David Fessler retired from semiconductor vendor LTX Corporation at the age of 47. It was right around the time of the dotcom bubble, and within the course of 18 months, LTX stock had shot up from just under a dollar to around $54 a share.“A number of us at LTX said, ‘Okay, we think this is enough,’” Dave tells me over the phone. “So we left.”As what often happens after early retirement, though, Dave got bored very quickly. He had spent four years out of college as an electrical engineer at Western Electric—once the primary supplier to AT&T—and 25 years at LTX. There was more he needed to do.After a couple of years at a small family-run telecommunications business in his hometown of Nazareth, Pennsylvania—claims to fame: Mario Andretti and Martin Guitars—he decided to pursue his longtime hobby, investing, full-time. Through an online ad, he learned that the Oxford Club was looking for writers.For the past 12 years, Dave’s been writing for and educating investors at the massively successful financial publishing firm, which now has more than 157,000 members from as many as 130 countries. As Oxford’s resident energy and infrastructure strategist, Dave focuses mainly on cutting-edge technologies, including renewable energy and electric vehicles (EVs).

These were among the topics I recently had the pleasure to pick Dave’s brain about. Read on for highlights of our interview…

So glad you could join me! I want to start by saying congratulations on the publication of your book.Thank you! It’s called

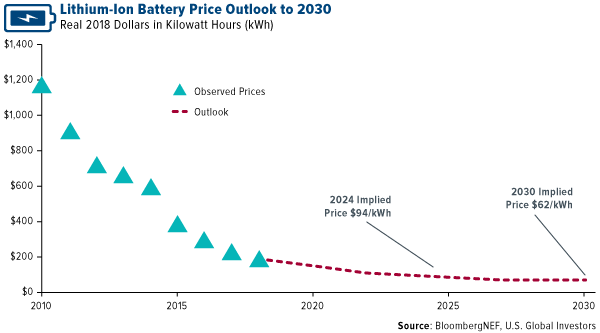

The Energy Disruption Triangle,and it was published this past January. The book is all about how solar, EVs and cheap battery storage are all converging and disrupting the energy sector as we know it today. That’s the “triangle” that the title refers to.

So what kind of EV do you drive?We started out with a Nissan Leaf in 2013 or 2014. It was the first EV to come out in quantity, and we jumped on that. We signed a two-year lease but ended up extending it for another year because we were waiting for the availability of the Tesla Model X. Once we were able to order the Tesla, in 2016, we were grandfathered in to free, unlimited supercharging, which I understand Tesla has

recently brought back to attract more buyers.The Model X is now being mass produced, but the exciting thing is that nearly every car company on the planet is working on its own EV. The technology is no longer just a science project. It’s going mainstream, and tens of billions of dollars are being spent on the supply chain, from mining the raw materials for the batteries to making the motors. It’s an amazing transformation, one that’s occurring much faster than anyone could have predicted. And there are so many opportunities for investors.

