If you want to know about the past, a good place to start is by looking at GDP. It tells you the dollar value of a country or region’s goods and services over a specific time period. But GDP’s like looking in the rearview mirror, in that it shows you where you’ve been and little more. It’s “blind” to what’s ahead of you.

For that you need another indicator, and if you’re a regular reader of the Investor Alert or Frank Talk, my CEO blog, you probably know which one I’m referring to: the purchasing managers’ index (PMI).

Unlike GDP, the PMI forecasts future manufacturing conditions and activity by assessing forward-looking factors such as production levels, new orders and supplier deliveries. PMI, then, is like the high beams that help guide you at night through the twists and turns of a mountain road.

Several times in the past, we’ve shown that there’s a high correlation between the global PMI reading and the performance of commodities and energy three months later. When a PMI “cross-above” occurs—that is, when the monthly reading crosses above the three-month moving average—it has historically signaled a possible uptrend in crude oil, copper and other commodities. Our research shows that between January 1998 and June 2015, copper had an 81 percent probability of rising 7 percent, while crude jumped the same amount three-quarters of the time.

click to enlarge

But the reverse is also true. When the monthly reading crosses below the three-month moving average, the same commodities and materials have in the past retreated three months later. And as I mentioned last week, the global PMI fell in December, from 51.2 in November to 50.9. The reading also crossed below the moving average.

click to enlarge

As you can see, the PMI has been in a relatively steady downtrend since midyear 2014, signaling the decline in commodities during the same period.

Below is our newly-released Periodic Table of Commodity Returns, which has consistently been one of our most popular research pieces year after year. Precious metals ended 2015 as the best-performing group, with palladium, gold and silver ranking among some of the more resilient commodities. A high-resolution copy of the table is available for download.

click to view interactive

Time to Cut the Red Tape

One of the main contributors to the lower global PMI reading in December was weak American manufacturing activity, according to a recent report from Cornerstone Macro. The research group had expected an improvement, but the one-month U.S. PMI reading landed “with a thud” at 48.2, its lowest point since June 2009.

click to enlarge

China also contracted in December, dropping to 48.2. The reading also crossed below the three-month average.

click to enlarge

The Asian giant is responsible for consuming massive amounts of raw materials—60 percent of the world’s concrete, 54 percent of aluminum. So when the PMI falls in both China and the U.S., the two largest economies in the world, it’s not a good sign.

Cornerstone cites the strong U.S. dollar, weaker exports, rising manufacturing inventory and the plunge in oil prices as factors that led to the downturn last month.

I agree that these factors played a huge role—oil slid below $30 per barrel this week—but I would also add more burdensome regulations to the list. Such rules have gunked up the gears of industry, and it’s essential that they be cleaned out to ignite synchronized global growth.

It’s hard to overemphasize just how important the American manufacturing sector is to the national (and world) economy. According to the National Association of Manufacturers (NAM), manufacturing has the highest multiplier effect and drives more innovation than any other sector. For every $1 spent on manufacturing, $1.40 is created and pumped back into the U.S. economy. The sector employs more than 12 million Americans, or roughly 9 percent of the workforce, and supports more than 18 million additional jobs.

If it were its own country, American manufacturing would be the ninth largest in the world.

And yet the cost of federal regulations falls disproportionately on manufacturers, who pay an average $19,500 per worker in compliance costs—about $10,000 more than what other industries must pay on average.

George Mason University’s Mercatus Center , a free market think tank, studied the effects of federal regulations on the productivity of various industries between 1997 and 2010. Unsurprisingly, the group found that the most regulated industries experience the least amount of growth. Whereas output per person for lightly regulated companies grew 63 percent during the period, output grew only 33 percent for those that carry heavier regulatory burdens.

More rules means less productivity and efficiency. As an analogy, imagine if professional basketball were played with more referees than players on the court, and with more rules than anyone can remember. No one would be able to score! This would have a huge multiplier effect: Viewers would drop off, ticket sales would plummet, advertising would dry up, and much more.

We must ensure that this doesn’t happen in manufacturing.

TPP to Unleash Global Trade

To achieve synchronized global growth, policymakers from the G20 countries must commit themselves to cutting red tape.

Look at how quickly energy and shipping companies shifted into gear after Congress lifted the 40-year-old oil export ban less than a month ago. Two tankers have already departed from Corpus Christi, Texas, to deliver crude to Europe. In anticipation of the policy change, infrastructure companies have poured billions into building new pipelines and oil storage facilities and expanding loading capacity at ports.

