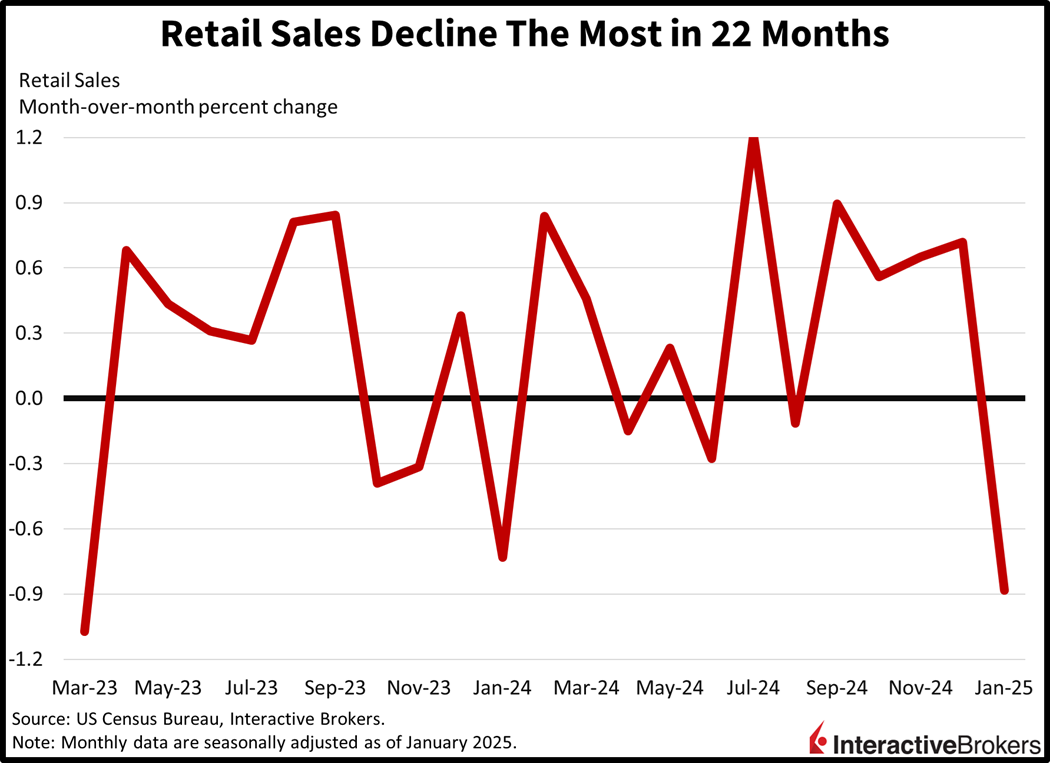

Interest rates are plunging from both relief that Trump tariffs are not imminent and data showing retail sales have experienced their sharpest drop in nearly two years, leading to folks wondering if the consumer is poised to slowdown this year. The weak consumption report is reopening the door to a potential Fed reduction this summer, a prospect that was dampened by a piping hot CPI print earlier this week. Meanwhile, stocks are near their flatline, hovering around all-time highs, as market participants consider the possibility that President Trump’s eventuality on trade will be characterized by vigorous barks followed by gentle bites. Traders are also looking ahead to the benefits that would arise if Kyiv and Moscow strike a peace deal and are hoping that the stagflationary winds of sluggish shopping amidst elevated price pressures in January are a one-off.

Cash Register Activity Weakens

Households took a break from shopping for physical goods last month with transactions falling by the most since March of 2023. The Census Bureau’s retail sales report reflected a 0.9% month-over-month (m/m) decline, well below expectations of a 0.1% slip and December’s upwardly revised 0.7% growth. The contraction was more modest when excluding gas and autos, however, at 0.5%. But the control group, which contributes heavily to the government’s consumption calculation as it relates to gross domestic product (GDP), dropped 0.8% during the period.

Sales Climbed in Only Four Categories

There was broad-based weakness across the report, which is significant considering that prices rose strongly last month. This print is not inflation-adjusted, pointing to folks consuming much less from a volume perspective. Just 4 of the 13 major categories posted transaction progress, including gasoline stations, restaurants and bars, general merchandise stores and miscellaneous retailers, sporting growth of 0.9%, 0.9%, 0.5% and 0.2%. But weighing on the headline were sharp drops at sporting goods destinations, automobile dealerships, ecommerce sites and furniture showrooms; those declined 4.6%, 2.8%, 1.9% and 1.7%.

Winter Blast Boosts Industrial Production

A sharp increase in utilities activity as a result of colder temperatures drove a strong beat in last month’s industrial production figures from the Federal Reserve. The output countered weakness in the mining and manufacturing areas and helped to generate a 0.5% m/m headline figure, beating the projected 0.3% but decelerating from December’s 1%. Utilities saw production climb 7.2% m/m, while mining and manufacturing ticked south by 1.2% and 0.1%.