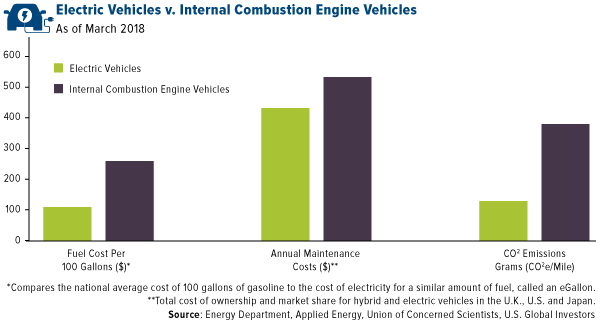

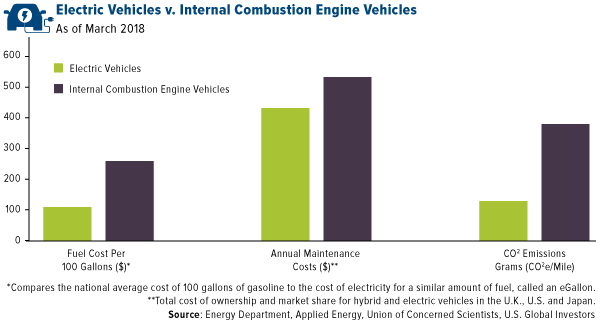

What do you think is the fundamental appeal of EVs? How are they an improvement over internal combustion engine vehicles?The obvious answer is that, with EVs, we’re not burning fossil fuels and adding to global warming. But if that doesn’t sway your opinion, consider the merits of EVs versus internal combustion engine vehicles from a maintenance point of view.You may have heard that car dealers don’t like EVs. That’s because there’s rarely anything that needs fixing. There’s no exhaust system, no fuel tank, no timing belts, no oil changes. There’s no need to replace the brakes because most of the braking is done by the motor itself. As soon as you take your foot off the accelerator, the car starts slowing down and putting power back into the battery. So all of the things that drivers have been accustomed to creating maintenance issues in the past are simply not present in an EV.I believe this is a huge selling point. Think of the savings in maintenance costs alone, not to mention gasoline. We’re used to being charged $75, $100, even $200 an hour at the dealership when something breaks. That’s no longer a concern with EVs.

click to enlarge

click to enlarge

Our Model X is now over three years old. We’ve replaced the tires once and had to replace the windshield after a stone hit it—fortunately, it was still under warranty. Other than that, we’ve had absolutely nothing go wrong with the car.It’s very comfortable on long car rides. We’ve driven it to the southern shore of Maryland. We’ve driven it to Penn State a number of times to visit my son.I believe they sell themselves. Whenever I give someone a test drive, their interest in EVs goes from zero to 100.

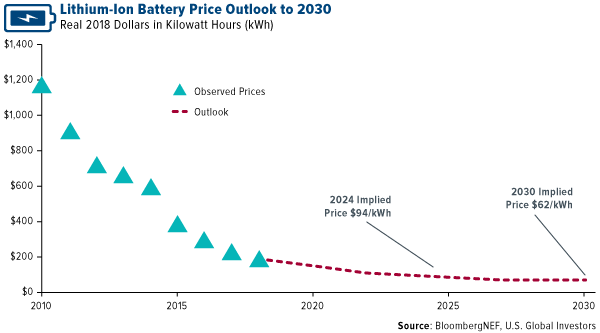

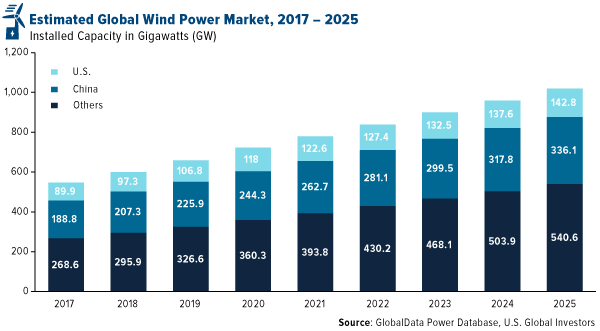

The Energy Information Administration (EIA) recently announced that, in April, the U.S. generated more electricity from renewables than from coal for the first time ever. What’s the next tipping point?To be honest, we’re already at the point now where wind and solar can compete very favorably with any other energy source, which is why utility companies are scrambling to bring them to market.The most common argument against renewables has been: Well, what do you do when the wind stops blowing and it gets dark? We’ve actually solved that pretty handily with cheap battery storage. Tesla has done it with the Powerwall. Meanwhile, other companies are ramping up their offerings for the residential and utility battery storage markets. That, combined with solar and wind, provides a fantastic replacement for always-on energy generators.

