Written by: Gabriela Santos

Chinese equity markets have had a volatile year, due to a new regulatory cycle affecting internet and education companies. Over the past month, the Chinese corporate bond market has been negatively affected by speculation that the property developer Evergrande may default on its $300bn of financial obligations. The myriad of headlines out of China this year are all pieces of a bigger puzzle involving the Chinese government’s shift in focus to the quality over quantity of growth. This is a tricky transition to manage and provides a source of uncertainty for investors. However, our base case is that the potential default of Evergrande does not pose a systemic risk or cause a hard landing in the Chinese and global economy. While these developments may have been a source of volatility for broad global markets early this week, they should weigh on them less and less the further away from the epicenter investors get. This remains dependent on the Chinese government’s expected quick and proactive liquidity injections, as well as some support for the company’s customers and suppliers. Lastly, this year’s developments do not derail the thesis that the rewards of investing in Chinese markets outweigh the risks – if done the right way.

Evergrande’s financial woes have not been a surprise to its bond investors, with its offshore (U.S. dollar) bonds already trading at 25 cents coming into this week, suggesting a default is consensus. Evergrande is a company-specific example of areas the Chinese government is aiming to improve during this new phase of growth:

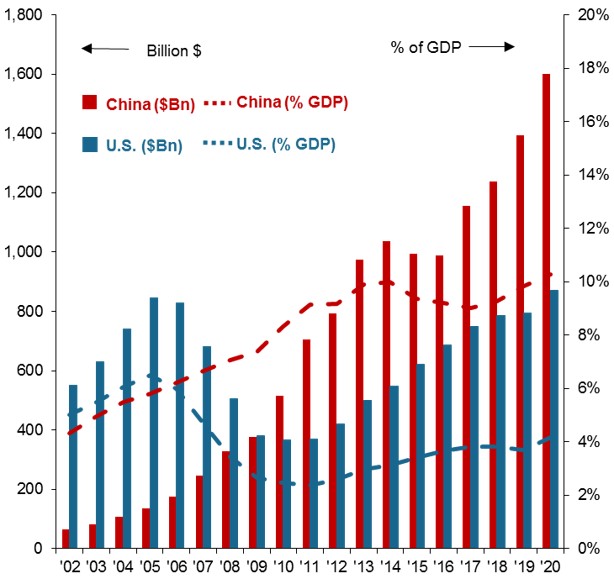

- Pivot the Chinese economy away from its reliance on residential property investment as a key engine of growth and towards household consumption and investment in cutting edge technology. Today, Chinese real estate investment represents 10% of Chinese GDP versus 4% in the U.S. (even in 2006, this figure was only 6% in the U.S.);

- Improve the affordability of housing for Chinese families in order to “promote common prosperity”. Today, the top 5 most expensive cities for apartment prices are found in China (as measured by the ratio of median apartment prices to median family disposable income);

- Rein in the level of indebtedness of the Chinese economy, which has an overall debt to GDP level of 285% of GDP versus 290% in the U.S. In order to tackle the leverage problem in real estate, in 2020 the Chinese government instituted a new criteria for property developers to meet “three red lines” with regards to their financial before being able to refinance;

- Further develop its bond market by permitting some corporate defaults in order to have market forces more closely determine its pricing and the allocation of capital. Since 2014, the annual value of defaults in the onshore corporate bond market has gone up from 1 billion Yuan to a healthier 102 billion Yuan in 2020.

What should investors watch?

Given these priorities, It seems unlikely the Chinese government will protect Evergrande’s bond investors, which represent a third of the company’s liabilities. However, for global investors, the concerns this week have extended beyond this epicenter, as investors wonder: 1) can this be the start of a systemic crisis in China? And 2) can this be the start of a sharp deceleration in economic growth in China and broader global economy?

- Our base case is that it does not pose a systemic risk, as the exposure of Chinese banks to the company is manageable at only 0.2% of total loans (with non-Chinese banks having limited to no exposure) and with Chinese banks having improved balance sheets compared to a few years ago. It will be key for the People’s Bank of China to continue to provide quick and proactive liquidity to the market, as it has begun to do over the past week, in order to prevent a tightening of liquidity for other property developers (which together represent 7% of total loans of Chinese banks). So far, the liquidity tightening in bond markets has been modest, with some contagion to other high yield property developers, but not investment grade ones.

- In order to limit sharp negative spillovers to economic growth, it will be key for the Chinese government to restructure the company in such a way that it is able to protect the company’s customers and suppliers (which represent about $150bn in liabilities through payments and accruals), so that it can prevent a sharper deceleration in property sales and prices. Given the importance of real estate investment for the Chinese economy at 10% of GDP and its second order impacts for household consumption through the wealth effect, this would be key in order to provide a floor to overall Chinese economic growth.

Should both of these issues be avoided, as is our base case, then the contagion to global markets should remain limited, with investor focus turning back to the pandemic, global economic and earnings growth, and global monetary policy normalization. Lastly, we do not believe the developments in China this year derail the thesis that the rewards of investing in Chinese markets outweigh the risks – if done the right way. Chinese equities can still provide investors higher return and low correlation to other equity markets (especially A-shares and the consumer and hard technology sectors), while Chinese bonds can provide higher yields and low correlation to the global bond market (especially the local currency government bond market). However, this year is a reminder that how you invest in China is essential and should include active management, careful security selection, and a focus on ESG factors.

Real estate is even more important to China than to the U.S.

Residential real estate investment, USD billions and % of nominal GDP

Related: What Should Investors Do After China’s Increase in Regulations?

Source: U.S. Bureau of Economic Analysis, National Bureau of Statistics of China, U.S. National Bureau of Economic Research, “Peak China Housing” by Kenneth Rogoff and Yuanchen Yang, August 2020, J.P. Morgan Asset Management.

Guide to China. Data are as of September 22, 2021.