As the world's attention is focused on the war in the Ukraine, it is the human toll, in death and injury, that should get our immediate attention, and you may find a focus on economics and markets to be callous. However, I am not a political expert, with solutions to offer that will bring the violence to an end, and I don't think that you have come here to read about my views on humanity. Consequently, I will concentrate this post on how this crisis is playing out in markets, and the effects it has had, so far, on businesses and investments, and whether these effects are likely to be transient or permanent.

The Lead In

To understand the market effects of the Russia-Ukraine conflict, we need to start with an assessment of the two countries, and their places in the global political, economic and market landscape, leading in. Russia was undoubtedly a military superpower, with its vast arsenal of nuclear weapons and army, but economically, it has never punched that weight. Ukraine, a part of the Soviet Union, has had its shares of ups and downs, and its economic footprint is even smaller. The pie chart below, provides a measure of the gross domestic product of Russia and Ukraine, relative to the rest of the world:

While Russia's share of the global economy is small, it does have a significant standing in the natural resource space, as a leading producer and exporter of oil/gas, coal and nickel, among other commodities. Ukraine is also primarily a natural resource producer, especially iron ore, albeit on a smaller scale.

Russia was also a leading exporter of these commodities, with a disproportionately large share of its oil and gas production going to Europe; in 2021, Russian gas accounted to 45% of EU gas imports.

The Market Reaction

As the rhetoric of war has heated up in the last few months, markets were wary about the possibility of war, but as Russian troops have advanced into the Ukraine, that wariness has turned to sell off across markets. In this section, I will begin by looking at the bond market effects and then move on to equities and other asset classes, starting by looking at the localized reaction (for Ukranian and Russian securities) and then the global ripple effects.

Bond Markets and Default Risk

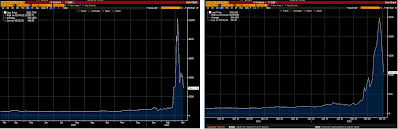

In times of trouble, the first to panic are often lenders to the entities involved, and in today's markets, the extent of the reaction to country-level troubles can be captured in real time in the sovereign CDS (Credit Default Swap) markets. The graph below shows the sovereign spreads for Russia and Ukraine in the weeks leading up and including the conflict:

The sovereign CDS spread for Russia, which started the year at 1.70% soared above 25%, just after hostilities commenced, and were trading at 10.56% on March 16, after rumors that peace talks were underway brought them down. The sovereign CDS spread for the Ukraine started the year at 6.17% and climbed in the first few days of the crisis to more than 100% (effectively uninsurable) before settling in on March 16 at 28.62%. Even the ratings agencies, normally slow to act, have been moving promptly, with Moody's lowering Russia's rating from Ba2 to B3 on March 3, from B3 to Ca on March 6 and from Ca to C on March 8, and Ukraine's rating from B3 to Caa2 on March 4. Other ratings agencies have also taken similar actions.

The worries about default have not stayed isolated to Russia and Ukraine, as ripple effects have shown up first in the countries that are geographically closest to the conflict (Eastern Europe) and more generally on sovereign CDS spreads in the rest of the world. The graph below looks at average spreads, by region, before and after the hostilities started:

|

| Change in Sovereign CDS, by Region |

There are no surprises in this table, with the effects on spreads being greatest for East European countries. Note, though, that while sovereign CDS spreads increased almost 51% between January 1, 2022 and March 16, 2022, in these countries, the overall riskiness of the region remains low, the average spread at 1.30%. The Middle East is the only region that saw a decrease in sovereign CDS spreads, as oil, the primary mechanism for monetization in this region, saw its price surge during the last few weeks. The Canadian sovereign CDS spread widened, but US and EU country spreads remained relatively stable.

The increase in default spreads was not restricted to foreign markets, as fear also pushed up spreads in the corporate bond market. In the table below, I look at default spreads on bonds in different ratings, across US companies, on January 1, 2022 and March 16, 2022:

It is worth noting that corporate bond spreads, which were are at historic lows to start the year, were already starting to widen before Russia's military moved into the Ukraine on February 24, 2022, but the invasion has pushed the spreads further up at the lower ends of the default spectrum. The overriding message in all of this data is that Russia/Ukraine war has unleashed fears in the bond market, and once unleashed that fear has pushed up worries about default and default risk premia across the board.

