The S&P 500 went back to relentless rallying on Friday, yet the selling wave before the close looks to indicate hesitation ahead. Even though VIX is attacking the 16 level, and the put/call ratio ticked higher, the bulls are little disturbed thus far – and they‘re unlikely to get upset. Whatever consolidation comes, would be a sideways one – one to be bought.

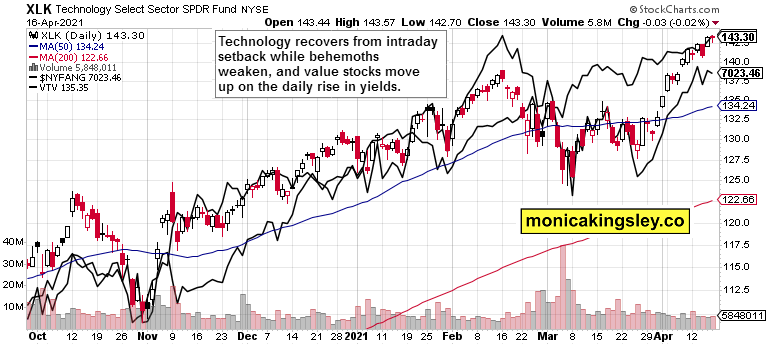

That‘s the result of ample liquidity in the system, which is denting the rotations. Yields can go up or down, yet the sectoral adjustments to the downside aren‘t largely there, and that extends beyond the recently discussed financials. It concerns tech specifically, as the sector appears at a turning point – it defended gains:

(…) without too much help from the behemoths, and value stocks surged. …. Retail sales outdoing expectations and unemployment claims dropping sharply – the economic recovery is doing fine, manufacturing expands, and inflation doesn‘t yet bite. We‘re still in the reflationary stage where economic growth is higher than the rate of inflation or its expectations.

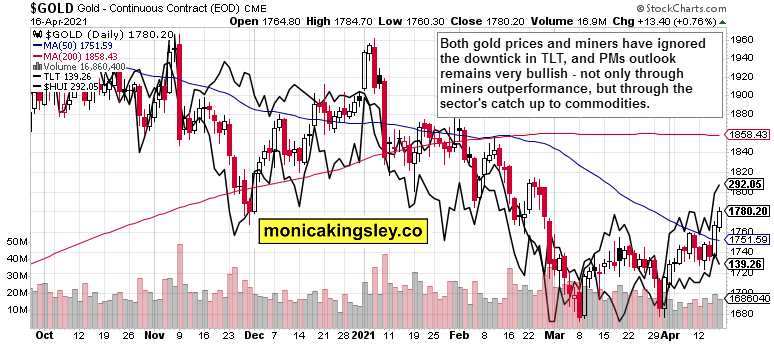

Gold loved the TLT upswing and Powell‘s assurances about not selling bonds back into the market in rememberance of eating a humble pie after the Dec 2018 hissy fit in the stock market (isn‘t this the third mandate actually, the cynics might ask). I called for the sharp gains across the precious metals board sending my open position(s) even more into the black.

Miners keep supporting the upswing in both metals, and the technical picture has turned, reflecting the economic realities and commodities‘ run anounced on Wednesday. Now, it‘s up to gold and silver to catch up on what they missed since the early Aug 2020. Inflation is running hotter, and the Fed is tolerant of it, amply supplying liquidity. The gold bottom is in, and much brighter days ahead.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

New ATHs, again and this time on rising volume – the momentum still largely remains with the bulls in spite of the late day selling pressure, and as said earlier, $NYFANG causing a few short-term wrinkles.

Credit Markets

Both high yield corporate bonds (HYG ETF) and investment grade ones (LQD ETF) have weakened, driven by the TLT retreat. This is a bearish omen unless the bulls step in, which could take a while.

Technology and Value

Reflecting the decline in long-dated Treasuries, tech wavered while its big names declined, and it was up to value stocks to save the day.

Gold in the Limelight

The gold sector is running, and miners show no signs of stopping their solid outperformance of the yellow metal. These two have risen on Friday in spite of TLT turning lower again – the decoupling from nominal yields is getting more pronounced.

The miners to gold ratio is as well pointing higher, and the higher low it made at the end of March, speaks volumes. The pressure is to go higher as the next precious metals upleg unfolds.

Miners in Focus

Gold seniors (GDX ETF) are matched in strength by silver miners (SIL ETF), and have convincingly broken above their recent highs and the declining resistance line connecting November and January tops. The unavoidable inflation data bringing down real rates are at work, and silver can be once again expected to start doing better than gold soon, and to considerably increase the open profits.

Summary

The daily S&P 500 consolidation looms, but will be a buying opportunity – not a sign of a market top. If you disliked the staircase climb for offering precious few opportunities to join without a discounted entry, your time is approaching.

Gold and miners keep surging as the commodities signposted, little hampered by the daily increase in nominal yields. Patience has been rewarded, and as we closed above $1,775, the gold bottom can be declared as in.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Related: Gold: You Can Win a Battle, but Still Lose the War

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.