That’s why I’m excited for Congress to ratify the Trans-Pacific Partnership (TPP), which was finally settled upon in October by the 12 participating nations, the U.S. and Canada included. Since then, I’ve been writing and speaking extensively about the TPP, yet I can’t seem to emphasize enough how vital the passage of this landmark free-trade agreement is for global economic growth and job creation.

Once ratified, 18,000 tariffs are expected to be eliminated among the 12 TPP nations, which together account for 40 percent of global GDP and 20 percent of global trade. The World Bank estimates that individual GDPs will rise between 0.4 and 10 percent by 2030 as a direct result of the TPP.

Could 2016 Be Gold’s Turnaround Year?

As the Periodic Table of Commodity Returns above indicates, gold has seen annual losses for the past three years. But there are already signs that 2016 could reverse the trend. With equities around the world weakening, more consumers have been turning to the precious metal as a safe haven.

In China, physical delivery from the Shanghai Gold Exchange reached a record 2,596 tonnes, or a whopping 80 percent of total global output for 2015.

click to enlarge

In addition, the People’s Bank of China reported adding 19 more tonnes in December, bringing the total amount to over 1,762 tonnes.

Meanwhile, here in the U.S., demand is just as electric. On January 1, Americans gobbled up unprecedented amounts of gold and silver coins from the U.S. Mint, purchasing in one day a sizable percentage of total sales in the entire month a year ago.

click to enlarge

“Should the epic demand for precious metals from the first day of sales persist,” writes Zero Hedge , “we are confident that the Mint will run out of gold and silver within a few days.”

We will continue to monitor the global PMI, and once the global, China and U.S. readings all cross above the 50 mark, it’ll be time to lock and load.

Next week I’ll be speaking at the Vancouver Resource Investor Conference , the world’s largest investor conference for resource exploration. I hope to see you there, but if you can’t make it, I’ll be sure to share with you my thoughts and takeaways.

Index Summary

The major market indices finished down this week. The Dow Jones Industrial Average lost 2.19 percent. The S&P 500 Stock Index fell 2.17 percent, while the Nasdaq Composite fell 3.34 percent. The Russell 2000 small capitalization index lost 3.68 percent this week. The Hang Seng Composite lost 5.05 percent this week; while Taiwan was down 1.67 percent and the KOSPI fell 2.02 percent. The 10-year Treasury bond yield fell 8 basis points to 2.03 percent.

Domestic Equity Market

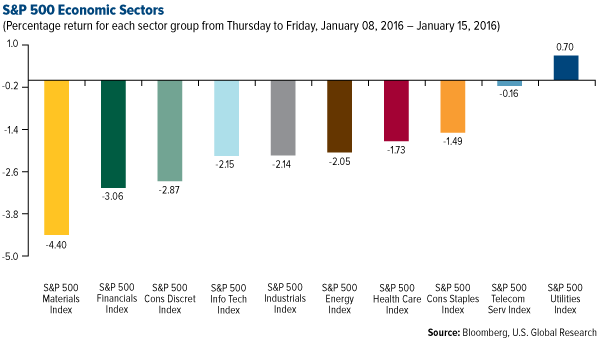

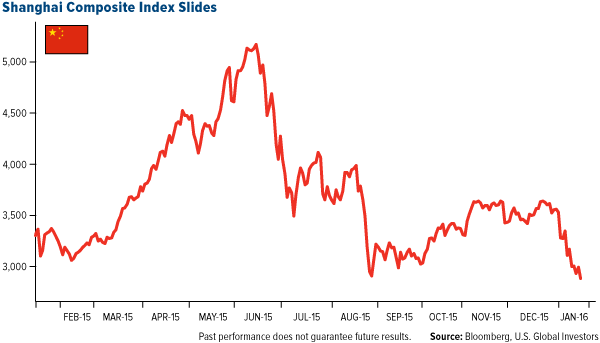

click to enlarge

Strengths

Utilities were the strongest sector for the week trading up .70 percent and unfortunately it was the only place for equity investors to hide. The strongest performing stock for the week was Sempra Energy, rebounding from being oversold last week. The company said it should be able to plug a leaking natural gas well before the end of February.

Weaknesses

The materials sector declined the most this week, falling 4.4 percent. Freeport-McMoRan lost the most this week, and there seems to be several drivers for the company’s decline. Most notable was Freeport’s credit downgrade to BBB- from Fitch along with the possibility of being forced into an asset sale.

