Written by: David Waddell | Waddell and Associates

On Wednesday, the Federal Reserve chose to leave rates unchanged for the fourth consecutive meeting. Market participants (i.e., algorithms) scrutinized every word in Powell’s prepared remarks and within his Q&A. Stocks initially reacted positively to the Chairman’s remarks, only to fall sharply after the following comment:

“Based on the meeting today, I would tell you that I don’t think it’s likely that the Committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that. But that’s to be seen. So, I wouldn’t call — you know, when you ask me about in the near term, I’m hearing that as March. I would say that’s probably not the most likely case or what we would call the base case.”

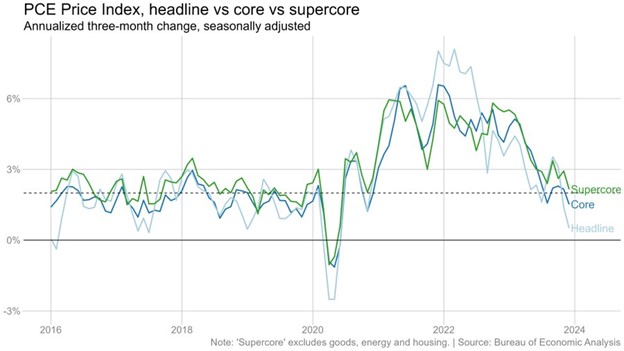

Those who own stocks based on timing and number of rate cuts took this news hard and sold. We did not. By zooming out, one gets a fuller and more supportive picture of the Fed’s thinking. First, the Fed acknowledges that inflation has fallen decisively and appears headed toward its 2% target. Second, strength within the US economy and labor market has not disrupted inflation’s path lower. Third, the Fed seems unconcerned about a reacceleration in inflation, only that inflation may plateau at a level higher than 2%. For this reason, they want to remain observant a little while longer before cutting. However, they do recognize that by annualizing shorter time frame data, inflation appears well within their target range. Note the 3-month annualization of different inflation measures presented below:

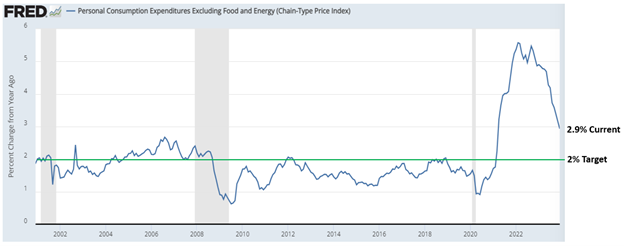

Each of these measures falls within range! To reign in rate-cut enthusiasts, Powell redirected attention to the trailing twelve-month figures, which provide more datapoints and, therefore, more confidence material:

By lengthening the data set, inflation pops back out of range, but any way you slice it, inflation is trending lower.

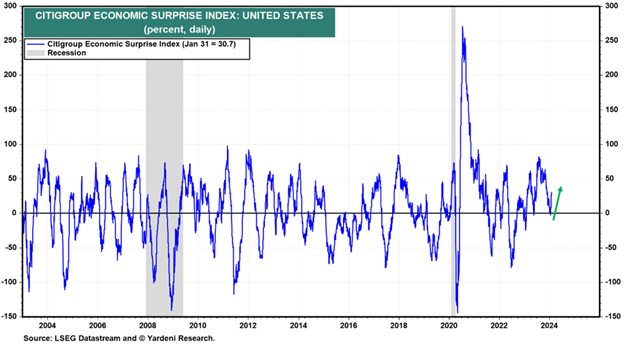

Whether the Fed cuts in March or waits until May is academic. The Fed has projected .75% of cuts this year, and that number may rise further when they release updated forecasts on March 20th. There is no present reason for the Fed to hold the overnight rate at 5.5% with inflation floating below 3%, but the strength in the economy provides Powell more time to digest more data, to gain more confidence, that cuts are appropriate…and recent economic data has surprised to the upside:

So, the Fed has time. Most importantly, Powell went into this inflation fighting cycle believing that they would have to choke off economic demand to whip inflation (i.e., cause a recession). Now, Powell believes that the economy can self-regulate and simply increase supply to meet demand. Therefore, we can have economic growth and rate cuts. That’s the mother’s milk for corporate earnings. And that’s why markets rallied back sharply to end the week!

The News: Earnings

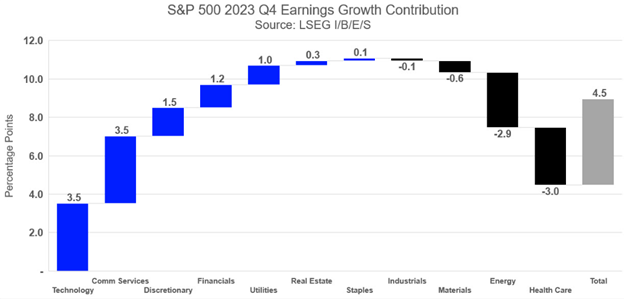

Earnings season has hit full stride. To date, 220 of the S&P 500 companies have reported their fourth-quarter earnings, with 68% of those reporting beating estimates. The chart below breaks down sector contributions:

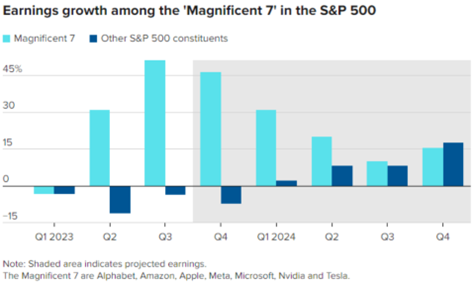

Of the eleven sectors within the S&P 500, seven have produced positive fourth-quarter earnings results. However, the bulk of the contribution stems from large cap technology names housed within the tech, communication, and consumer discretionary sectors. While the Magnificent 7 may get overhyped, it’s not without good reason based on their earnings results:

The earnings power of Apple, Amazon, Google, Meta, Microsoft, Nvidia, and Tesla are mind-blowing and have eclipsed earnings weakness among the remaining 493 over the past few quarters. However, as the year progresses, analysts expect earnings acceleration beyond the biggies, which will help broaden participation and improve overall investor outcomes.

Don’t let the Fed’s rate noise distract you. Broadening corporate earnings contribution is the news…and the news is good!

Have a great weekend!

Sources: Bureau of Economic Analysis, FRED, LSEG Datastream I/B/E/S, Yardeni Research