This morning’s cooler-than-expected wholesale inflation figures are modestly relieving investor angst after yesterday’s hotter-than-projected Consumer Price Index (CPI) sent capital markets into a freefall. When considering the weak demand for 10-year Treasury notes at yesterday’s auction shortly after the hot CPI, reprieve is just what investors need. Later today, however, we’ll hear from regional Fed Presidents Williams, Collins and Bostic while another Treasury auction occurs, this time involving $22 billion worth of 30-year bonds. Today’s commentary alongside the level of auction demand will offer clues on the path of monetary policy, term premium dynamics and the appetite for longer-term fixed-income instruments amidst an uncertain inflationary future.

Price Gains Ease Slightly

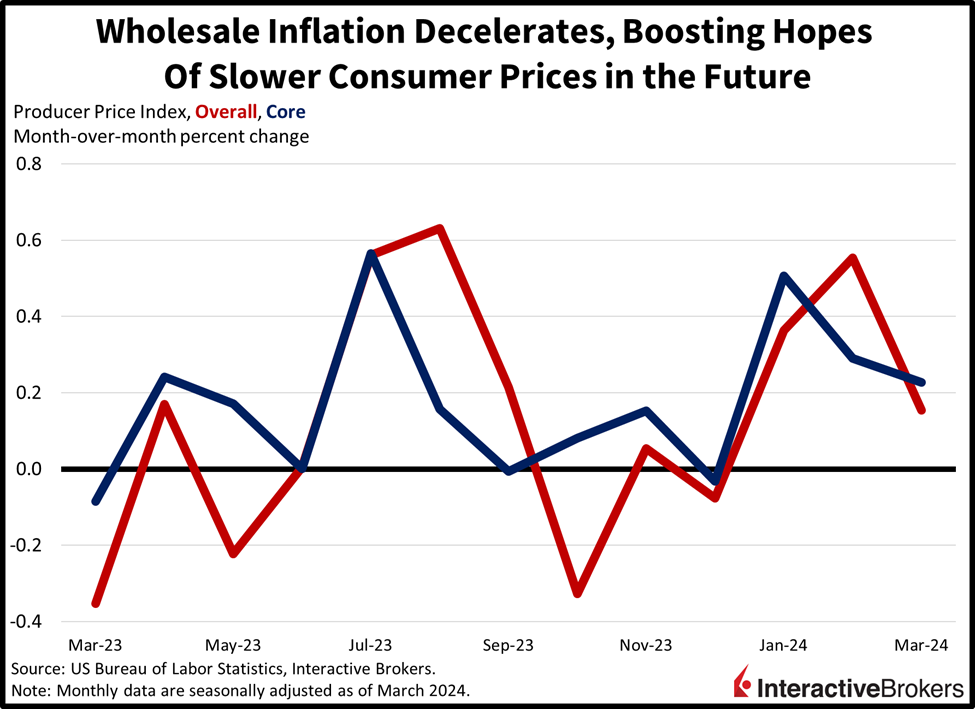

This morning’s Producer Price Index (PPI) showed that wholesale price increases decelerated last month, pointing to softening inflationary pressures in the pipeline and the possibility of lighter consumer inflation in the coming months. For disinflation to gain traction this year, however, the price of WTI crude oil, which has been climbing recently, must not exceed $87 a barrel, an uncertain factor that is highly dependent on the wildcards of geopolitics and economic performance out of Beijing.

Service Inflation Continues to Thrive

Encouragingly, March’s PPI rose just 0.2% month over month (m/m) and 2.1% year over year (y/y), a tenth of a percentage point lighter than projections on both m/m and y/y figures. The results were also more favorable than February’s figures of 0.6% m/m and 2.2% y/y. The core figures, which exclude food, energy and trade, were less favorable, as services contributed significantly to price hikes. Core PPI rose 0.2% m/m and 2.4% y/y, near projections of 0.2% and 2.3%, respectively, while the previous month’s numbers came in at 0.3% and 2%.

Price gains were driven by services and food as charges for goods and energy declined. Wholesale prices for services rose 0.3%, with the transportation and warehousing category experiencing a 0.8% increase. Trade and other services gained just 0.3% and 0.2%. Main contributors to services price pressures were securities businesses and passenger airlines. On the goods side, prices were discounted 0.1% during the period as the energy category’s 1.6% decline offset the 0.8% increase in the food segment. Deflationary items on the product side included wholesale gasoline, jet fuel, chicken eggs, carbon steel scrap and fresh fruits.

