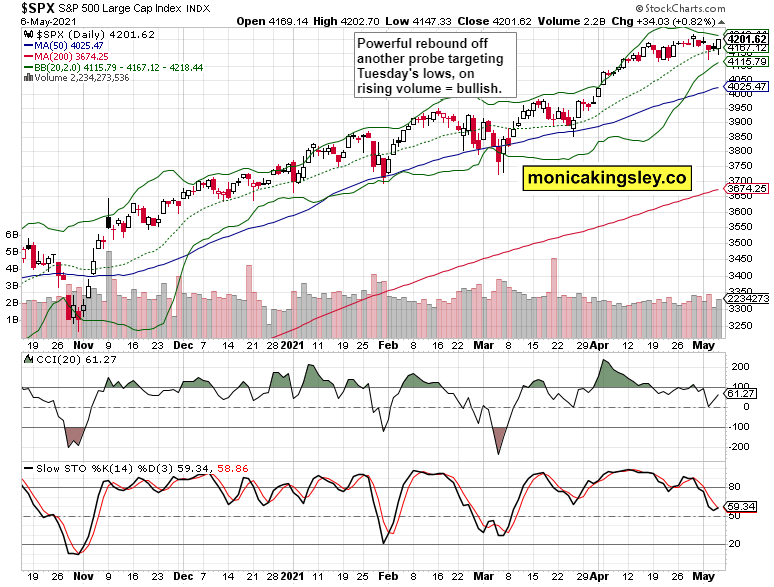

One final attempt to go down before reversing to strong gains all the way to the closing bell – the S&P 500 returned to trading back at the upper border of its prolonged consolidation range. Again at 4,200, new ATHs are back in sight – that‘s at least what the impression from declining VIX says, and the option traders might disagree here all they want, they‘re likely to be the next cannon fodder in the bullish advance.

Needless to say that my reasonably and justifiably aggressive long positions in both S&P 500 and gold, are innundated with rising profits. Initiated in the vicinity of Tuesday‘s lows, I look for more gains in stocks (we‘ll get to the metals shortly) in spite of smallcaps still lagging behind (don‘t worry, they‘ll catch up over time, and I will cover that), and precisely because emerging markets are rejoicing over further dollar woes. Yes, the glitzy and fake tightening show is officially over since I first vocally called for it in Monday‘s analysis.

Keep an eye on the big picture presented yesterday:

(…) no change in the reflationary positive dynamics for stocks, let alone the red hot commodities. These (copper, agrifoods, base metals, lumber, oil) continue appreciating in spite of nominal yields pulling back a little these days. Make no mistake though, deflation isn‘t about to break out.

Lower yields finally coincided with (supported) the defensive sectors the way it ideally should – technology bottom searching is over, Dow Jones Industrial Average is spurting higher, utilities recovered, and consumer staples continued upwards as if nothing happened at all. Maybe is this heavy on P&G sector placing faith in the market leader‘s pricing power to result in a success once September arrives with the rest of crowd following? That‘s the part of the cost-push inflation I discussed on Monday. I truly hope that people are paying attention, and don‘t put all their eggs into e.g. the dollar basket when it comes to commodities:

(…) the USD Index … anticipated downside move ... would help lift international markets, and is also part of the explanation behind the strong commodity performance these days. This CRB Index move is key, and shows how far have real assets progressed in shaking off the dollar link – if you compare the dollar‘s value in early Feb and now, you are looking at very meaningfully higher commodity prices over that same time period.

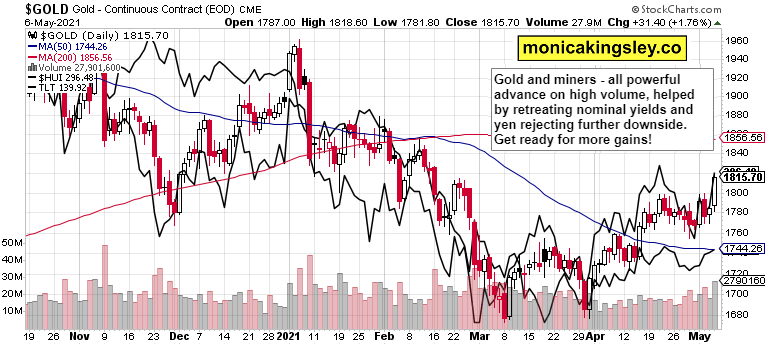

Gold and silver fireworks arrived, and more is to come! What a better proof than a broad based advance across the sector, starting with both metals, and extending to gold and silver miners left and right. Not to mention the copper fires burning brightly – if you were listening to my incessant red metal bullish calls, you‘re very happy now. And just as in the precious metals, there is more to come here too. So happy for all you who had the patience to wait out a couple of adverse sessions, because:

(…) The key metrics such as nominal or real yields support the precious metals rebound increasingly more – don‘t be fooled, gold would break above the $1,800 resistance, whether you look at it as a purely psychological one, or as a neckline of an inverse head and shoulders on the daily chart.

The advance across the real assets, the precious metals and commodities super bull, would be more well rounded then.

As for Bitcoin, such was my yesterday‘s (still valid) assessment in a series of updates of the leading, but currently lagging crypto when compared to Ethereum or Dogecoin, the latter being a true middle finger to the financial system. GameStop, silver squeeze, Doge...

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

Yesterday‘s rebound happened on rising volume, lending it credibility for the sessions to come. The bears weren‘t obviously convinced enough to sell as yesterday‘s volume lagged behind Tuesday‘s one.

