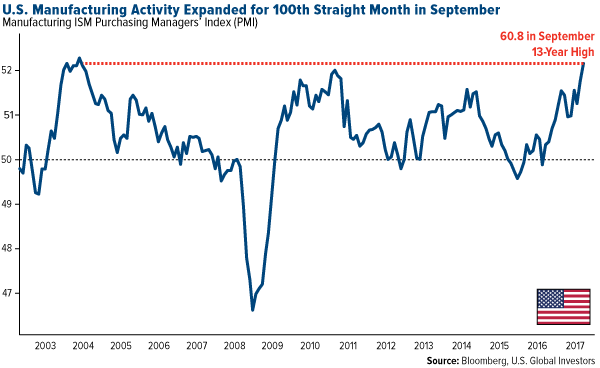

American manufacturers grew at their fastest pace since May 2004 in September, according to the Institute for Supply Management (ISM).

Manufacturing activity, as measured by the ISM Purchasing Managers’ Index (PMI), expanded for the 100th straight month, climbing to a 13-year high of 60.8. The higher above 50, the more rapid the acceleration.

Not only is this reflective of a strengthening U.S. economy, but it also supports demand for commodities going forward.

With construction spending also up in the U.S., I think the time could be ripe for investors to consider increasing their allocation to energy, natural resources and basic materials.

According to the ISM report, growth was fastest in prices, which rose 9.5 percentage points from the August level. Factories reported having to pay higher prices for materials including textiles, plastics, wood products, chemical products and more. Other areas that saw rapid expansion were supplier deliveries, up 7.3 percentage points in September, and new orders, up 4.3 percentage points.

Hurricanes Harvey and Irma disrupted supply chains in August and September, prompting companies to stockpile goods as a precautionary measure. This likely lifted the already-impressive ISM reading somewhat, but it doesn’t change the strong fundamentals that underlie the U.S. economy in general right now.

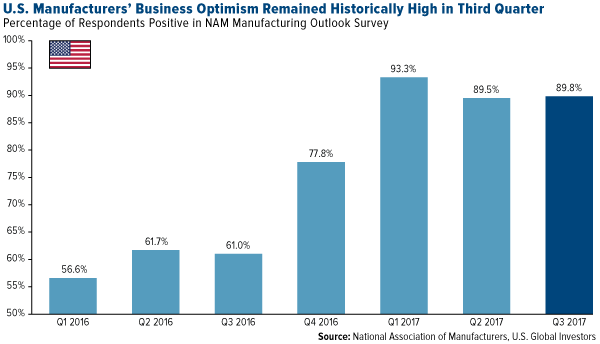

Optimism Among Manufacturers Historically High

Manufacturers’ optimism remained historically high during the September quarter, with nearly 90 percent of those surveyed by the National Association of Manufacturers (NAM) saying they expected to see strong industry growth over the next 12 months. That reading’s up more than 28 percentage points compared to the same quarter last year.

In the March quarter following the U.S. election, the survey rose to the highest level in its 20-year history as manufacturers expressed optimism in President Donald Trump’s plans to lower corporate taxes and streamline industry regulations. Although the reading has cooled since then, optimism still remained at historically high levels during the quarter.

Related: Is Another Crisis in the Works? Gold Stocks Could Be a Safe Haven

Other Regions Showed Marked Improvement

The U.S. wasn’t the only region that made strong gains. Manufacturing activity in the world’s two other major economies, China and the eurozone, surged in September. China’s official manufacturing PMI rose to a five-year high of 52.4, representing the 14th straight month of expansion and beating analysts’ expectations.

Chinese manufacturing profits are among the highest in years, spurred by government spending on infrastructure, higher prices and stronger exports.

The eurozone PMI, meanwhile, climbed to a 79-month high of 58.1 in September, with output and new orders expanding in all eight of the ranked countries. Backlogs of work reached its steepest acceleration in over 11 years. Even Greece, which has struggled to come out from under mountains of debt, registered a 52.8, a 111-month high.

All of this could be a tailwind for companies engaged in the production of natural resources and basic materials. Such companies make up a little over 60 percent of our Global Resources Fund (PSPFX). We believe energy companies also stand to benefit from increased manufacturing activity, make up close to 20 percent of the portfolio.