Employers Continue to Hoard Workers

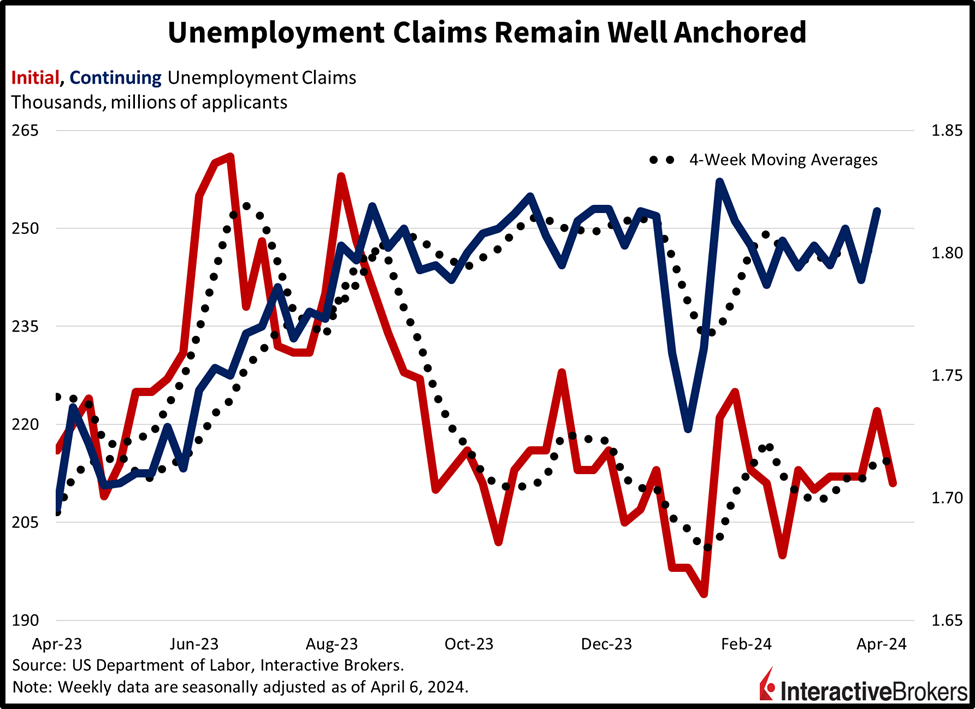

Employers’ slowing the pace of laying off workers continued during the week ended April 6, extending a trend of tight labor conditions. Initial unemployment claims fell to 211,000 during the week from 222,000 in the prior week while missing expectations of 216,000. However, continuing claims for the week ended March 30 totaled 1.817 million, up from 1.789 million in the previous week and higher than estimates of 1.8 million. The four-week moving average for initial claims, which is less volatile than weekly data, was 214,250 down slightly from 214,500 while the trend for continuing claims during the four-week period ended March 30 rose slightly from 1.799 million to 1.803 million.

Markets Move Sideways

Markets are mixed at the moment with equities paring gains in earlier trading while short- and long-end yields move in opposite directions. For stocks, the tech-heavy Nasdaq Composite and small-cap Russell 2000 indices are moving modestly higher, with the benchmarks up 0.3% and 0.1%. But the Dow Jones Industrial and S&P 500 indices are lower by 0.4% and 0.1%. Sectoral breadth is poor with just 2 out of 11 sectors up on the session, namely technology and communication services. Leading the way lower are financials, industrials and energy, which are down 1%, 0.6% and 0.6%. Bond yields and the dollar are near the flatline, with the 2-and 10-year Treasury maturities trading at 4.95% and 4.57%, 3 basis points lower for the former but higher for the latter. The greenback is gaining relative to the yen, euro and Canadian dollar but losing ground versus the Aussie dollar, franc, yuan and pound sterling. WTI crude oil is down 1%, or $0.84 per barrel, to $85.36 per barrel, as fears of a stronger dollar and higher-for-longer central banks offset supply concerns stemming from continued conflicts in the Middle East and Far East regions.

A Doubleheader of Sentiment Driving Events

Investors who are sifting through yesterday’s hot CPI data and this morning’s PPI report are waiting anxiously for Fed Regional Presidents’ Williams, Collins and Bostic podium time today to gauge how policymakers are tweaking their outlook for rate reductions. Yesterday’s market bloodbath illustrated how investors have looked past high valuations and instead have bet on the Fed cutting rates this year as the CPI threw cold water on expectations for the central bank to promptly turn dovish. Additional hawkish comments from these speakers could further chill sentiment and push optimism from today’s PPI into the background, while weak demand at today’s 30-year Treasury auction would point to additional fears among investors that the economy is likely to sag under the weight of a restrictive central bank. Dovish comments from Fed speakers and a strong showing of bond buyers, however, could cause today to end on a positive note as those potential developments could further rally investor sentiment and reinforce this morning’s PPI data that points to easing inflation.

Visit Traders’ Academy to Learn More About the Producer Price Index, Unemployment Claims and Other Economic Indicators