Equity Markets and Equity Risk Premiums

Lenders may be the first to worry, when there is a crisis that puts their payments at risk, but equity investors are often with them, pushing down stock prices and pushing up equity risk premiums. Again, I will start with Russian and Ukranian equities, using country indices to capture the aggregate effect on these markets, from the invasion:

|

| Russia: RTX Russian Traded $ Index, Ukraine: Ukraine PFTS Index |

Neither index is particularly representative, and currency effects contaminate both, but they tell the story of devastation in the two markets. In fact, since trading has been suspended on both indices, the extent of the damage is probably understated. To get a better sense of how Russian equities, in particular, have fared in the aftermath of the invasion, I looked at four higher profile Russian companies,:

The four Russian companies that I picked are representative of the Russian economy: Lukoil is a stand-in for Russia's oil businesses, Sberbank is Russia's most dynamic bank, a part of almost every aspect of Russian financial services, Severstal is a global steel company with roots and a significant market share in Russia and Yandex is Russia's largest technology company. In addition to being traded on the MICEX, the Russian exchange, these companies all have listings in foreign markets (Yandex has a US listing and the other three are listed on the London Exchange). The collapse in stock prices has been calamitous, with each of the four stocks losing almost all of their value, and with trading suspended since the end of February, it is still unclear whether the trading will open up, and if so at what price.

A knee-jerk contrarian strategy may indicate that you should be buying all these stocks, as soon as they open for trading, but a note of caution is needed. The price drop in these companies, especially severe at Sberbank, is not necessarily an indication that these companies will cease to exist, but that the Russian government may effectively nationalize them, leaving equity worthless.

As Russian equities have imploded, the ripple effects again are being felt across the globe. The table below summarizes the market cap change, by region of the world:

It is no surprise that Eastern Europe and Russia, which are in the eye of the hurricane, have seen the most damage to equities, but other than the Middle East, every other equity market in the world is down, with the US, EU and China shedding significant market capitalization. Slicing the data based on sector yields the following:

Against, there are no surprises, with energy being the only sector to post positive returns and with consumer discretionary and technology generating the most negative returns. Finally, I looked at firms based upon price to book ratios as of January 1, 2022, as a rough proxy for growth/maturity, and at net debt to EBITDA multiples, as a measure of indebtedness:

In this crisis, the conventional wisdom has held, at least so far, with mature companies holding their values better than growth companies. Since these mature companies tend to carry more debt, you see more indebted companies doing much better than less indebted companies. While the value crowd, bereft of victories for a long time, may be inclined to do a victory dance, it is worth noting that the same phenomenon occurred between February and March of 2020, at the start of the COVID crisis, but that growth companies quickly recouped their losses and finished ahead of mature companies by the end of 2020.

In keeping with my belief that it is the price of risk that is changing during a crisis, causing contortions in prices, I estimated the implied equity risk premium for the S&P 500, by day, starting on January 1, 2022, going through March 16, 2022, in the graph below:

|

| Download ERP, by day |

Note that equities were already under pressure in the weeks before the invasion, as inflation fears surfaced again, and then hostilities have put further pressure on them. The implied equity risk premium, which started the year at 4.24%, was at 4.73% by March 16, and the expected return on equity, which was close to an all-time low at 5.75% at the start of the year, was now up to 6.92%, still lower than historical norms, but closer to the numbers that we have seen in the last decade.

Flight to Safety and Collectibles

As in any crisis, there was a rush to safety, accentuated by wealthy Russians trying to move their wealth to safe havens, with safety defined not just in terms of currency, but also in terms of being beyond the reach of US and European regulators and legislators. In the graph below, I start with two traditional havens for US investors, the US dollar and treasury bonds:

|

| Trade-weighted dollar & US 10-year T.Bond Rate |

The dollar has strengthened since February 23, with the trade weighted dollar rising about 3% in value, but the ten-year treasury bond, after an initial rise in prices (and drop in yields) has reversed course, perhaps as inflation concerns overwhelm safe haven benefits. I also looked at crisis investments, starting with gold, an asset that has held this status for centuries and contrasting it with bitcoin, millennial gold:

Gold, which started the year at just above $1,800 an ounce, rose from $1,850 on February 23 to peak at $2,050/oz a few days ago, before dropping back below $2,000/oz on March 16. Bitcoin, which started the year at about $46,000, had a strong first half of November, also rose at the start of this crisis, but seems to have given back almost all of its gains. To the extent that crypto holdings may be more difficulties for authorities to trace and lay claim on, it will be interesting to see if you see a rise in the prices of crypto currencies as Russian wealth looks for sanctuary.