Opportunities

According to BCA Research, the S&P telecommunications services sector traditionally outperforms during economic recessions and/or when overall profits contract. While the former is unlikely at this point, the latter is already underway. Industrial output growth will continue to sink, according to the bearish message from the ISM manufacturing survey. Retail sales at toy stores are soaring at a time when the overall retail market is struggling. This acceleration in consumer spending on toys and games is inversely correlated, with a lag, with fuel prices. Booming pharmaceutical drug demand should ensure that pharmacy foot traffic continues to grow. Pharmaceutical shipments have skyrocketed in the past few months. Given these trends, the defensive, growth-oriented S&P retail drugstore index provides an entry point at a market forward P/E multiple for above market potential earnings growth.

Threats

Global semi-conductor sales are contracting, lagging well behind overall GDP growth. As a result, deflation pressures are intense. According to BCA Research, prospective relative returns for the S&P capital markets index are tilted heavily to the downside on the back of waning risk appetites. Media companies are undergoing a fundamental shift in consumer media consumption habits. Several companies have already started warning that cord cutting could have a negative impact on profit results.

The Economy and Bond Market

Strengths

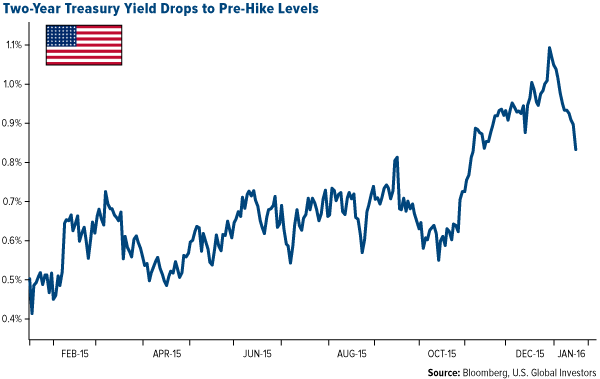

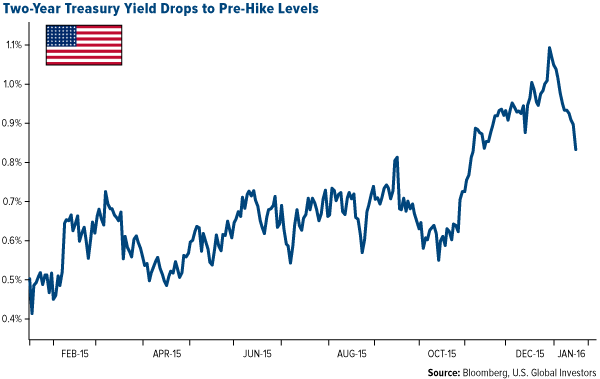

Consumer sentiment in the U.S. rose in January to a seven-month high, according to the University of Michigan’s Consumer Sentiment Index. At 93.3, sentiment surpassed analysts’ expectations of 92.9. Amid the risk-off rout in global equity markets this week, bond prices rose significantly as yields declined, almost across the board, in developed markets. The yield on the U.S. two-year Treasury fell to levels last seen in early November, more than retracing its rise into and following the Federal Reserve’s December rate hike.

click to enlarge

Weaknesses

Highly correlated selloffs in global equity markets this week speak to broad concerns of slower global growth, ongoing deflationary fears and policy uncertainties internationally. The week saw multiple indices, including the broad European equity Stoxx 600 Index and the Shanghai Composite Index, enter technical bear markets. Questions over growth prospects prompted several large brokerage houses to reassess fourth-quarter U.S. GDP estimates, even as analysts brace for China’s fourth-quarter GDP release over the holiday weekend in the U.S. The Empire State Manufacturing Index came in today at -19.37, considerably weaker than expectations for only -4.00, and marking new multi-year lows. December data was revised lower as well, adding fuel to the fire on a day already wracked by risk-off sentiment. Initial jobless claims in the U.S. ticked up this week to 284,000, short of expectations for 275,000.

Opportunities

Investors should not overreact to alarming headlines about China selling Treasuries, as private-sector buying in the U.S. is more than offsetting official Chinese selling. That is why longer dated Treasury yields have remained flat, even as China’s stock of U.S. treasuries has decreased. Furthermore, additional weakness in the Chinese currency can eventually be bond bullish, to the extent that it acts to tighten U.S. monetary conditions via a stronger dollar. According to BCA Research, it would be a mistake to think that the economy is about to go off the rails. While inflation expectations have come down in recent months, they remain well above 2010 levels. Wage growth has also picked up, and with the job openings-to-applicants ratio at its highest level since 1992, further gains are likely. Crucially, many of the forces that have contributed to deflation, such as falling property prices and corporate deleveraging, have abated. Real estate prices are rising in most cities and Japanese corporations are sitting on more cash than their entire stock market capitalization. In comments filed in the U.S. International Trade Commission’s official review of the Trans-Pacific Partnership’s (TPP’s) impact on the overall U.S. economy, the Progressive Policy Institute highlighted the beneficial economic effects of the TPP’s groundbreaking provisions on small business trade, international e-commerce and the digital economy.

