The latest boxing round of tariffs featured yet another heightening of tensions, but this time it included a fair amount of booze.

Cross-Atlantic levies on American whiskey and European wine are totally blunting the impact upon markets of two consecutive lighter-than-expected inflation reports on the back of President Trump threatening to impose a 200% retaliation tax on wine and other alcohol. Meanwhile, today’s PPI miss follows yesterday’s downside surprise on CPI, but the international confrontation is sending equities and Treasurys south, because traders are focusing on the possibility of cost pressures to firm up later in the year if the implementation of duties are heavy and widespread. The PPI reflected this mounting anxiety under the hood, featuring the fastest pace of wholesale core goods price increases in over two years. Furthermore, investors, consumers and business executives alike are cautious about making bold moves in light of the significant uncertainty on the horizon. Turning to this weekend, a potential government shutdown is also adding to the worries, which the IBKR ForecastTrader marketplace assigns a 30% probability of occurring as speculators look for capital gain opportunities while hedgers seek to protect their portfolio holdings.

Source: ForecastEx

PPI Looks Good on the Outside

This morning’s Producer Price Index (PPI) served a doughnut on the table, as weaker margins amongst trade service providers and lower energy costs curbed wholesale inflation. February’s PPI was expected to reflect an increase of 0.3% month over month (m/m) and 3.3% year over year (y/y), but the figures came in at 0% m/m and 3.2% y/y. The core version of the gauge, which excludes food and energy, retreated 0.1% m/m while rising 3.4% y/y, below the anticipated 0.3% and 3.5%. The m/m progress was noteworthy in aggregate, however, as the numbers for headline and core were much stronger in January, coming in at 0.6% and 0.5% m/m as well as 3.3% and 3.5% y/y.