click to enlarge

click to enlarge

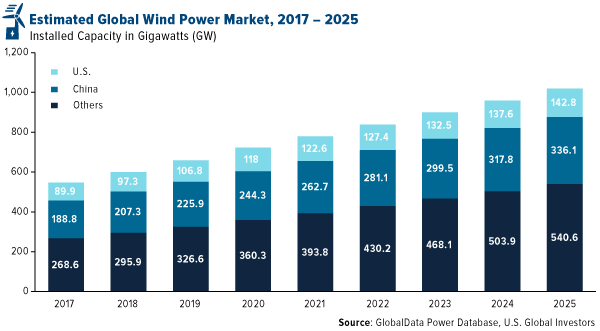

Peaker plants, for instance, can easily be replaced by battery storage. Today, when energy demand spikes, it can take several hours to fire up a peaker plant and get it generating electricity. A coal plant can take several days, a nuclear plant even longer. By comparison, you can source power from a bank of batteries within milliseconds.U.S. offshore wind is just at the beginning of its tipping point, and there are now several gigawatts (GWs) worth of projects in various stages underway in a number of the northeastern coastal states. The turbines will be 30 to 40 miles offshore—out of sight, out of mind. Multiple companies in the U.S. are preparing for this right now by producing wind energy components. It’s going to be a big area of growth.So you have all of these different disruptions occurring, but together, they’re totally disrupting the energy system as we know it.

click to enlarge

click to enlarge

Change is inevitable.Absolutely! In the 19th century, coal was the main engine of the Industrial Revolution and economic growth. In the 20th century, it was oil—which, I might add, was discovered in western Pennsylvania. Even though we’ll continue to use fossil fuels, the 21st century will be the age of renewables.Take a look at China. They’re burning the candle at both ends. They’ve opened a few new coal plants in recent years, but they’re also moving very rapidly toward renewables, mainly because their big cities have become too polluted. For large developing countries such as China and India to thrive, they must embrace renewable energy. There’s really no other choice. The pollution is just too big of a problem in such densely populated urban areas like Shanghai and New Delhi.

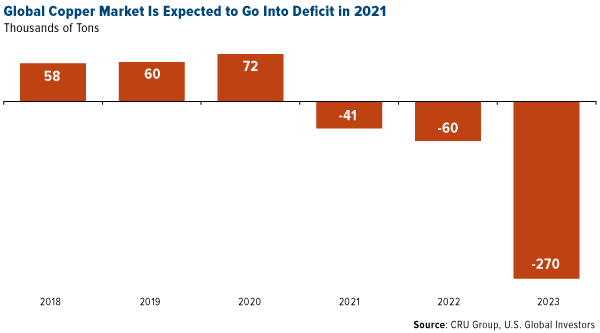

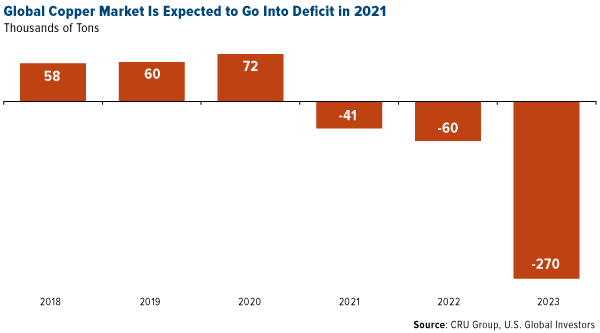

How can investors participate in this trend?One of my favorite materials moving forward is

copper. Everyone’s focused on lithium and cobalt, but they’re ignoring the one thing that connects it all together. A single wind turbine can have up to a ton of copper wiring in the massive generators at the top of the tower. The same goes with EV motors. Because of this, copper is expected to be in short supply in the coming months.

click to enlarge

click to enlarge

Besides your book, which I highly recommend, where can investors read some of your work?I write a weekly article for

Profit Trends, which is our free newsletter. We also have a paid monthly newsletter,

Strategic Trends Investor. And then there’s my paid VIP newsletter,

Fessler’s Flash Profits. Thanks so much for speaking with us, Dave!The pleasure was all mine!Related:

Gold Just Hit New All-Time Highs with Yields Sinking Everywhere

click to enlarge

click to enlarge  click to enlarge

click to enlarge  click to enlarge

click to enlarge  click to enlarge

click to enlarge