Economic Consequences

It is difficult to argue that people were taken by surprise by the events unfolding in the Ukraine, since the lead in has been long and well documented. It can be traced back to 2014, when Russia annexed Crimea, setting in motion a period of uncertainty and sanctions, and the global economy and Russia seemed to have weathered those challenges well. As this crisis plays out in financial markets, roiling the price of risk in both bond and equity markets, the other question that has to be asked is about the long term economic consequences of the crisis for the global economy.

Commodity Prices and Inflation Expectations

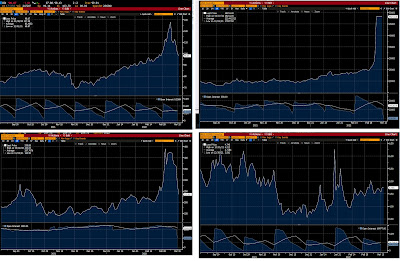

Given Russia's standing as a lead player in commodity markets, and its role in supplying oil and gas to Europe specifically, it should come as no surprise that the markets for the commodities that Russia produces in abundance has been the most impacted, at least in the short term:

All four commodities saw their prices soar in the aftermath of February 23, with oil rising to $130 a barrel, before falling back below $100, and trading in the nickel market suspended on March 7, after prices rose about $100,000 a ton. Even as prices rose in the spot market, the futures market indicated that many participants believed that the price rise would be temporary, with futures prices closer to $80 a barrel, for a year ahead and two year ahead futures contracts.

In a market already concerned about expected inflation, the rise in commodity prices operated as fuel on fire, and pushed expectations higher. In the graph below, I list out two measures of expected inflation, one from a inflation expectations ETF (ProShares Inflation Expectation ETF) and the other from the Federal Reserve 5-year forward inflation measure, computed as the difference between treasury and TIPs rates.

Both measures indicate heightened concerns about future inflation, and these are undoubtedly also behind the increase in the US ten-year treasury bond rate from 1.51% to 2.19%, this year.

Consumer Confidence and Economic Growth

The question that hangs over not just markets but economic policy makers is how this crisis will affect global economic growth and prospects. It is too early to pass final judgment, but the early indications are that it has dented consumer confidence, as the latest reading from the University of Michigan consumer survey indicates:

|

| University of Michigan Consumer Sentiment |

Consumer sentiment is now more negative than it was at any time during the COVID crisis in 2020, and if consumers pull back on purchases, especially of discretionary and durable goods, it will have a negative effect on the economy. While the contemporaneous numbers on the US economy on unemployment and production still look robust, worries about recession are rising, at least relative to where they were before the hostilities. The graph below looks at the median forecasts of recession probabilities for the US, on the left, and for the Eurozone, on the right (from Bloomberg):

|

| Median forecast probability of recession, US (left) and Eurozone (right) |

As a result of the events of the last three weeks, forecasters have increased the probabilities of recessions from 15% to 20% for the US and from 17.5% to 25% for the Eurozone.

Investment Implications: Asset Classes, Geographies and Companies

The Russian invasion of Ukraine has undoubtedly increased uncertainty, affected prices for financial assets and commodities and exacerbated issues that were already roiling markets prior to the invasion. For investors trying to recapture their footing in the aftermath, there are multiple questions that need answers. The first is whether a radical shift in asset allocation is needed, given how these perturbations, across asset classes, geographies and sectors. The second is how the disparate market sell off, small in some segments and large in others, over the last few months has altered the investment potential in individual companies in these segments. On January 1, 2022, I valued the S&P 500, building in the expectation that the economy would stay strong for the year and that interest rates would rise over the course of time from the then prevailing value (1.51%) to 2.50% over five years, and arrived at a value of 4,320 for the index, about 10.3% lower than the traded value of 4766. While that was only ten weeks ago, the index has since shed 7.03% of its value, the T.Bond rate has risen to 2.19% and Russia's invasion of the Ukraine have increased commodity prices and the likelihood of a recession. I revisited my valuation of the index, with the updated values:

