Written by: Brandon Rakszawski

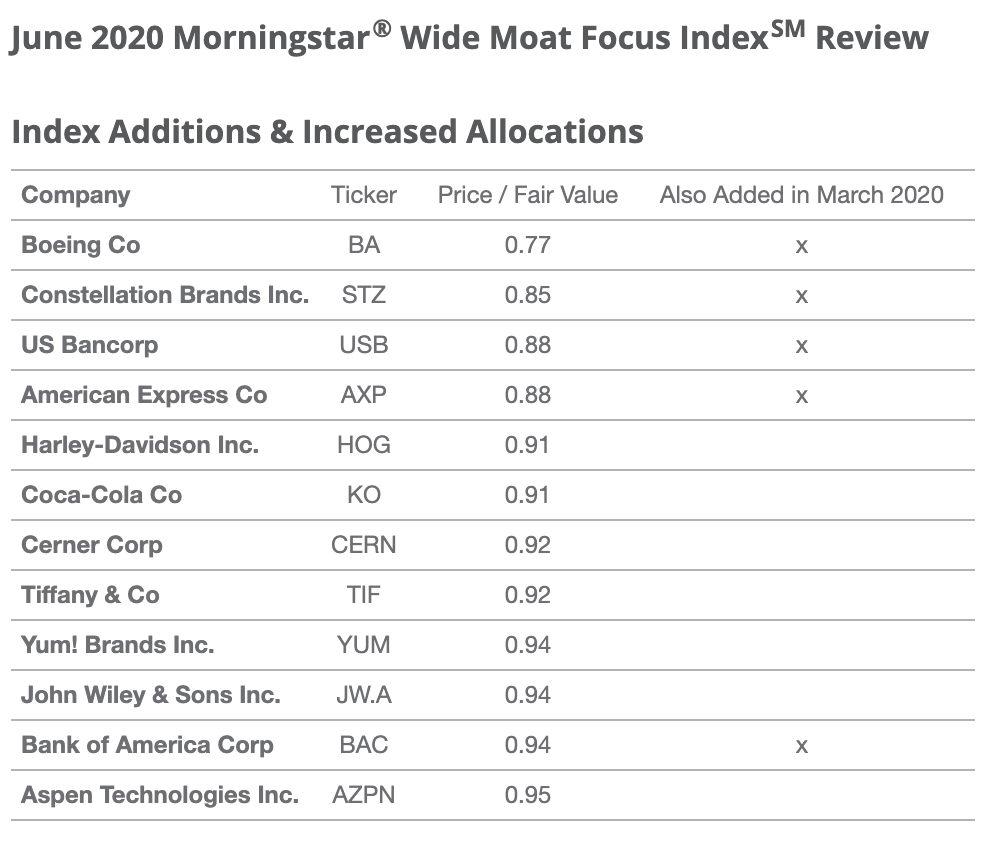

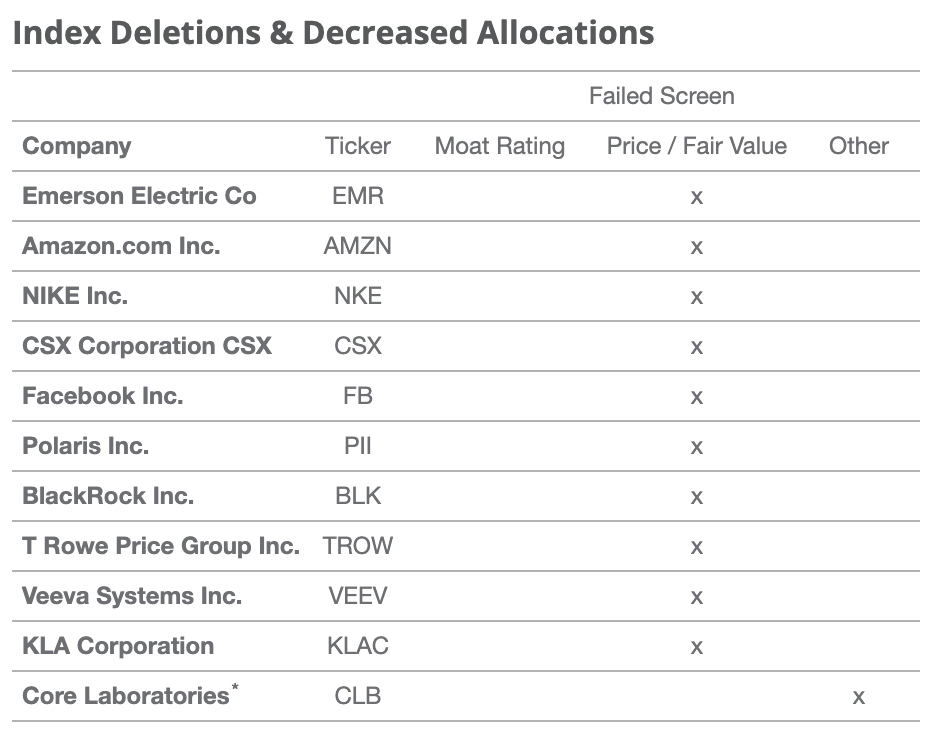

The Morningstar® Wide Moat Focus IndexSM (the “Index”) completed its quarterly rebalance and reconstitution on Friday, June 19, 2020. Several trends emerged as new names entered the Index and other big name companies saw their position dialed back. Many of the stocks that Morningstar identified as undervalued and added to the Index in March 2020 continued to feature attractive valuations, resulting in an increase to their weightings this quarter. Also notable, exposure to FAANG (Facebook, Apple, Amazon, Netflix, and Google) stocks was further reduced in the Index from an already low level.

FAANGs Out

Impressive performance resulted in unattractive relative valuations for Amazon (AMZN) and Facebook (FB) during the second quarter Index review. Both companies’ index weight was effectively cut in half following strong returns year-to-date.

FAANG stocks have received more than their share of investor and media attention in recent years as they have, at times, contributed to an outsized portion of the broad U.S. stock markets’ returns. The Index has naturally been underweight these stocks relative to most broad U.S. market indexes. Morningstar equity research analysts have assigned Apple (AAPL) and Netflix (NFLX) a narrow moat rating, leaving both ineligible for inclusion in the wide moat-only Index. Google, or Alphabet, Inc. (GOOGL), was included in the Index as recently as December 2019, but was removed as the company became too pricey relative to other eligible wide moat companies. Despite being underweight these stocks, the Index has maintained an impressive near- and long-term track record.

