S&P 500 stumbled in its upward run again, but has it been decisively so? VIX has risen, the put/call ratio as well – but that‘s little more than white noise, for nothing has dramatically changed in the markets. We‘re chopping along without advance clues either way – unless you look at inflation expectations and Treasury yields. The Jun 10 CPI reading is ahead:

(…) While I think that the red hot CPI inflation would die down a little (i.e. not keep rising ever as steeply as was the case with Wednesday‘s data) once the year on year base to compare it against normalizes, a permanently elevated plateau of high and rising inflation would be a reality for more than foreseeable future simply because the Fed would be as behind as Arthur Burns was in fighting the 1970s inflation, and upward price pressures in the job market pressures would kick in.

The much awaited Jun 10 CPI readings would likely come on the hotter side of the spectrum, but would be part and parcel of a continued move to a higher inflation environment where commodities‘ pressures are amplified by job market ones – not that the distortions and disincentives to work wouldn‘t be there.

The Treasury market‘s lull only means that inflation trades have been dialed back somewhat, but haven‘t been broken. As I wrote on May 27, so far it‘s only the precious metals that are relentlessly calling the Fed‘s bluff – by rising almost in a straight line. And when you thought the transitory or permanently elevated inflation debate couldn‘t get any more ridiculous, there comes the Dudley dove talking how transitory could become permanent – it‘s almost as miraculous as being half pregnant.

Seriously, it‘s a testament to the Fed communication‘s success that the transitory story has been swallowed hook, line and sinker to this degree. We‘re getting a temporary reprieve but the cost-push inflation isn‘t going away. At the same time, we‘re in a reflationary period before inflation starts biting noticeably more.

How close before the wheels come off, and would that come from inflation or growth worries? There are two distinct possibilities: GDP growth and its projections start sputtering, or inflation (including inflation expectations) don‘t come down nearly enough as much as the transient camp believes. I‘m in the latter camp.

Timing is everything, though. Any growth scare wouldn‘t materialize before we „discover“ that inflation isn‘t really going away. Add the job market pressures entering the fray – discussed on May 19 – you‘ll sooner take fright over persistent inflation hitting the growth prospects than seeing them downgraded first. No deflationary scare quarters ahead either, sorry – 2021 will be another good year in stocks.

This also speaks against a sharp (think 10% and higher) correction in the stock market over the summer, and likewise affects commodities. These would employ a wait and see approach, with precious metals sticking out like a sore finger. Forget the taper dog and pony show. When the Fed is forced to move, precious metals win – either way.

Gold and silver aren‘t giving up gained ground – why should they? Miners have awaken from their slumber, and the greater risk in this bull market run is being out rather than in. The new long consolidation will get an upside breakout in its own due time, across the board.

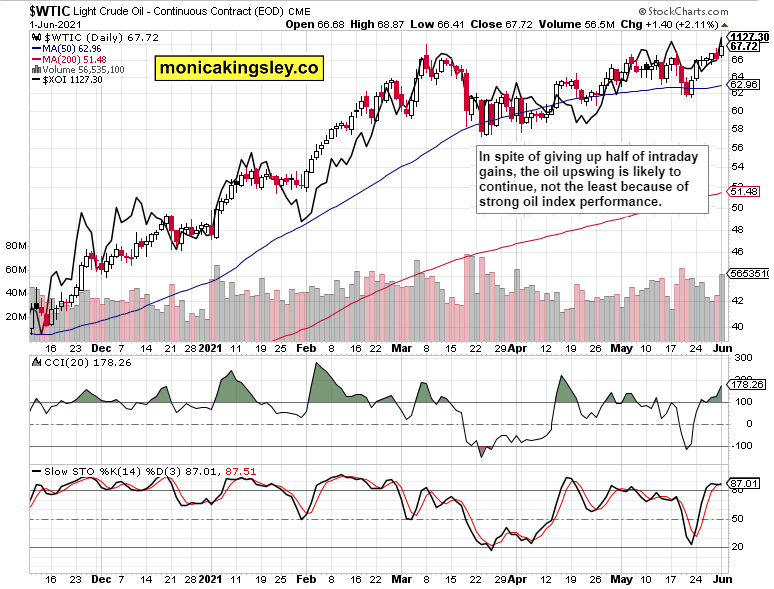

Crude oil sharply rose on the OPEC pronouncements (U.S. can‘t possibly act as a swing producer anymore – the policy supporting that isn‘t there anymore), and the upswing has been supported by the oil index. The daily chart remains bullish, and the pressure to go higher I discussed yesterday, is being resolved.

