Tuesday’s JOLTs report is one of many data points showing that the labor market is near or back to the prevailing conditions before the pandemic. It’s not just JOLTs and the labor market normalizing; most other economic indicators show the economy is finally normalizing at pre-pandemic levels.

Yesterday’s Commentary argued that while the unemployment and PCE inflation rates are not far from the Fed’s longer-term projections, the Fed Funds rate is too high, at almost 3% above their extended forecast. Given that divergence, we wrote: “Even if the economy continues to chug along without a recession, it appears that barring higher inflation, significant rate cuts in the coming year will be consistent with the Fed’s economic outlook.”

A reader asked us: “If the economy is normalizing, what comes next?” The oft-used airplane analogy may be the best way to answer. Can the Fed bring the economy back to a typical economic cruising altitude and keep it there? Or might the downward trajectory continue, leading to a soft or hard landing? Given that most other major economies exhibit little economic growth and the Fed is applying tight monetary policy, a new period of higher-than-average growth is the least likely scenario. However, that could change if significant fiscal stimulus follows the election. We are looking for signs that the economy might continue to weaken, thus prompting recession calls. However, the Wall Street consensus is for smooth sailing ahead. Stay tuned!

What To Watch

Earnings

Economy

Market Trading Update

In yesterday’s commentary, we discussed the drastic drop in bond ETFs, which sparked many questions. As usual, most things don’t mean anything. Intra-day and daily price movements in anything are usually unrelated to any macro theme and are a function of short-term overbought or oversold conditions.

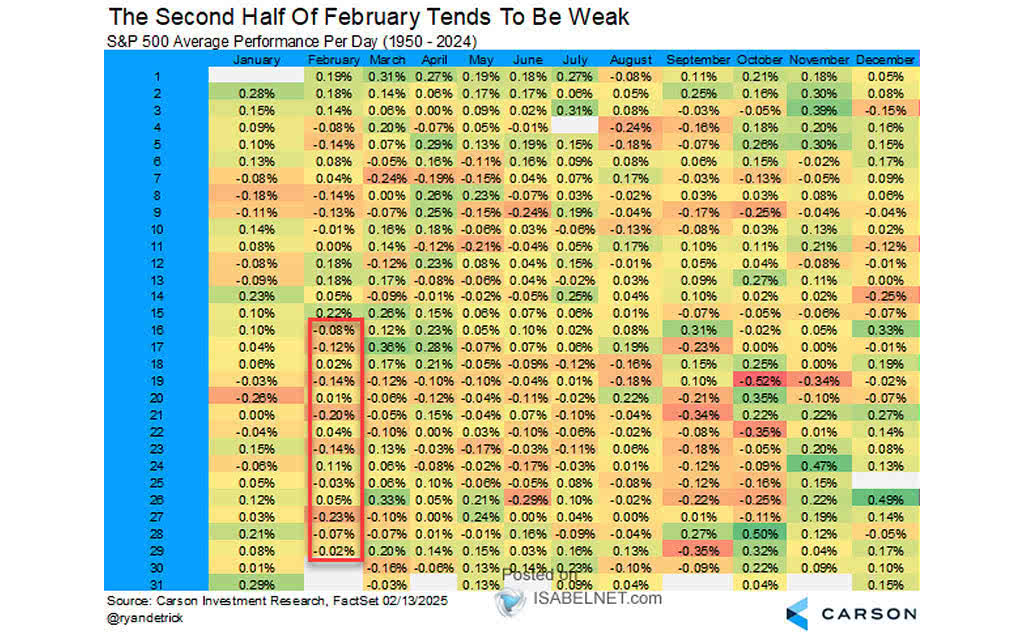

Such is the case with the market as we begin the year’s second half. Historically, performance tends to be stronger in the first half of the month and weaker in the last half. August and September also tend to be weaker, particularly in election years.

Interestingly, we are now repeating much of what we said this time last year. In 2023, the markets were racing higher, hoping for Fed rate cuts and the “artificial intelligence” craze. At that time, markets were overbought and deviated from their means, but momentum was very strong as volatility remained suppressed. Then, like today, we were warning of the potential for a 5-10% correction to reverse some of those conditions.

As shown, the beginning of this year has been almost a mirror image of last year, with market performance very close. Will the correlation continue, and we see a correction this summer, or will this time be different? I don’t know for certain, but the similarity is eerie, and the risk of correction is elevated in the near term. Trade accordingly.

More On Bad Breadth

The graph below from Ned Davis Research is very telling for two reasons. First, thus far in 2024, the percentage of stocks outperforming the S&P 500 is at a record low, going back about fifty years. This follows a near-record low in 2023. Looking back, there is only one other instance of two consecutive years with such poor market breadth: 1998 and 1999.

While comparing the internet era in the late 1990s to the AI era today may seem appropriate, it’s important to remember the old adage: “Markets can remain irrational longer than you can remain solvent.” The point is that while the market will correct at some point, and yes, AI and other stocks with massive price surges can fall by 30, 40, or even 50% or more, that may not occur for a while.

Accordingly, appreciate the risks and realize a correction is highly likely. However, to better anticipate such an event, close attention must be paid to the market technicals. As they always have, they will alert us when to take a more conservative posture.

Jerome Powell’s Latest Thoughts

Fed Chair Powell spoke on Tuesday morning in Portugal at an ECB forum and shared his latest thoughts on the economy, inflation, and rate cuts. He was generally dovish but didn’t seem overly anxious to cut interest rates. Below, we share a few poignant comments.

Inflation now shows signs of resuming its disinflationary trend.” “We are getting back on a disinflationary path.” “We’ve made a lot of progress.

I’m not going to be landing on any specific dates here today…so we’re aware that we have two-sided risks now, more so than we did a year ago. That’s a big change. I’d say risks are coming much more into balance now

The risk of inflation is that we act too fast

We are well aware of the risk going too soon and too fast

Inflation may get back to 2% late next year or the following year

As shown below, Fed Funds futures now imply an 83% chance the Fed will cut rates twice by year-end. The number of rate cuts has fluctuated between one and two over the previous two months.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”