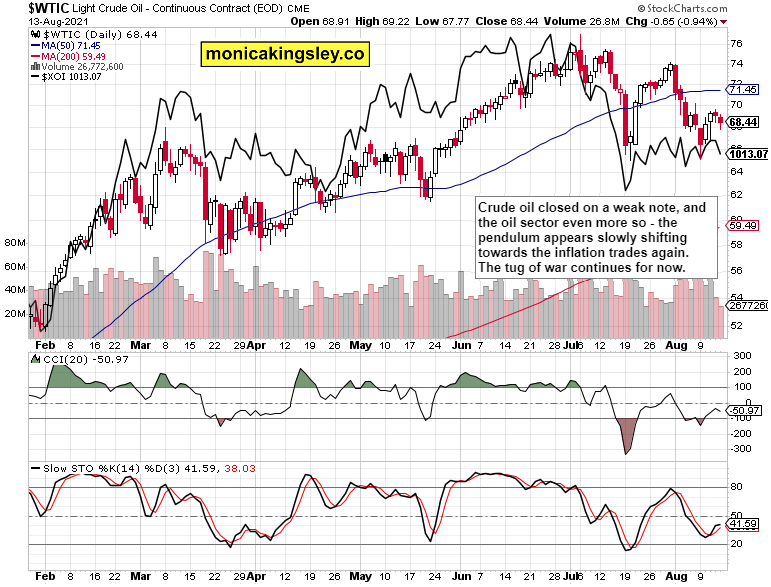

Crude Oil

On one hand, crude oil decline on lower volume is less credible, on the other hand, the oil sector fell even more. Sideways trading in black gold looks set to continue (closer to $60 than $80 within the range I mentioned lately), but I look for it to be eventually resolved with an upswing.

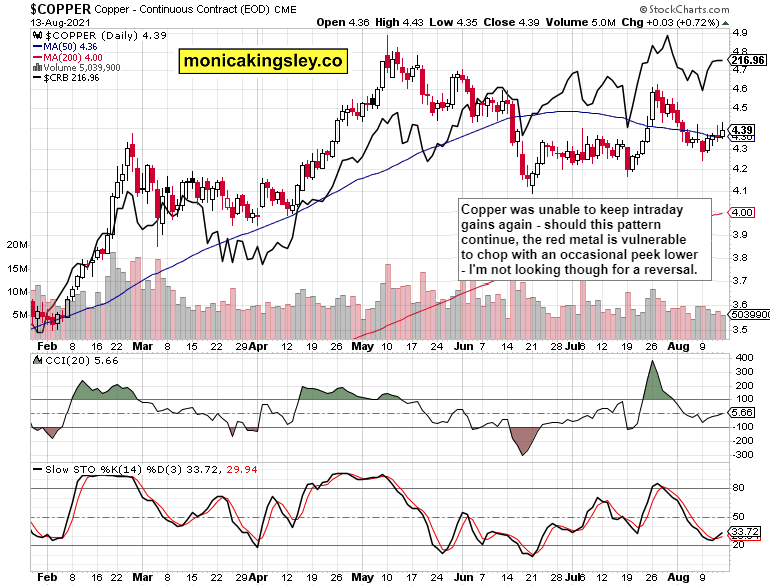

Copper

Copper upswing was again rejected, and the commodity index went nowhere. Still, the red metal managed to rise on the week – no small feat given the creeping doubts about where the real economy‘s growth path is headed.

Bitcoin and Ethereum

Some more base building in cryptos, and encouragingly it‘s above the 200-day moving average in Bitcoin while Ethereum isn‘t weak. The benefit of the doubt is still with the bulls.

Summary

In place of summary today, please see the above chart descriptions for my take.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Related: Fresh Highs to Meet Fresh Volatility

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.