Bitcoin and Ethereum are likewise preparing to overcome yesterday‘s modest retracement of prior rebound. The charts in both speak in favor of taking on the red resistance line discussed yesterday. The strength to go higher is there.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 daily reversal leaves much to be desired, and neither the Nasdaq 100 is plunging.

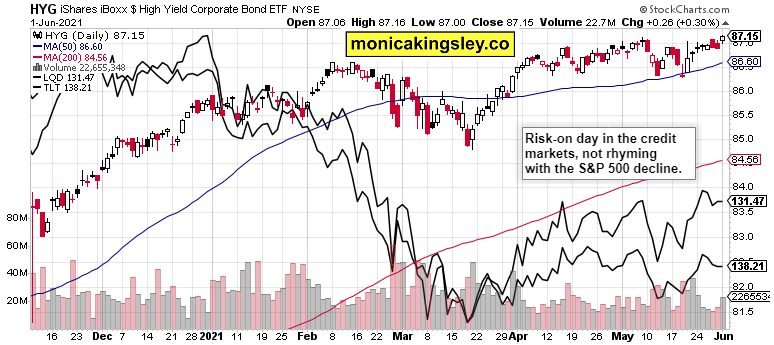

Credit Markets

High yield corporate bonds scored gains while the quality debt instruments treaded water. That‘s an inconclusive, yet mildly positive sign for the risk-on trades.

Technology and Value

It‘s only select tech segments that are being hit here. I‘m leaning towards microrotations rather than huge red flag explanation.

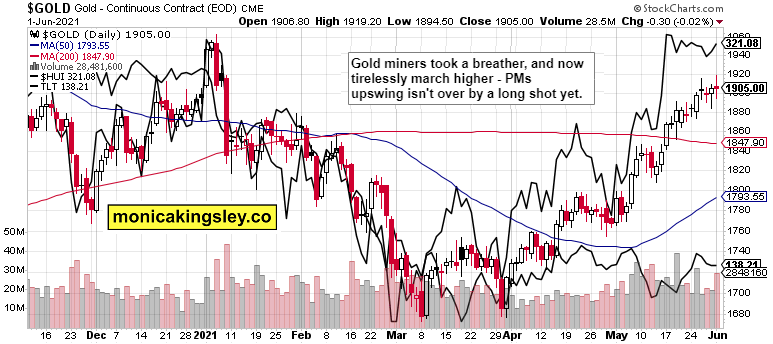

Gold, Silver and Miners

A sideways and volatile day in gold, where rising miners and not throwing a spanner in the works nominal yields, are casting their verdict.

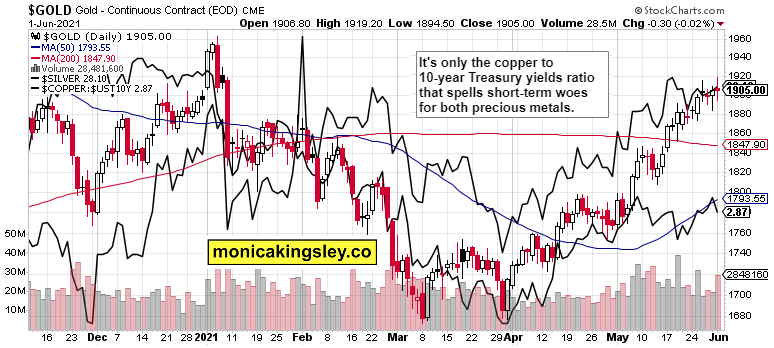

The copper to 10-year Treasury yield ratio is the only one to bring about (short-term) wrinkles.No worries though as the copper chart is by no means in a crash mode – nominal yields retreat isn‘t over, and would power both metals higher (as it interplays with inflation). Aka real rates rule.

Crude Oil

Crude oil offered a one-way session, and its upswing was amply supported by volume. Oil companies didn‘t lag behind – the next upswing is underway with not too many resistances ahead.

Summary

S&P 500 is getting ready for another upside breakout – it‘s a question of time.

Gold and silver remain well bid and technically primed to go higher, let alone fundamentally.The upleg is very far from over, and the only watchout in the short run is the copper to 10-year yield ratio.

Crude oil consolidation is over, and odds favor a new upleg to proceed.

Bitcoin and Ethereum are consolidating, but rebound continuation is more probable.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the four publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals and Bitcoin Trading Signals.

Related: Stock Market: No More Destruction ... Beyond Cryptos

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.