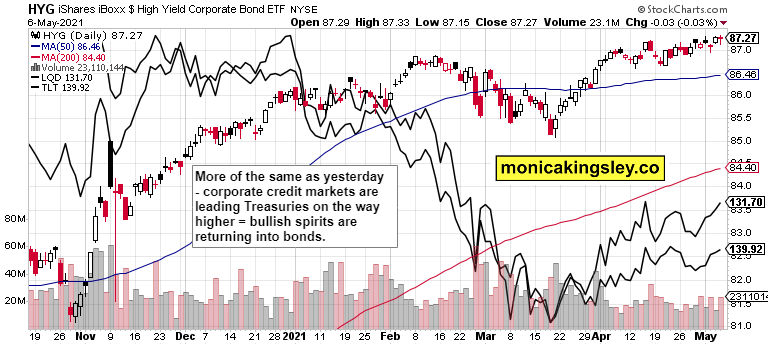

Credit Markets

The corporate credit markets kept yesterday and still keep today signalling higher stock prices next. Notably, both HYG and LQD rose again in spite of long-dated Treasuries turning up as well.

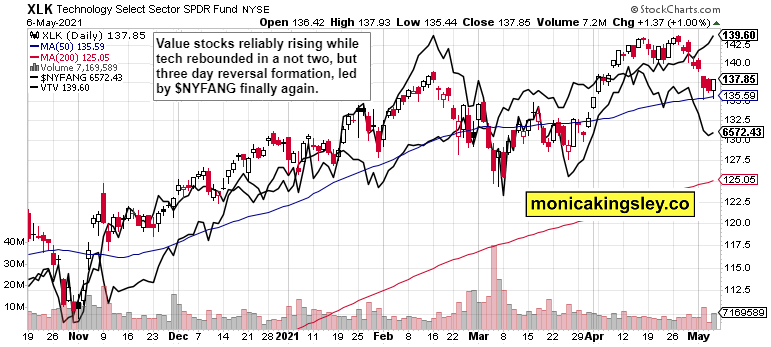

Technology and Value

Technology did indeed bottom, and the heavyweights contributed reasonably enough to its advance. Semiconductors could have fared a little better, but that‘s not a major issue. At the same time, value stocks continued their steep ascent, as reliably as ever.

S&P 500 Market Breadth

The S&P 500 advance wasn‘t accompanied by either new highs new lows or the advance-decline line turning up noticeably. Might be disappointing at first sight, but the overall impression is still of a healthy and quite broad advance.

Gold and Miners Short-Term

Miners and gold are in tune with each other, jointly pulling the cart of the precious metals advance. No further words are necessary here, I believe.

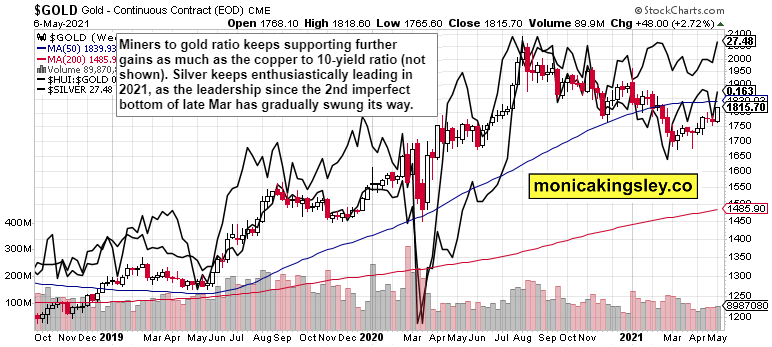

Gold, Silver and Miners Long-Term

Just as strongly when I doubted the miners to gold plunge on Monday, the ratio swiftly recovered starting Tuesday and extending gains yesterday. Please note silver springing to leadership position again – gradually first, more obviously throughout this week on the silver squeeze heels, which would be a volatile ride, but once again, silver is the best of both worlds – the monetary and industrial applications ones.

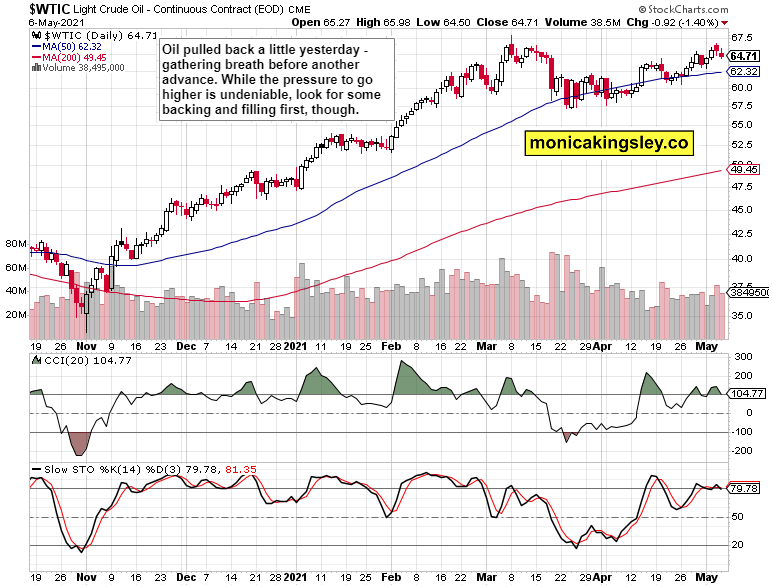

Crude Oil

Crude oil pulled back a little yesterday, but the series of higher highs and higher lows since April hasn‘t been violated. The table remains set for further gains, and the only question is how fast these come – I‘m standing by my calls for at least $80 West Texas Intermediate before 2022 is over. Seasonality is still good for black gold, so enjoy the ride!

Summary

Gold, silver and miners have firmly positioned themselves to extend yesterday‘s much awaited and well deserved gains. The upleg is just getting started, now that the few weeks‘ consolidation is over.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Related: SPX Correction Arriving or Not?

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.