Threats

High-yield corporate bond stress could have unintended consequences because of the prevalence of "go anywhere," fixed-income funds that stretched for yield in recent years. Fund redemptions and retail selling of ETFs could spur self-fulfilling liquidation. Politics are becoming a headwind to risk assets in both Europe and the U.S. as populism ascends. The combination of Chinese equity/currency weakness and Fed hawkishness triggered the sharp, across-the-board selloff in risk assets last August, and the past week seems like a repeat performance, especially for currencies. Concerns about China and the Fed continue to pose material downside risks to the global economy and risk assets.

Gold Market

This week spot gold closed at $1,089.03, down $15.02 per ounce, or 1.36 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, fell 9.63 percent. Junior miners outperformed seniors for the week as the S&P/TSX Venture Index traded down 5.00 percent. The U.S. Trade-Weighted Dollar Index gained 0.38 percent this past week.

DateEventSurveyActualPriorJan-14U.S. Initial Jobless Claims275k284k277kJan-15U.S. PPI Final Demand YoY-1.0%1.0%-1.1%Jan-18China Retail Sales YoY11.3%--11.2%Jan-19Germany CPI YoY0.3%--0.9%Jan-19Eurozone CPI Core YoY0.9%--0.9%Jan-19Germany ZEW Survey Current Situation53.1--55.0Jan-19Germany ZEW Survey Expectations7.9--16.1Jan-20U.S. Housing Starts1200k--1173kJan-20U.S. CPI YoY0.8%--0.5%Jan-21Eurozone ECB Main Refinancing Rate0.050%--0.050%Jan-21U.S. Initial Jobless Claims280k--284k

Strengths

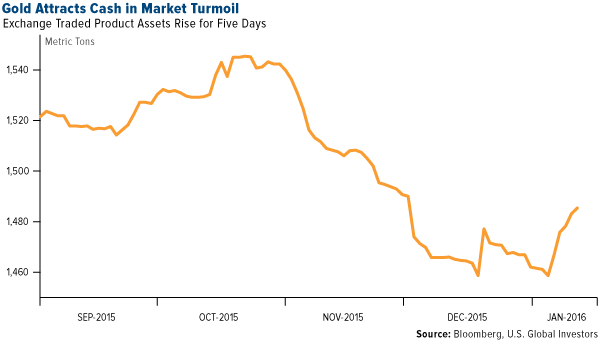

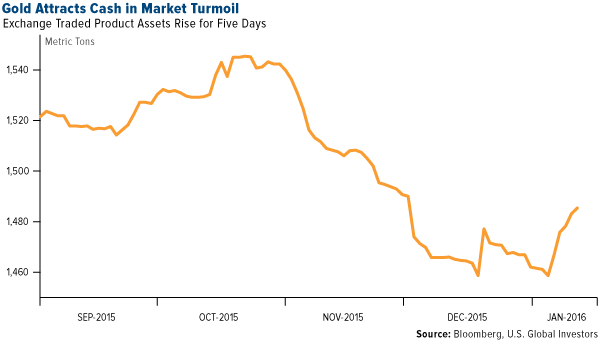

In a down week for most markets, silver fared the best, falling only 0.11 percent. There was no particular story supporting the move, but note that silver really didn’t fully participate in the precious metal rally last week and perhaps had less to lose. Over the past five days investors bought 26.8 metric tonnes of bullion through exchange-traded products backed by the metal, according to Bloomberg, the most since January 2015 as seen in the chart below. In addition, Reuters says gold and silver demand is off the charts; the U.S. Mint sold nearly as much gold on the first day of 2016 as in all of January 2015, with silver sales equally as astounding.

click to enlarge

HSBC believes that gold has “shrugged off” two bearish developments, a strong dollar and weaker commodity prices, announcing that they remain bullish on the precious metal. The group sees good emerging market demand, eventual dollar declines and central bank accumulation helping gold this year. As reported by Bloomberg, the FTSE/JSE Africa Gold Mining Index, which rallied 20 percent this year, has had the best start since 1995.

