Written by: Jordan Jackson

At its final meeting of 2023, the Federal Open Market Committee (FOMC) voted to leave the Federal funds rate unchanged at a target range of 5.25%-5.50% and strongly hinted it is finished hiking interest rates this cycle. There were notable adjustments to the statement language that were decisively dovish. First, the statement acknowledged the slowing pace of economic activity relative to the boomy third quarter growth reading. Second, it highlighted that inflation “has eased over the past year” acknowledging the disinflationary trend but still cited the current run rate as elevated. Lastly, and perhaps most notably, it added the word “any” to the phrase, “in determining the extent of any additional policy firming” all but sealing the deal of no further rate increases this cycle.

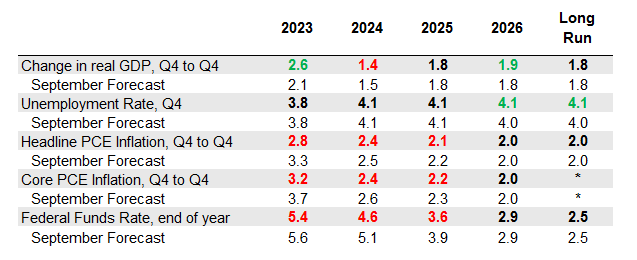

Updates to the Summary of Economic Projections (SEP) further signaled a more dovish outlook for policy rates in the year ahead. Relative to the committee’s September forecast:

- Real GDP growth was upgraded to a strong 2.6% for 2023, and modestly reduced by 0.1% to 1.4% in 2024.

- Unemployment rate projections were broadly unchanged.

- Both headline and core personal consumption deflator (PCE) projections were lowered from 3.3% and 3.7% to 2.8% and 3.2%, respectively for 2023. Moreover, both headline and core inflation were adjusted lower to 2.4% by the fourth quarter of 2024.

- Policy rate projections (dot plot) signaled no further adjustments this year and one additional rate cut in 2024, bringing expected cumulative cuts to three in 2024. Moreover, no committee member anticipates any further hikes over the forecast period.

It’s apparent the dovish shift in policy expectations have been driven by the improvement in inflation and while the committee may still be uneasy about the level of inflation, it seems confident the disinflation trend will continue into next year allowing the Fed to hold rates steady. At the press conference, Chairman Powell emphasized that the committee views current policy rates as restrictive which should allow inflation to return to trend over time. That said, the committee will be cautious about cutting interest rates prematurely if growth remains strong and labor markets remain tight.

Following today’s announcement, investors can breathe a sigh of relief now that the Fed is done raising interest rates. Indeed, equites bounced, and yields fell based on a more accommodative interest rate outlook next year. Looking ahead, it is reasonable to expect that the balance of risks in 2024 are now skewed towards the impact higher rates will have on growth and labor markets, not necessarily inflation. That said, the past two years have shown that inflation can come down even with tight labor markets and above trend growth, and should that dynamic continue into next year, a less restrictive monetary policy stance should allow for a soft landing in the U.S. economy.

FOMC December 2023 Forecasts

Percent

Source: Federal Reserve, J.P. Morgan Asset Management. Data are as of December 13, 2023.

Forecasts of 19 FOMC participations, median estimate. Green denotes an adjustment higher, red denotes an adjustment lower. * Longer-run projection for core PCE inflation are not collected.

Related: What Is the Market Outlook for 2024?