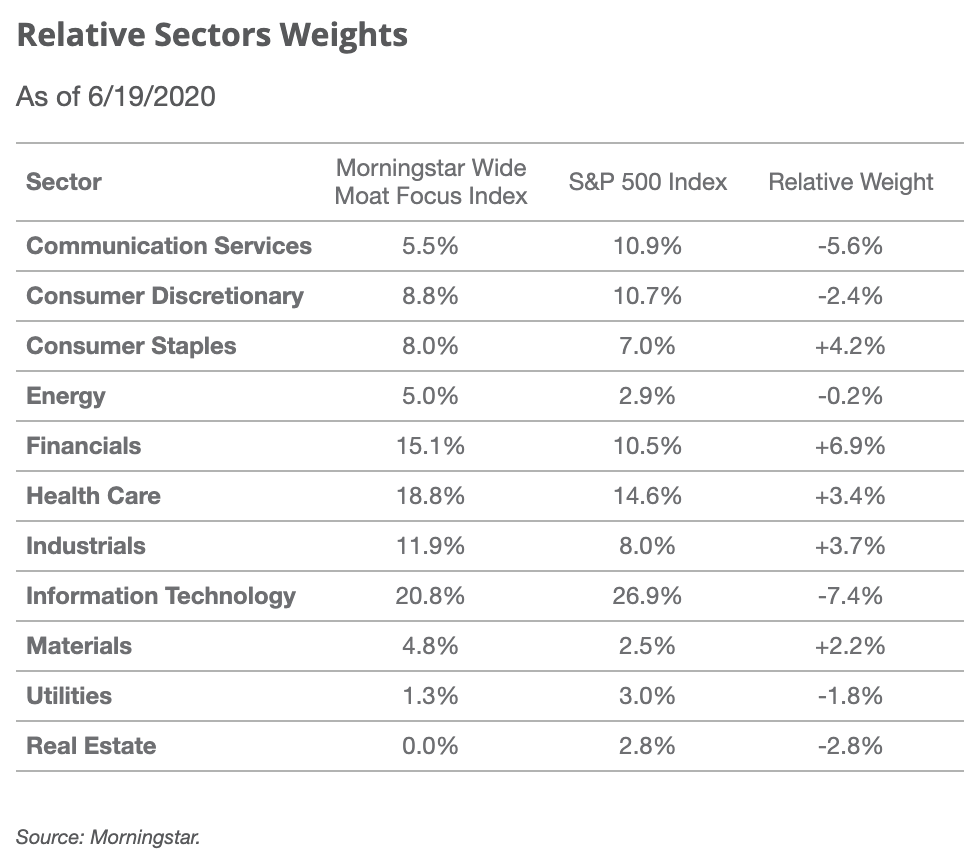

Communications services and information technology are currently a combined 13% underweight relative to the S&P 500 Index, signaling the increasing valuations among these companies and growth-oriented sectors broadly speaking.

Consumer Brands In

Several highly recognizable consumer brand companies were added to the Index this quarter. These companies are consumer reliant, global, and have been impacted by the COVID-19 induced economic slowdown.

- Coca-Cola Co. (KO): Coca-Cola entered the Index for the first time since 2014. The beverage company has long benefited from its strong brand (intangible assets) and cost advantages and is currently trading at a 15% discount to fair value as of June 23, 2020, according to Morningstar. Morningstar’s equity research team sees long-term value in Coca-Cola shares despite limited near-term visibility on potential COVID-19 impact on revenue.

- Tiffany & Co. (TIF): Tiffany has a classic intangible asset source of economic moat, allowing it to charge more for a piece of jewelry because of its historic brand and iconic blue box. Despite this strong wide economic moat, the company has only been in the Index for three quarters since its launch in 2007, all in 2016. According to Morningstar, 95% of the jeweler’s brick and mortar locations in the Americas and Japan and 85% in Europe were closed at the end of its latest reporting quarter. However, 85% of Asia-Pacific stores have been partially or fully reopened. As of June 23, 2020, Tiffany was trading slightly below fair value as it works toward the completion of its acquisition by LVMH, the premium of which is reflected in Morningstar’s current $135 fair value estimate.

- Yum! Brands (YUM): Yum’s last and only time in the index was for two quarters in 2017. Another company that is facing COVID-19 related pressure, Yum was trading at a 14% discount to fair value on June 23, 2020 despite a reduction to its fair value estimate from $110 to $102 per share in mid-March. Morningstar believes Yum is well-positioned to survive, and even thrive, following the COVID-driven downturn. “We see near-term pressures as temporary and believe Yum is well-positioned to compete for market share ceded by smaller independent restaurant closures following coronavirus-related disruptions,” noted Morningstar consumer strategist R.J. Hottovy in a June 15, 2020 analyst note.

Below is a summary of the stocks added and removed in this quarter’s review. Click here for a full recap of the review

*Dropped from parent index due to market cap requirement. Source: Morningstar. Price/fair value data as of June 9, 2020. Past performance is no guarantee of future results. For illustrative purposes only.

VanEck Vectors Morningstar Wide ETF (MOAT) seeks to replicate as closely as possible, before fees and expenses the price and yield performance of the Morningstar Wide Moat Focus Index.

Related: Mobile Gaming: Innovation in Action