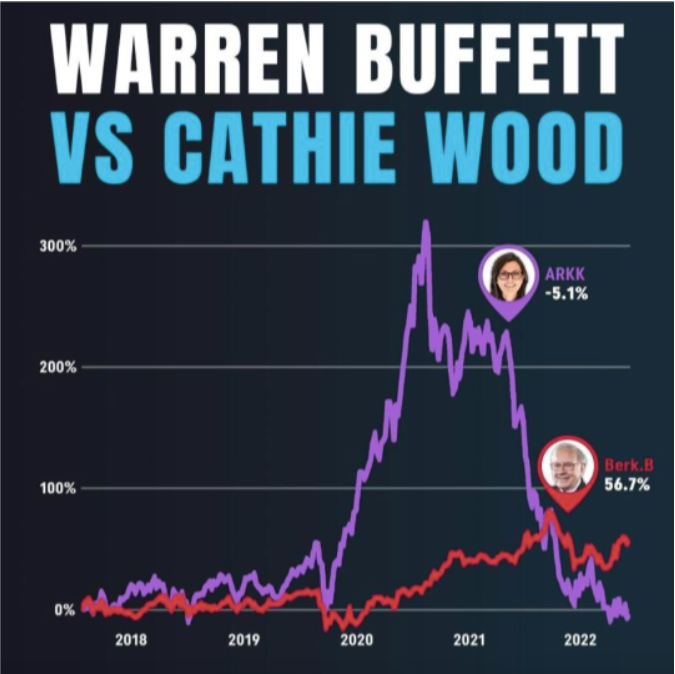

The below graph perfectly sums up the difference between growth and value investing. While Cathie Wood’s growth-focused ARK Innovation ETF delivered stellar returns to shareholders amid the pandemic, a majority of these stocks are now under the pump.

Comparatively, Warren Buffett’s portfolio of cash-generating blue-chip stocks have managed to hold their own across market cycles.

During a bull run, high-flying growth stocks tend to crush broader returns and derive outsized gains for investors.

For instance, some of the top holdings for the ARKK ETF include Tesla (NASDAQ:TSLA), Roku (NASDAQ:ROKU), and Shopify (NYSE:SHOP). Between September 2017 (when Roku went public) and December 2021:

Tesla UP 1,460%

Shopify UP 1,110%

Roku UP 871%

Alternatively, growth stocks terribly underperform the markets when market sentiment turns bearish as investors focus on companies with stronger fundamentals, predictable cash flows, and robust balance sheets.

The triple whammy of rising interest rates, supply chain disruptions, and surging inflation numbers have dragged Tesla, Shopify, and Roku lower by 63%, 77%, and 91% from all-time highs, respectively.

On the other hand, Warren Buffett’s diversified portfolio has managed to perform admirably amid the market chaos in 2022. While Apple (NASDAQ:AAPL) accounts for a majority of Berkshire Hathaway’s equity portfolio, the Oracle of Omaha also has exposure to market leaders such as Coca-Cola (NYSE:KO), Kraft Heinz (NASDAQ:KHC), Chevron (NYSE:CVX), and Bank of America (NYSE:BAC).

Will value stocks continue to outperform growth stocks in 2023?

According to historical data, value investing has outpaced growth over the long term. This trend has been observed across international equity markets, sectors, and sizes. As seen here, the relative performance of the value index has gained pace via a long-term downward trendline. It also indicates the beginning of a “sustainable period of outperformance for value stocks.

Typically, the performance of stocks is tied to relative earnings growth. So, in a period of economic expansion, growth stocks are well poised to accelerate their bottom line due to multiple factors, including higher consumer spending and lower bond yields. But as the economy contracts, the market rewards companies that enjoy significant pricing power and stable cash flows.

The value index comprises of cyclical and defensive companies across sectors such as financials and utilities, while the growth index consists of less cyclical companies such as technology.

In 2022, value stocks have delivered solid returns due to the outperformance in just two sectors such as energy and materials. The Russia-Ukraine war has driven the prices of oil and other commodities higher, resulting in higher earnings for companies part of these sectors.

Most value stocks also pay investors a dividend, and the reinvestment of these payouts has been a major driver of the historical outperformance for value investors. Right now, the Russell 1000 Value Index has a dividend yield of over 2%, compared to the 1% yield of the Russell 1000 Growth Index.

What percent of the S&P 500 index is growth vs. value?

The S&P 500 does not break down stocks into categories such as growth and value. But growth-oriented sectors such as technology and consumer discretionary account for 40% of the index, while financials, energy, consumer staples, and industrials account for 29% of the index.

The division to invest in growth or value stocks depends on the individual investor's preference. You must consider multiple factors, such as risk tolerance, investment horizon, and financial goals.

Related: How Will the S&P 500 Index Perform Towards the End of 2022?