Written by: Jordan Jackson

"History suggests that now may be just as good as any to put cash to work in the market – especially if you’re investing for the long run like retirement."

The market has had an impressive rally over the past year, rising 91% on a total return basis since the March lows. As a result, the market has reached a new high 27 times so far this year, already outpacing the average number of all-time highs achieved per year since 1988. While we believe the path of least resistance for markets is higher, it’s reasonable to expect some choppiness as elevated valuations, risks of a new COVID-19 strain outbreak and materially higher inflation, all pose risks to the outlook.

For investors, this may cause some trepidation about getting invested today, particularly for those whom we would consider do-it-yourselfers (“DIYers”) saving for retirement. Generally, these individuals are not invested in a target-date strategy that provides a strategic glide path allocation across stocks and bonds as investors approach retirement, but rather they make their own investment decisions in their retirement accounts.

These DIYers account for roughly 25% of defined contribution retirement participants. Importantly, on average, individuals in this group:

- are already allocated fairly conservative; around half are all in cash and/or stable value funds. This trend is consistent across all age groups, and

- generally, have static equity allocations, ranging between 25%-40%. In our view, this suggests a severe under-allocation to stocks, especially for younger participants.

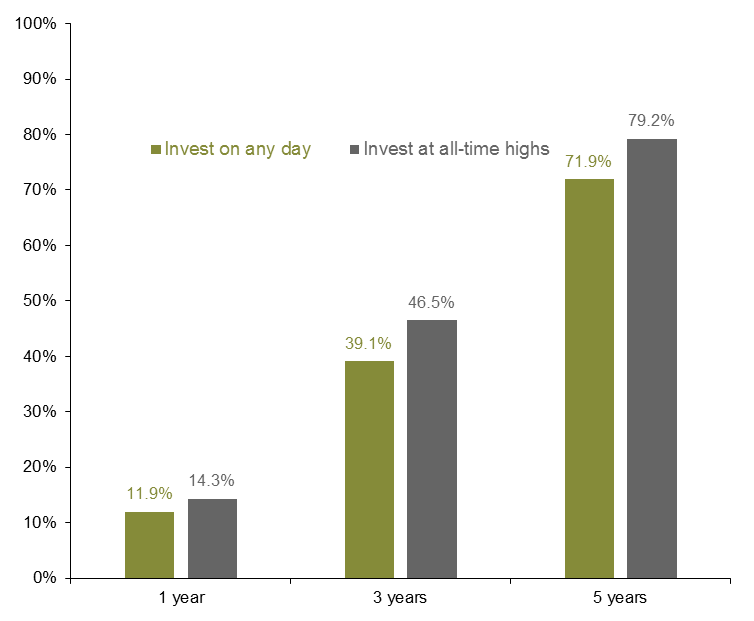

For many DIYers and other retail investors, as the market continues to hit new all-time highs, it’s likely they may want to pull back on risk even further. However, history suggests that now may be just as good as any to put cash to work in the market – especially if you’re investing for the long run like retirement. As shown, if you invested in the S&P 500 on any random day since the start of 1988, on average, your one year total return was +11.9%. Perhaps somewhat surprisingly, if we only consider investments on days when the S&P 500 closed at an all-time high, your average one year total return was +14.3%. Moreover, if we look at cumulative total returns three or five years out, the takeaway is the same.

While we, of course, cannot time the market, fundamentals remain supportive: monetary policy should remain accommodative over the next couple of years, further fiscal stimulus is on the horizon and corporate earnings should rebound strongly as the pandemic recedes, all providing support for equities over the medium-term. With this in mind, investors saving for retirement should be positioned more aggressive in their allocations.

Average cumulative S&P 500 total returns

January 4, 1988 – present

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Data are as of April 26, 2021.

Related: Are We in a Commodity Super-Cycle?