In Part 1, we suggested a weaker dollar may not lead to the bullish outcomes many investors expect in 2023. We will build on that thesis in Part II, and bonds will win in the first half of 2023 and stocks in the second half.

The big question heading into 2023 is the dreaded “R” word. Can the U.S. economy avoid a “recession” amid the most aggressive rate hiking campaign by the Federal Reserve since 1980?

Anything is certainly possible. However, with economic activity impacted by higher rates and inflation, the odds of a recession seem elevated. Such was a point made in Part 1 stating:

“As we head into 2023, we expect a rather sharp dollar decline. Such should be the consequence of Federal Reserve rate hikes and aggressive policy tightening, sparking an economic recession. As discussed, our monetary policy conditions index, which combines the dollar with inflation, interest rates, and Fed funds, suggests an economic contraction is the most likely outcome. Historically, a dollar decline coincides with economic slowdowns and recessions, which is not surprising as demand for goods declines.”

![]()

Of course, the inversion of 80% of the 10 economically important yield curvesalso suggests a recession is likely.

“The Federal Reserve controls the short-end of the yield curve (1-month to 2-year rates.) However, the economy, wages, and inflation control the long end of the curve. Therefore, as the Fed continues to hike rates, such will increase the number, and the depth, of inverted yield curves. Notably, the inversion of various yield curves is essential to both market outcomes and the economy (aka recession).”

![]()

The inverted yield curves play an essential role in our 2023 portfolio positioning. While many hope the Federal Reserve will “pivot,” such may not be as immediately “bullish” as many expect.

The Un-Inverting Yield Curve

In “The Policy Pivot May Not Be Bullish,” we explained:

“Notably, most ‘bear markets’ occur AFTER the Fed’s ‘policy pivot.’ The reason is that the policy pivot comes with the recognition that something has broken either economically (aka “recession”) or financially (aka “credit event”). When that event occurs, and the Fed initially takes action, the market reprices for lower economic and earnings growth rates.”

The last sentence is key.

So far, investors have mostly overlooked the rate shock impact on the real economy. However, the Fed’s aggressive rate hikes have collapsed the composite Economic Composite Index and the 6-month rate of change of the Leading Economic Index. These indicators are strong leading indicators of economic slowdowns and recessionary onsets.

![]()

As noted recently by BofA, investors are ignoring the risk of aggressive rate hikes on three assumptions:

- The “Fed Always Blinks”

- “Stocks Always Go Up”

- “Tech Always Leads Stocks Higher”

These assumptions are not surprising given the last decade of monetary policy interventions each time the market hiccuped. However, the difference today is inflation is at its highest level since the 1970s. The Fed remains clear it will continue to hike rates and keep them there until its inflation battle is complete.

The problem is that such will lead to two eventual outcomes, neither supportive of being “bullish on stocks.”

The first is the still-coming impact on earnings and profit margins. Since early 2022, we warned earnings estimates remain excessively high relative to what the economy will generate in 2023. With rates and inflation eroding economic activity, forward earnings estimates must adjust lower. As such, stocks will have to reprice lower as well. The Economic Composite Index, as noted above, confirms the same.

![]()

The second is the UN-inversion of the yield curve.

Why Bonds May Be The Best Asset In 2023

Our investment strategy for 2023 remains predicated on what happens when the yield curve UN-inverts. Interestingly, this un-inversion is part of the investor’s primary belief that the “Fed always blinks.”

The most likely outcome of the Fed’s most aggressive monetary campaign in history is a recession. Such would lead to an immediate policy reversal. Crucially, the Fed controls the short end of the curve, but the economy and inflation control the long end. Therefore, as the recession takes hold, interest rates will decline on the long end of the curve. However, such will lead to a deeper reversion in yields until something “breaks.“ Only then will the Federal Reserve begin to cut rates.

![]()

As yields fall, the race will be the Fed cutting rates faster than the long-end declines to boost monetary accommodation to offset recessionary pressures. Such is why, as shown below, Fed rate changes “take the stairs up, but the elevator down.”

![]()

Of course, as yields plummet, bond prices rise as investors seek the “safety of capital” over “risk” as the equity market reprices for recessionary outcomes.

Such leaves the real opportunity to buy stocks coming later next year.

What If I’m Wrong

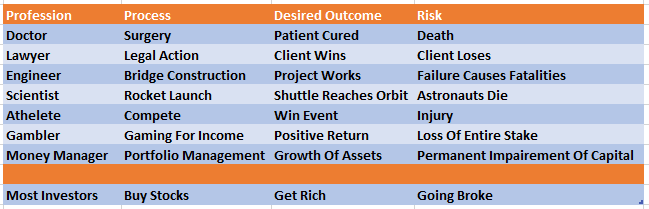

In virtually every professional field, there is “risk.”

Those who fail to focus on and recognize the inherent risk, more commonly known as “being reckless,” tend not to be around very long in any given profession. What always separates the “winners” from “losers” are those that can avoid catastrophic damage over time.

While a recessionary outcome, given the magnitude of rate hikes by the Federal Reserve, seems to be the most logical case, there is always the “possibility” something else could happen.

If I am wrong about a further earnings decline, and the economy avoids a recession, then the market is likely more reasonably priced than not.

Such would also suggest investors are closer to the equity market lows than not.

However, there is a problem with that scenario. In a non-recessionary environment, the Fed won’t be cutting rates (pivoting). In that scenario, the labor market will remain resilient as inflation stays elevated, albeit at lower levels. Should such turn out to be the case, it would still seem that earnings, and profit margins, will continue to get pressured between high borrowing costs and inflation, still suggesting downside risk to asset prices.

Such is the problem with current earnings estimates, which remain deviated above their long-term 6% annualized growth trend.

![]()

Throughout history, earnings regularly revert to the long-term growth trend, if not beyond it. The risk of a reversion was not expected in 2020 either before it came. I suspect 2023 may be no different.

![]()

While bonds will likely be the best asset class during the first half of 2023 as the yield curve un-inverts, equities will probably bottom in the second half as the bear market ends.

As Nobel laureate Dr. Paul Samuelson once quipped:

“Well, when events change, I change my mind. What do you do?”