Inflation Persists

The third inflation report in three days also reflected persistent price pressures, with this morning’s Bureau of Labor Statistics export and import print reflecting climbing costs last month. Imports and exports saw charges increase 0.3% and 1.3% m/m, compared to projections of 0.4% and 0.3% and December’s 0.2% and 0.5%. Fuel and nonfuel imports saw prices increase 3.2% and 0.1% m/m while nonagricultural exports experienced a monthly advance of 1.5%. Charges for nonagricultural exports dipped 0.2% during the period.

Treasurys Lead the Rally

Markets are climbing overall with notable increases in fixed-income instruments being met with modest gains in equities and losses in commodities. All major domestic stock benchmarks are nearly unchanged as the Nasdaq 100, S&P 500 and Russell 2000 indices advance about 0.1% while the Dow Jones Industrial Average slips by 0.1%. Sectoral breadth is split against the backdrop with energy, communication services, and financials leading the bulls; they’re up 1.1%, 0.5% and 0.4%. Conversely, the laggards are represented by consumer staples, industrial and healthcare with those segments down 0.6%, 0.3% and 0.3%. Treasurys are catching strong bids as investors brace for a potential economic slowdown. The 2- and 10-year maturities are being offered at 4.24% and 4.45%, 7 and 8 basis points (bps) lighter on the session. And those softer borrowing costs are weighing on the greenback and its index is losing 37 bps as the US currency depreciates relative to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan, loonie and Aussie tender. Commodities are tilted bearish for the most part as copper, gold and crude oil lose 2.7%, 1.2% and 0.6%, but lumber and silver are up 0.7% and 0.4%.

Inflation is Good for Stocks

This week’s data was just awful when considering its stagflationary implications in aggregate. Elevated prices were met with waning consumer spending momentum, a recipe for an economic slowdown. Emblematic of this development is this morning’s retail sales print shaving 60 bps from the Atlanta Fed’s GDP Now forecast for the first quarter, which now stands at 2.3%. But is inflation good for stocks? Consider that 2023 and 2024 carried price pressure rates well in excess of the Fed’s 2% target and both years delivered returns near 25%. One thing that carried the market during those two years though folks was resilient household spending, a dynamic that is absolutely necessary for corporate earnings to continue growing. Meanwhile, 2022 featured a GDP contraction in the first quarter, which coincided with a losing year for equities amidst an earnings recession. Rising inflation will benefit stocks if it arrives alongside a tolerant central bank, but contracting consumption will absolutely weigh on fundamentals and is not conducive to share appreciation.

International Roundup

Singapore’s Growth Blows Past Expectations

Singapore’s economic expansion decelerated quarter over quarter (q/q) during the last three months of 2024 while posting terrific growth from an annual perspective despite softening consumer spending. GDP increased 5% year over year (y/y) in the fourth quarter, much stronger than the 4.7% projected but slower than the 5.7% in the preceding three months. The q/q expansion in the quarter ended December 31 of 0.5% slowed from 3% in the third quarter. The following sectors and their stated growth rates contributed the most to GDP expansion:

- Manufacturing, up 7.4% y/y with results driven by demand for electronics, transportation engineering and general manufacturing

- Wholesale trade, up 6.7% y/y, with support from machinery, equipment and electronic components. Petroleum and chemicals also contributed to growth.

- Construction, up 4.4% y/y, with growth supported by both private sector and public projects.

Conversely, the food and beverage categories, retail trade group, and the administrative and support sector sank 0.3%, 1% and 0.6%.

Europe Experiences Anemic Employment Growth

Employment growth in the both the European Union (EU) and the euro area consisting of 20 countries that use the euro expanded 1% q/q during the final three months of last year, according to eurostat. In the preceding three-month period, employment was flat in the EU and was up 0.2% in the euro area q/q.

In a related matter, Porsche will cut 1,900 jobs in Germany. A company spokeswoman told Automotive News that the layoff involves both manufacturing and engineering positions and is required due to weak demand for electric vehicles (EVs) and “challenging geopolitical and economic conditions.” Prior to this announcement, Porsche laid off 2,000 workers. On a broader scale, the European Association of Automotive Suppliers last month reported that slow uptake of EVs is likely to result in 54,000 redundant jobs and will cause layoffs in the coming months, according to GoAuto.com.

South Korea Reverses Job Losses

After surrendering 52,000 jobs in December y/y, the South Korean labor market has bounced back with 135,000 new jobs in January relative to the same month in 2024, according to Statistics Korea. While the reversal is encouraging, the January gain is lower than additions during the first half of last year when the economy added between 200,000 to 300,000 jobs a month. Also concerning, the construction industry, which is facing the headwinds of high interest rates and bad weather, gave up 169,000 jobs y/y and manufacturing lost 56,000 positions. Job losses also continued in the wholesale and retail categories, marking an 11-month streak of contraction. Jobs in the public health and social welfare field, however, gained 119,000 while the science and technology category added 98,000.

Canada’s Releases Disappoint

Canada’s manufacturing sales rose 0.3%, but wholesale transactions sank 0.2% m/m in December. The results weakened from November’s 0.7% manufacturing gains and the flat results for wholesale activity. For December, analysts expected the two categories to expand 0.6% and 0.1%.

Related: Tariffs and Strong Wage Growth Drive Inflation Fears Higher