Written by: David Waddell | Waddell and Associates

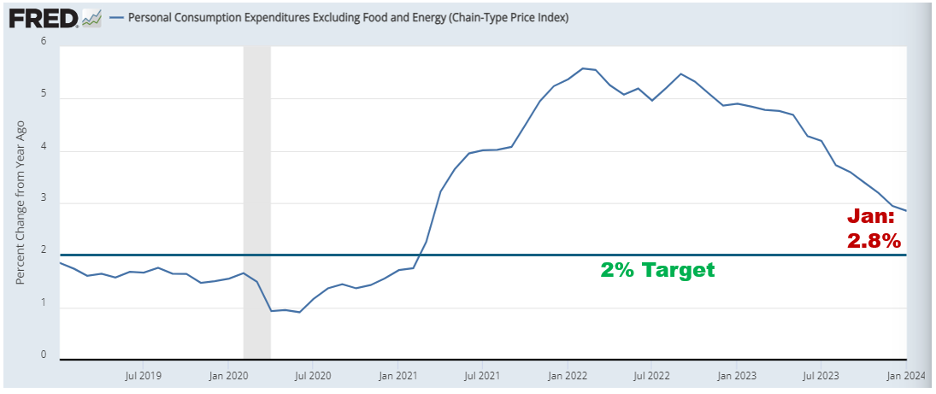

Inflation re-acceleration poses the most significant risk to our optimistic outlook for 2024. This places market moving weight on each CPI, PCE and PPI inflation release. This week, we received the January read on core PCE inflation, which is the Fed’s preferred inflation measure and the one they ascribe their 2% target to. The number came in high, as January numbers tend to do, but as expected, and still directionally lower:

Markets took the measure in stride as rates remained subdued and stock prices rose further into record territory. Some commentators suggested that the hotter January monthly data indicated a break in trend and a risk to further stock market gains. We don’t think so.

Remember that inflation involves price negotiations between buyers and sellers. I specifically remember a post-COVID conversation I had with a close friend in a very large company. Global supply chains collapsed, economic shutdowns created systematic shortages and stimulus money flooded consumers with cash. My advice to him: “RAISE YOUR PRICES A LOT! You will never have another opportunity like this! A massive increase in demand paired with a massive decrease in supply gives you generational cover to increase your prices. Once things calm down you may have to lower them to protect market share, but your base prices will be much higher by that point.”

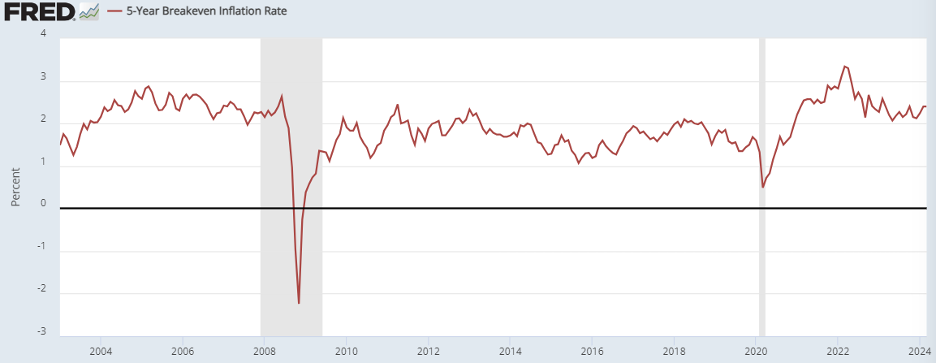

I was certainly not alone in providing this advice and they did raise prices a lot, because they could, and people expected it. That situation no longer exists:

This chart chronicles the 5-year breakeven inflation rate within markets. At 2.4%, we sit right at the pre-GFC crisis level and only slightly above the pre-COVID level. Markets largely believe inflation has passed.

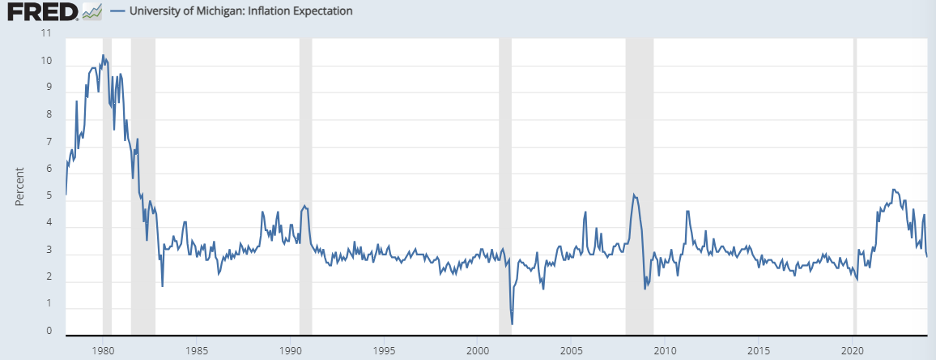

This chart chronicles the Michigan Inflation Expectations index which recounts consumer inflation expectations over the upcoming year. At 3%, we sit right at the long-term average, down significantly from the post-COVID surge. Consumers largely believe inflation has passed.