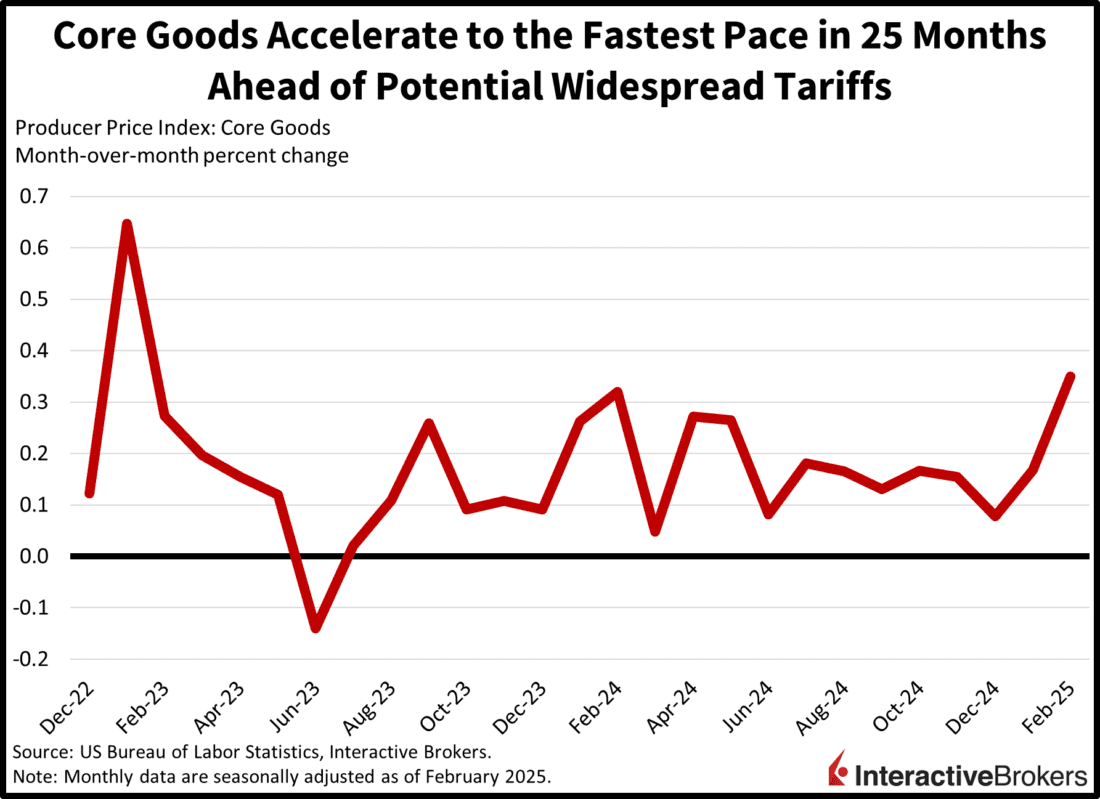

But Appears Worse Under the Hood

There were some worrisome developments under the hood, however, with the increase in core goods jumping to the steepest pace in 25-months as producers and consumers alike attempted to front run the potential inflationary impacts of Trump tariffs. Indeed, wholesale charges found support in the food, core goods and other services segments, seeing stickers climb 1.7%, 0.4%, and 0.2% m/m. Conversely, countering those raises were costs for energy and trade services, which fell 1.2% and 1% m/m. The transportation and warehousing services category was unchanged during the period.

Unemployment Claims Trend Slightly Higher

On the job front, unemployment claims declined slightly in this morning’s Department of Labor report, but the modest slips weren’t enough to offset the rising four-week moving averages across both the initial and continuing segments. Initial filings totaled 220,000 for the week ended March 8, missing the 225,000 median estimate and the previous period’s 222,000. Similarly, continuing applications also edged lower, drifting south to 1.87 million, below the anticipated 1.90 million and the 1.897 million from the prior 7-day interval. Four-week moving average trends climbed on both fronts, however, moving from 224,500 and 1.866 million to 226,000 and 1.872 million.

Earnings Outlook, Tariffs Weigh on Equities

Markets are getting clobbered and investors are reaching for equity volatility protection to guard against further stock market downside and commodity futures that may stand to benefit from protectionist policies and loftier price pressures. All major, domestic equity benchmarks are losing on the session, with the Nasdaq 100, Russell 2000, S&P 500 and Dow Jones Industrial indices losing 1.3%, 1.1%, 0.9% and 0.9%. All 11 major sectors are falling except for materials, which is up a modest 0.1%. Consumer discretionary, technology and real estate are leading the laggards lower; they’re down 2.2%, 1.4% and 1.3%. Treasurys were getting sold but are now getting bid up with the 2- and 10-year maturities changing hands at 3.98% and 4.30%, a basis point (bps) softer across both durations. But lighter borrowing costs aren’t derailing the greenback; its index is up 21 bps on the latest bout of Trump tariffs, which is weighing heavily on foreign currencies on a relative basis. The US dollar is appreciating versus the euro, pound sterling, franc, yuan, loonie and Aussie tender. It is depreciating against the yen, however. Commodity price action is tilted to the bullish side, as silver, gold and copper gain 2.2%, 1.5% and 1.3% but crude oil and lumber are weaker by 1.1% and 0.6%.

Growth or Contraction Depends Heavily on Collaboration or Confrontation

In light of international negotiations turning increasingly confrontational rather than collaborative, I’m reducing my expectation for 2025 economic growth to 1.7%. And while the updated estimate marks a modest slip from 2024, the wide range of possible outcomes is especially concerning. Top of mind are trade and taxation, folks, as acquiescence on the former and congressional execution of the latter will lead to continued corporate earnings prowess and accelerating GDP advancement. But on the flip side, a lack of partnership and a failure to deliver tax relief could put the nation on watch for a meaningful slowdown in profitability and activity figures. Nevertheless, other headwinds include government spending reductions and immigration restrictiveness, which could be countered by regulatory alleviation and a stronger manufacturing sector driven by higher capital expenditures and hiring. Finally, our IBKR ForecastTrader prediction market is much more bullish on the economy than I am, as it’s firmly projecting an expansion in excess of 2% every quarter this year. The discrepancy offers an opportunity for hedgers that want to protect their assets from the potential for economic deceleration well as speculators that forecast a series of soft patches on the horizon. A trade I like for first quarter GDP is the “No” on a number arriving ahead of 2.5%, priced at just $0.53, it serves a dollar back if the publication prints at 2.5% or under.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here