Written by: Lauren Goodwin | New York Life Investments

Rates have moved relentlessly higher in recent weeks, and despite market hopes, the Fed is not yet weighing in. During Wednesday’s press conference, the Fed acknowledged improving growth expectations and even pulled forward their expectation for the next rate hike. At the same time, they stuck to their typical script: policy will remain accommodative for the foreseeable future.

Bond markets aren’t buying it. While the Fed projects it won’t hike interest rates until the end of 2023 or beginning of 2024, markets are pricing a hike a full year earlier. We’re inclined to not fight the Fed, at least until wage pressures show up. That said, growing uncertainty over the front end of the curve will contribute to market volatility in the coming months, and raise the stakes for investors. Alpha will be driven more by sector rotation and company fundamentals as capital costs rise.

Sources: New York Life Investments Multi-Asset Solutions, Federal Reserve Bank of St. Louis, Bloomberg LP, 3/16/21.

When do these expectations begin to impact equities?

One of the key questions for investors is: when will rising rates start to weigh on the booming stock market? And the answer is—it’s a moving target. Broad equity multiples are driven by several factors, namely economic growth rates, the cost of capital, and market sentiment. Rising interest rates could impact each of these factors by slowing economic growth, increasing borrowing costs, or reducing investor confidence.

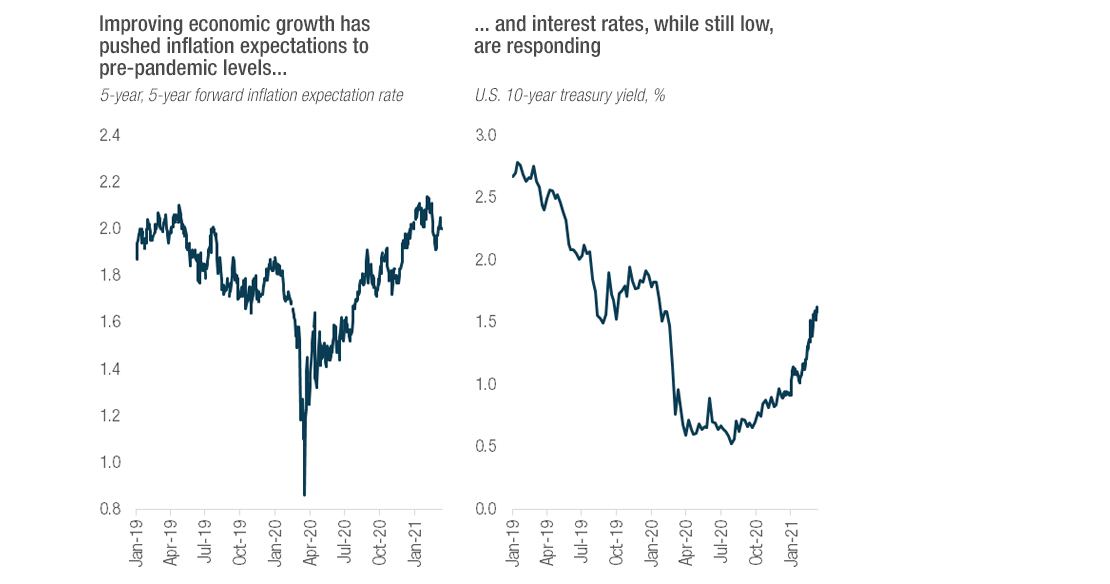

These factors are in balance, at least for now. Bond yields are moving higher in response to higher economic growth—a good thing for risk assets. And while bond yields have increased, they are still significantly lower than pre-COVID levels (see chart above). Equity prices can continue to move higher as long as earnings outpace the rise in borrowing costs, and as long as borrowing costs don’t choke off broader economic growth.

Can you put a number on that?

When would borrowing costs weigh heavier than economic growth can allow? It’s not just the level of interest rates that matters for equity. The pace of any increase and steepness of the curve are important, too.

Level of rates. At this point, we think most economic growth expectations are priced in, and expect another 50 basis points (bps) increase in the U.S. 10-year Treasury yield this year—putting us near 2.0 – 2.1% for the end of 2021. If the 10-year moves much higher than this market consensus figure without an increase in growth expectations, equity markets would likely respond.

Pace of rise. If rates reach the levels described above faster than end-of-year—again, assuming there’s no other major changes in growth expectations—we could see some churn in equity markets. So far, and unlikely in 2013 when real rates rose 150 bps in two months, the current pace is still mild and in the normal range given that the strong economic recovery is already at our doorstep.

Steepness of the curve. Historically, steepness of the curve in an early economic recovery matters less for markets as a whole but does impact certain businesses and sectors. Housing is one example, where higher long-term market rates could reduce demand for transactions.

How might you consider investing?

In the long run, it’s far from certain that rates will move dramatically higher. The structural underpinnings of inflation are slow-moving and international in nature, and it’s not clear that complicated factors such as globalization and labor force participation can improve enough to offset the disinflationary impacts of technological advancement.

While economists hash out these issues, there are actions investors can take this year to account for the increases in growth and rates.

In fixed income, investors with the appropriate risk tolerance and time horizon (i.e. ability to move tactically) could focus on shorter duration, high-yield, and floating rate securities. We are shortening duration in our portfolios this year, but would be willing to add back duration when yields approach the 2.0% level, all else equal.

As for equities, sector rotation and security selection will be essential for alpha generation this year. In 2020 and even 2019, declining interest rates resulted in multiple expansion—a rising tide that “raised all ships.” 2021’s rising rate environment means that investors have to focus on the fundamentals. In some cases, that means identifying the sectors that benefit disproportionately from improving economic growth: such as financial services, materials, energy, and industrials. Mergers and acquisitions may also benefit. In other cases, it means avoiding the sectors and companies most impacted by rising rates, such as “long duration” or growth equities. In all cases, it requires identifying the companies whose earnings and margins are set to improve, supporting higher valuations even amid rising rates.

Investors can also consider policy-supported strategies. One example is the move towards green infrastructure, which can be supported by infrastructure funds, municipal bonds, or ESG investments.