Weaknesses

Platinum faced the worst losses this week with a 5.75 percent price decline. Price action seemed to track the falling equity markets but in countries like South Africa and Russia, which have had falling local currencies, the incentive to continue producing remains attractive. Rubicon Minerals is having a rough start to the year, tumbling nearly 80 percent for the week, after a revised new resource estimate showed a significant decrease in metric tons and ounces compared to a 2013 report. Similarly, Royal Gold extended its drop (24.5 percent for the week) after an update on its Phoenix Gold Project, and Eldorado Gold tumbled 29.85 percent due to “Greek mining woes,” as reported by Bloomberg. The controversial Pebble Mine project, a proposed gold mine near Alaska’s Bristol Bay, was deemed an environmental risk by the Environmental Protection Agency which is moving toward a formal decision to bar mining operations there. The EPA, however, was questioned on its “misuse of authority,” according to the Washington Post, and now the group’s internal watchdog has announced there is “no evidence of bias in the agency’s efforts.” Critics who have followed the EPA’s review process noted that the EPA investigator did not consider a significant body of publically available information brought to light by the Congressional Science Committee that demonstrates clear instances of bias and predetermination.

Opportunities

Evercore ISI took a look at sectors they believe are candidates for being “exalted” in 2016, meaning those that have underperformed over the past several years, but could now perform in excess of their index. Of these “exalted” industries, gold makes the list. Jeremy Wrathall of Investec is quoted this week in Mineweb reinforcing ISI’s annual rotation picks, stating “we will see a very different mining industry in 12 months’ time…those who haven’t got debt will reshape the industry.” In its Technical Outlook 2016, UBS writes that the seven-year cycle in equities is rolling over and now it’s time to “buy gold.” The group warns investors not to be surprised by “record spikes in volatility over the next 12 to 17 months.” Adding to UBS’ rhetoric, U.S. Treasury Secretary Lawrence Summers is quoted in Bloomberg this week saying that “risks are substantially tilted to the downside,” when it comes to global commodity and stock markets. Jeffrey Gundlach, CEO of DoubleLine Capital and one of the first to predict the oil price crash in 2014, thinks that gold could surge this year. Gundlach believes that as investors look for safe haven assets in a volatile market, the precious metal could “soon climb” 30 percent higher from its current price, according to an article on StreetTalk.

Threats

Gold demand in India could take a hit this year as farmers are likely to reduce buying on account of a poor crop production this season, according to a CommodityOnline article. This could also mean that gold demand will see a dent during wedding season. Experts predict a 10 to 15 percent dip in purchases this year. According to Pranabesh Ray of the Xavier School of Management (during a conference on e-waste this week), 50 pounds of gold and 20,000 pounds of copper could be extracted from one million discarded cell phones if processed properly. “E-waste,” which comprises precious metals like gold and silver, can produce more gold than what is obtained through mining, according to a Bloomberg article recapping the conference. Bullion may drop to around $995 per ounce in the fourth quarter, according to Societe General’s Asia Head of Commodities Research Mark Keenan. During a Bloomberg TV interview this week Keenan reminded viewers that SoGen has been bearish on gold for some time.

Energy and Natural Resources Market

Strengths

Gold posted its biggest gain in six weeks on falling equity markets after investors lost confidence in Chinese authorities’ efforts to stimulate the market. U.S. equities tested the August 2015 lows on disappointing retails sales growth, giving way to gold to outperform based on its safe haven status. The best performing sector for the week was integrated oil. Despite oil prices collapsing to lows not seen since 2003, major integrated names held up better than other resources sectors, owing to their more robust balance sheets which allow them to weather the downturn for longer. The best performing stock for the week in the broader natural resource space was Cal-Maine Foods Inc., the largest producer of eggs in the U.S., as investors expect egg prices to inch higher following the confirmed presence of a new breakout of avian influenza in Indiana.

Weaknesses

U.S. oil production rose to 9.23 million barrels per day last week, a fresh four-month high with VTB Capital reporting that lenders are pushing producers to maximize output to keep-up interest payments, even when losses continue to mount. According to the Wall Street Journal, it is estimated North American oil and gas companies are losing nearly $2 billion every week at current prices. The worst performing sector for the week were major miners after signs of a slowdown in China sent copper down sharply, to a fresh six-year low. The weakness intensified after BHP announced a major write-down, leading investors to question the sustainability of the high dividends in the space. The worst performing stock for the week in the S&P Global Natural Resources Index was First Quantum. The Canadian-listed copper miner slumped as copper prices fell below $2 per pound as weaker demand in China is met with excess supplies.