|

| Spreadsheet to value the S&P 500 |

There are two things to note in this valuation. The first is that I have raised the target rate for the US T.Bond to 3%, reflecting both the increase that has already occurred this year, and concerns about how current events may be adding to expected inflation. The second is that I continue to use analyst estimates of earnings, and at least as of this week (with estimates from March 14, 2022), analysts do not seem to be lowering earnings to reflect recession concerns. That may either reflect their belief that this storm will pass without affecting the US economy significantly or a delay in incorporating real world concerns. If you open the spreadsheet, I offer you the option of adjusting expected earnings, if you believe analysts are being unrealistic in their forecasts. The net effect of the changes is that my estimated value of the index is now 4197, making the index over valued by 5.6% as of March 16, 2022.

More generally, the question that investors face as they decide whether to reallocate their portfolios is whether the market has over or under reacted to events on the ground.

- If you are a knee-jerk contrarian, your default belief is that markets over react, and you would be buying into the most damaged asset classes, which would include US, European and Chinese stocks (worst performing geographies), and especially those in technology and consumer discretionary spaces (worst performing sectors), and selling those investments (energy companies and commodities like oil, that have benefited the most from the turmoil.

- If, on the other hand, you believe that investors are not fully incorporating the effects of the long term damage from this war, you would reverse the contrarian strategy, and buy the geographies and sectors that have benefited already and sell those that have been hurt.

As an avowed non-market-timer, I think that both these strategies represent bludgeons in a market that needs scalpels. Rather than make broad sector or geographic bets, I would suggest making more focused bets on individual companies. In picking these companies, market corrections, painful though they have been, have opened up possibilities, for investors, though their stock picks will reflect their investment philosophies and their views on economic growth:

- Discounted Tech: During the course of 2022, markets have reassessed their pricing of tech stocks, and marked down their market capitalizations, for both older, and profitable tech and young, money-losing but high growth tech. A few weeks ago, I posted my valuation of the FANGAM stocks and noted that only one of them was under valued, at the prices prevailing then. In the last few days, every company on the list has dipped in price by enough to be at least fairly valued or even cheap. While there may be value in some young tech companies, any investments in these firms will be joint bets on the companies and a strong economy, and with the uncertainties about inflation and economic growth overhanging the market, I would be cautious.

- Safety First: If you have been spooked by market volatility and the Russian crisis, and believe that there is more volatility coming to the market in the rest of the year, your stock picks will reflect your fears. You are looking for companies with pricing power (to pass through inflation) and stable revenues, and in my view, and while you should start by looking in the conventional places (branded consumer products and food processing, pharmaceuticals), you should also take a look at some of the big names in technology.

- The Russia Play: For the true bargain hunters, the wipeout of market capitalization of Russian stocks (like Sberbank, Severstal, Lukoil and Yandex) will create temptation, but I would offer two notes of caution. The first is that you have to decide whether you can buy them in good conscience, and that is your judgment to make, not mine. The second is that corporate governance at Russian companies, even in their best days, is non-existent, and I do not know how this crisis will play out in the long term, at these companies. After all, your ownership stake in these companies is only as good as the legal structure backing it up, and in Russia, that your stake may be worthless, even if these companies recover. A less risky route would be to tag companies with significant exposure to Russia, such as Pepsi, McDonald's and Philip Morris, and evaluate whether the market is overreacting to that exposure. I have seen no evidence, so far, that this is the case, but that may change.

There is one final sobering note to add to this discussion, and that relates to low probability, potentially catastrophic events, and how markets deal with them. There is a worst case scenario in the Russia-Ukraine war, that few of us are willing to openly consider, where the conflagration spreads beyond the Ukraine, and nuclear and chemical weapons come into play. While the probability of this scenario may be very low, it is not zero, and to be honest, there is no investing strategy that will protect you from that scenario, but market pricing will reflect that fear. If we escape that doomsday scenario, and come back to something resembling normalcy, markets will bounce back, and in hindsight, it will look like they over reacted in the first place, even if the risk assessments were right, at the time. Put simply, assuming that crises will always end well, and that markets will inevitably bounce back, just because that is what you have observed in your lifetime, can be dangerous.

Related: How Russia's Invasion of Ukraine Affects Energy Income Strategies