The reason I share this perspective is that, while the Fed monitors the numbers and the markets react to every release, price takers no longer see inflation as a major concern and, as such, will not willingly accept price hikes.

Within the economy, pricing power has rebalanced from the sellers to the buyers. Marketplace psychology will help further guide inflation toward the Fed’s 2% target, absent some exogenous event that allows companies to capitalize on confusion.

The February inflation release falls on March 12th. This number could be hotter as well, considering seasonality distorts early-month readings as new-year price schedules post. Markets may react, but interest rates side with us as seen in the movement of the 10-Year Treasury yield, despite the potential January/February jump:

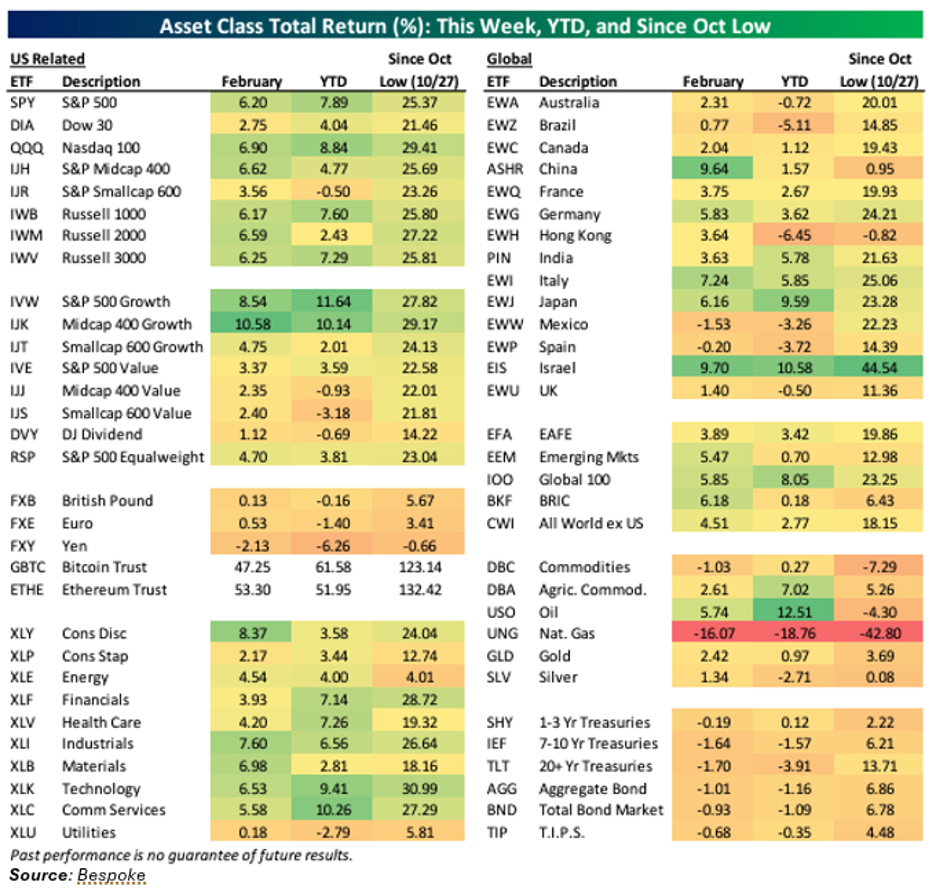

Lastly, if disinflation maintains course, rates remain subdued, earnings keep climbing, and the Fed continues signaling rate cuts, this rally should broaden well beyond the Magnificent 7. And so, it has:

Note that, for the month of February, small cap stocks (Russell 2000) outperformed large cap stocks (S&P 500), industrials outperformed technology, and China outperformed the U.S. At this pace, markets would rise 50% this year. Unlikely. It may be time for a breather, but as long as the inflationary trend maintains course… this rally should also.

Sources: FRED, Marketwatch, Bespoke

Related: NVIDIA Dominance: Living in a Tech World Shaped by Innovation