Opportunities

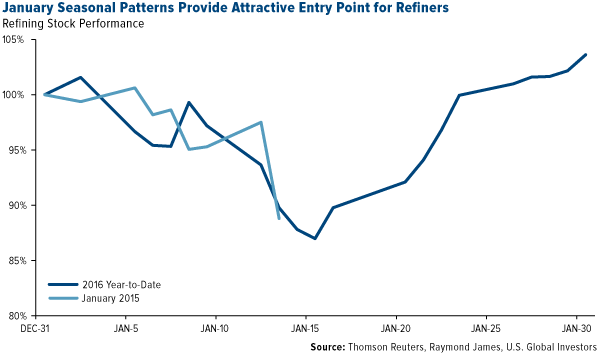

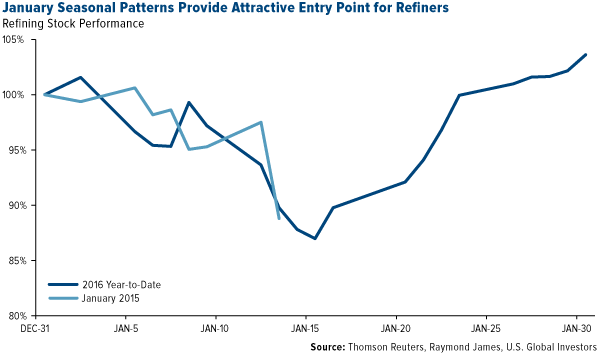

The recent selloff in the refining space should be seen as a buying opportunity. According to Raymond James analysts, the chart below highlights how similar this year’s refining performance has been to 2015, with refining stocks setting lows in mid-January before rallying through much of the year. Further to this, gasoline crack spreads have remained at double-digits in January, implying higher profitability for the space than at this same time last year.

click to enlarge

China commodity imports rose to near-record highs in December as prices for raw materials weakened to their lowest prices since 2008. Data showed oil imports rose 9.3 percent, a new record high, while copper imports increased 9.3 percent to the second highest reading on record. While some of the growth has been attributed to strategic stockpiling, it may also suggest better demand from the world’s biggest consumer. The long-term outlook for oil supply and demand has improved, as Wood Mackenzie estimates 68 major projects worth an expected 27 billion barrels of oil were cancelled during 2015. Furthermore, the consultancy company estimates the average breakeven costs for major projects sits at $60 per barrel thus making it unlikely for the new projects to be initiated under current prices.

Threats

BHP Billiton, a leading mining and energy company, booked a $7.2 billion write down on the value of its U.S. shale assets, as it accounts for major declines in oil and gas prices. The write down sparked fears that most other major mining and energy companies could be forced to reassess their reserves and resources at lower commodity prices, which could trigger a sequence of write downs in the space. Crude prices fell to fresh lows this week on prospects of Iran quickly increasing oil export volumes to an already oversupplied market. The sanctions on Iran could be lifted as soon as next week, opening the way for an additional 500,000 barrels per day to hit the markets almost immediately. Soybean margins have slumped to the lowest level in more than two years as a record U.S. harvest flooded the market. Fertilizers have also seen price declines as weaker farmer economics limit demand growth for agricultural chemicals.

China Region

Strengths

The Indonesian rupiah held up well this week, strengthening by 0.38 percent. The Jakarta Composite Index is among the strongest in the region over the last quarter. After largescale intervention by the People’s Bank of China (PBOC) in foreign exchange markets to try to stabilize the yuan earlier in the week, the Chinese government backed off toward the end of the week, which may have avoided roiling markets further. Wynn Resorts Ltd. rose about 13 percent in U.S. trading today after the casino operator reported better than expected results. Macao earnings at Wynn came in ahead of estimates, and may be a sign of better things to come for Macao.

