Written by: Steven Vannelli, CFA | Knowledge Leaders Capital

While many seemed to focus on the basics of the employment report like average hourly earnings (which don’t take into consideration industry mix shifts among the employed) and the payroll job beat for the month, there is one very important variable that revealed the weakness in last month’s jobs report.

The one statistic we start with in assessing the employment report is aggregate weekly hours worked. This basically multiplies weekly hours worked by the number of workers on payrolls.

Let’s start with the pieces. There are 131 million workers on private payrolls.

They worked on average 34.4 hours/week, down from 35 hours at the start of the year.

So, then aggregate weekly hours worked equal 4,506,400,000 (131,000,000*34.4) hours worked. Each .1 hours worked equals roughly aggregate hours worked of 13,100,000. Taking this one step further, 13,100,000 hours worked divided by 34.4 hours/week equals roughly 380,814 jobs. So, the .1 weekly hours worked tick down in the latest monthly report is equivalent to about 540,000 fewer jobs than the headline figure that was reported. In other words, using November weekly hours worked (34.4), we actually shed over 380,000 jobs last month. Furthermore the .6 hours/week drop since the beginning of the year, applied to current private payrolls equals roughly 78,600,000 weekly hours worked. Divide this by the current 34.4 weekly hours worked and it equates to roughly 2,284,883 jobs. This is quite a different picture of the labor market than many hold. Comparing that to the roughly 4 million gross jobs created this year, looked at through the lens of hours worked means we’ve really added more like 1.8 million net jobs this year, less than half the reported total.

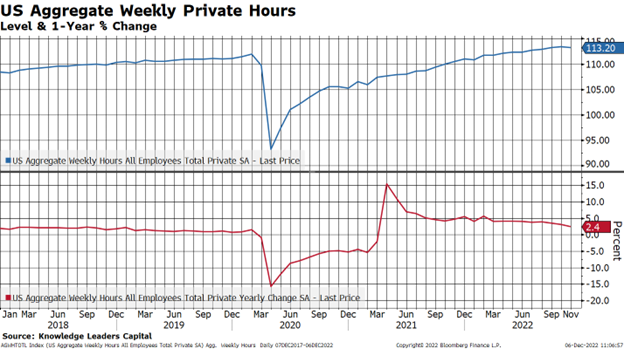

Focusing on aggregate hours worked, we can see that the index has been decelerating all year, down to a 2.4% year-over-year change.

Focusing in on just this year, it is the second month this year where the month-over-month aggregate weekly hours worked declined, falling .2%.

They rebounded in February from January’s drop, but then again fed funds were still 25bps and the Fed was still engaged in QE. Given rates are now 4% and the Fed is engaged in QT, I don’t ascribe high odds that aggregate hours bounce back next month. Moreover, October saw an explosion in Challenger job cut announcements, going from roughly 35,000 in October to 76,835 in November.

The bond market appears to be sniffing out this inflection in labor market conditions.

All year long, while aggregate hours worked slowly rose, average hourly earnings (as previously mentioned an imperfect metric for economy-wide compensation) decelerated. Ironically, in the first month while the Fed has been tightening monetary policy, aggregate hours declined, but average hourly earnings turned up slightly. I think average hourly earnings are noise, and the signal is that the labor market is slowing (the bond market seems to agree). I don’t see anything in the jobs report that supports the notion the Fed needs to tighten further and hold for longer due to wage inflation pressures.