March Madness started on Thursday (Mar. 18), but stocks got the jump on their own brackets this week. Let’s dive in.

Although Wednesday (Mar. 17) saw the indices have a nice St. Patrick’s day green reversal thanks to Jay Powell babying us on inflation thoughts again, Mr. Market isn't stupid. Manic, but not stupid. We saw a return to the strong rotation trend out of growth stocks the day after Powell's testimony (Mar. 18).

Thursday (Mar. 18) saw bond yields surge to their highest levels in what seems like forever. The 10-year yield popped 11 basis points to 1.75% for the first time since January 2020, while the 30-year rate climbed 6 basis points and breached 2.5% for the first time since August 2019.

Predictably, the Nasdaq tanked by over 3% for its worst session in 3-weeks.

Jay Powell and bond yields are the most significant market movers in the game now. Get ready for the market next week when he testifies to Congress. That'll be a beauty. What's coronavirus anymore?

So after what's been a relatively tame week for the indices, we can officially say bye-bye to that.

Bond yields, though, are still at historically low levels, and the Fed Funds Rate remains at 0%. With the Fed forecasting a successful economic recovery this year, with GDP growth of around 6.5% -- the fastest in nearly four decades -- the wheels could be in motion for another round of the Roaring '20s.

The problem, though, is that the Great Depression came right after the first Roaring '20s.

Many are sounding the alarm. However, like CNBC's Jim Cramer, others think the current headwinds are overblown, and a mirror of the 2015-2016 downturn is based on similar catalysts.

Figure 1: Jim Cramer Twitter

Cramer argued that Powell is a talented central banker willing to "let the economy continue to gain strength so that everyone has a chance to do well."

Nobody can predict the future, and these growth stock jitters from rising bond yields may be overblown. But for now, it's probably best to let the market figure itself out and be mindful of the headwinds.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

There is optimism but signs of concern. The market has to figure itself out. A further downturn is possible, but I don’t think that a decline above ~20%, leading to a bear market, will happen any time soon.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

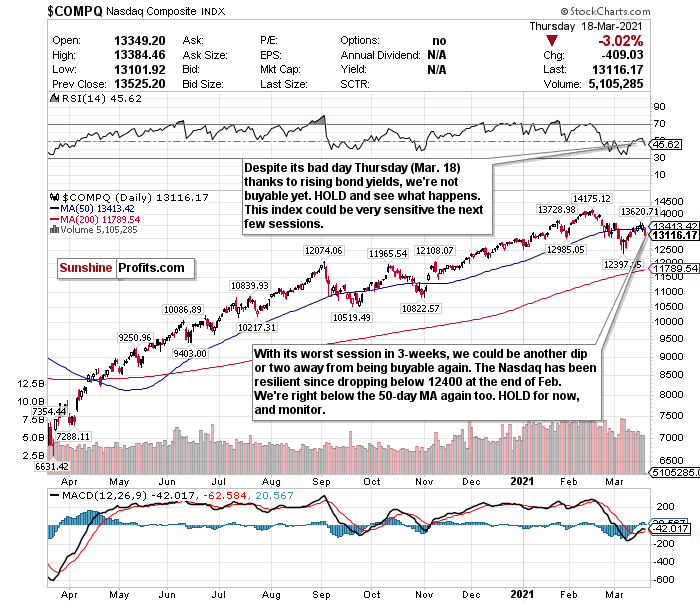

Nasdaq- Another Buyable Dip?

Figure 2- Nasdaq Composite Index $COMP

The last time I switched my Nasdaq call to a BUY on Feb 24 , that worked out very well. I will use the same criteria again for the Nasdaq as the market figures out bond yields: The RSI and the 13000 support level. I need the Nasdaq’s RSI to dip below 40 while also falling below 13000 before buying.

We’re not quite there. This is an excellent dip, but it’s really only one down day and its worst down day in weeks. I think we may have some more buying opportunities next week if bond yields pop due to Jay Powell’s testimony. I mean, it seemingly always happens after he speaks.

Pay very close attention to the index and its swings.

If the tech sector takes another big dip, don’t get scared, don’t time the market, monitor the trends I mentioned and look for selective buying opportunities. If we hit my buying criteria, selectively look into high-quality companies and emerging disruptive sub-sectors such as cloud computing, e-commerce, and fintech.

HOLD, and let the RSI and 13000-support level guide your Nasdaq decisions. See what happens over subsequent sessions, research emerging tech sectors and high-quality companies, and consider buying that next big dip.

For an ETF that attempts to correlate with the performance of the NASDAQ directly, the Invesco QQQ ETF (QQQ) is a good option.

For more of my thoughts on the market, such as a potentially overbought Dow Jones, small-caps, inflation, and emerging market opportunities, sign up for my premium analysis today.

Related: Stock March Madness: Who You Got?

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.