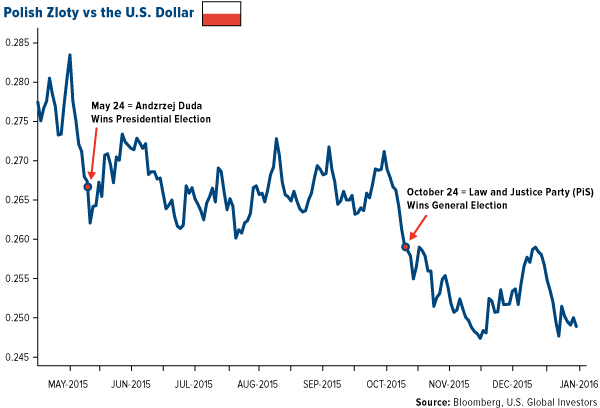

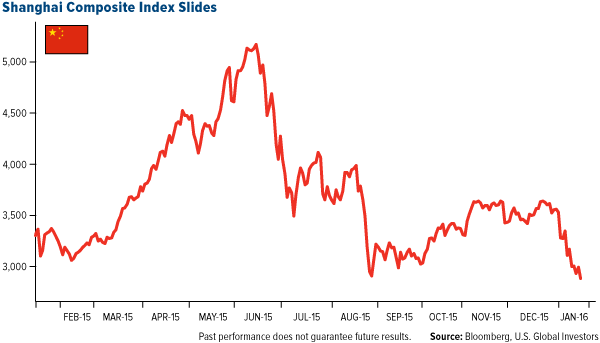

Weaknesses

The Shanghai Composite Index entered a technical bear market—for the second time in a year—and finished the week with its lowest close in more than 52 weeks. The Hang Seng Composite Index made new 52 week lows.

click to enlarge

New loans for December in China came in much weaker than expected, at only 598 billion yuan versus much higher analyst expectations of 700 billion yuan. The Hong Kong dollar weakened by 40 basis points this week, and while investors may not fear Hong Kong’s ability to maintain its longstanding peg to the U.S. dollar in the near future, the foreign exchange movement garnered attention as a possible sign of capital outflows from the Chinese mainland, which could itself distressingly signal a potentially-diminished ability of the PBOC to stabilize the yuan going forward.

Opportunities

China will release its fourth quarter GDP data on Monday. Analyst expectations are for 6.9 percent, in line with China’s third quarter GDP number. A decent GDP print may lead Chinese markets to bounce in relief. The people of Taiwan will go to the polls tomorrow and vote on whether the Democratic Progressive Party (DPP) Chairwoman Tsai Ing-wen will become Taiwan’s first female leader. Tsai Ing-wen is pitted against the ruling Kuomintang (KMT) party’s Eric Chu, who is the mayor of New Taipei City. While the DPP officially supports independence from China, the KMT has maintained closer ties to the Chinese mainland. In any case, the Taiwanese market and people should soon have some resolution. The rapidity and scale of the recent global selloff means that numerous equities markets are heavily oversold in the very short term, and may present opportunity for a regional rebound.

Threats

Investor chatter and expectations of possible forthcoming stimulus from the Chinese government may make for expectations that run too high, and could be easily disappointed. Largescale foreign exchange intervention by the PBOC, another technical bear market for Shanghai, and a recent global equities rout may collectively mean that additional negative news or missed expectations weigh more heavily upon markets, especially in China, where the Shanghai Composite is now sitting precariously upon its 52 week lows. Jakarta suffered a terrorist attack this week in which multiple people were killed and several handfuls more were wounded. That ISIS claimed responsibility for the attack raises more concern about the expanding reach of that sinister group. Taiwanese election results might yield significant potential changes in Taiwanese government policy, the effects of which may not be anticipated fully.

Emerging Europe

Strengths

Turkey was the best-performing market this week, gaining 64 basis points. The country revised up its gross domestic product (GDP) forecast to 4.5 percent in 2016 and 5 percent in 2017. Its budget deficit should stand at 1.3 percent in 2016 and 1 percent in 2017. The Hungarian forint was the best-performing currency this week, gaining 2.8 percent against the dollar. November’s trade surplus data, just published by the Central Statistical Office, reached 673 million euros. Exports were up 6.5 percent year-on-year, and imports gained 7.7 percent in November year-on-year, in euro terms. The utilities sector was the best-performing sector among Eastern European markets this week.

Weaknesses

Russia was the worst-performing market this week, losing 8 percent. The Russian Ministry of Economic Development revised down its outlook for 2016. Country GDP is expected to contract 0.8 percent instead of the earlier estimate of 0.7 percent growth. The revised outlook is based on the oil price assumption of $40 per barrel. Brent crude oil declined 15 percent in the past five days and closed below $30 per barrel. The Ukrainian hryvnia was the worst-performing currency this week, losing 4.3 percent against the dollar. Conflict with Russia put pressure on the economy and currency. Ukraine exited a year-and-a-half slump in the third quarter, but a Bloomberg survey now puts the chance of another recession in 2016 at 60 percent. The consumer staples sector was the worst-performing sector among Eastern European markets this week.

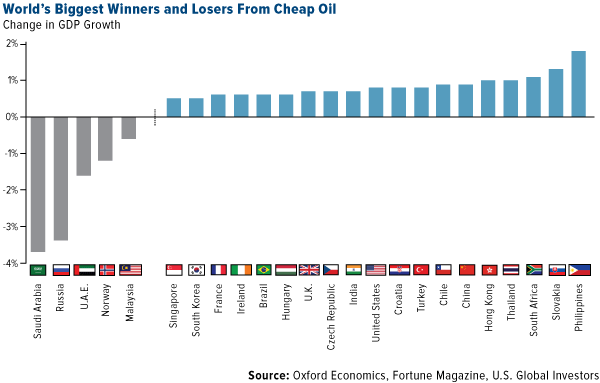

Opportunities

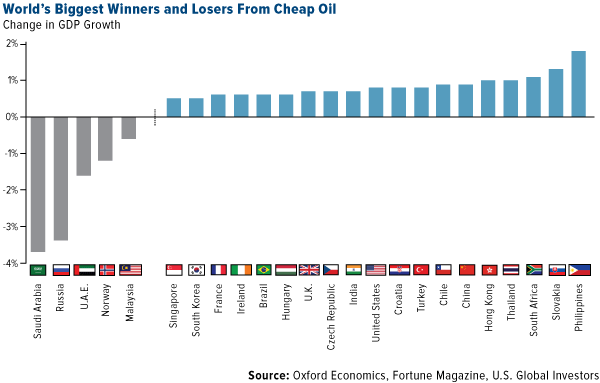

Central emerging European markets will benefit from cheap oil prices as they are net importers of the commodity.

click to enlarge

Intra-week Polish stocks surged the most in more than two years after a newspaper reported Finance Minister Pawe? Sza?amacha doesn’t plan any changes to the country’s pension fund system. Pension reform took place two years ago when the government moved half of privately-owned OFE (“Otwarty Fundusz Emerytalny”) funds into government-owned pension fund ZUS (“Zaklad Ubezpieczen Spolecznych”), lowering its debt-to-GDP ratio. The eurozone’s December purchase manager’s index (PMI) data will be released next week and is expected to stay at the 53 level, well above 50 that separates growth from contraction.

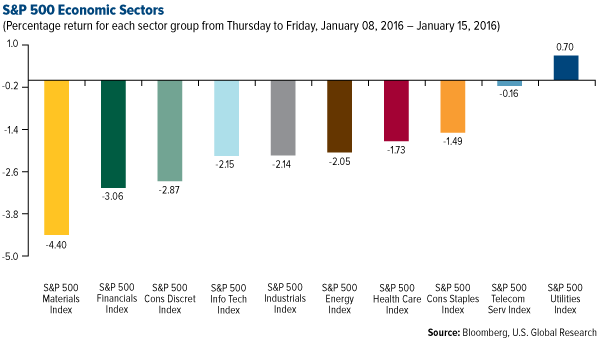

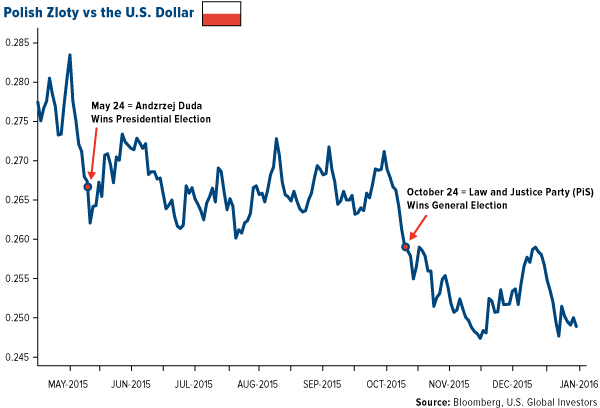

Threats

The European Commission launched a preliminary review into whether Poland violated the European Union’s rule-of-law standards in the recent months since the new government took majority seats in the general election last October. In December, Poland’s new ruling party, Law & Justice, took steps to get influence in the constitutional tribunal, which should be independent from the power to block government legislation. Critics say the current ruling party’s steps threatened democracy and put pressure on Polish equites and the zloty.

click to enlarge

Russian Economic Development Minister Alexey Ulyukaev said that the state should think about privatizing Sberbank and VTB Bank. According to HSCB, there might be two reasons behind the increased privatization efforts now. First, according to Finance Minister Anton Siluanov, the Russian budget balances at an oil price of $82 per barrel, and second, Russian companies may decrease oil exports this year, weakening its positions on global markets. Another tragic suicide bomber attack took place in Turkey. A Syrian suicide bomber reportedly arrived in Turkey as a refugee only seven days prior to the attack. Among the detained suspects are three Russians.