Written by: Stephanie Aliaga

The economy and the stock market are not always playing to the same tune. In today’s financial market ensemble, a stable economy plays a familiar melody with some nuance around rate cuts. Meanwhile, AI has staged a dramatic crescendo—perhaps lasting too long for comfort.

The S&P 500 is up a stellar 45.8% since the start of 2023, but subtracting just one name from the index, Nvidia, cuts that return to 37.4%. Subtracting the top 5 names further reduces that return to 23.4%. While impressive tech performance has boosted the overall market, excessive stock rallies and 31 new all-time highs this year have raised concerns about a potential bubble.

However, there are reasons to believe this isn’t the case.

- Risk appetite. During the dotcom bubble, rampant speculation surrounded young companies flaunting internet excitement before profitability. In contrast, today’s AI beneficiaries are already very profitable companies that make their money selling key infrastructure and resources to the rapidly growing market of AI adopters. Additionally, interest rates are high, IPOs have slowed to a trickle and global VC investments have fallen from their peak in 2021[1]. While bullish sentiment has surely provided a boost[2], the impact of earnings upgrades is likely more significant—the Mag 7 posted a remarkable +50% y/y earnings growth in 1Q24[3].

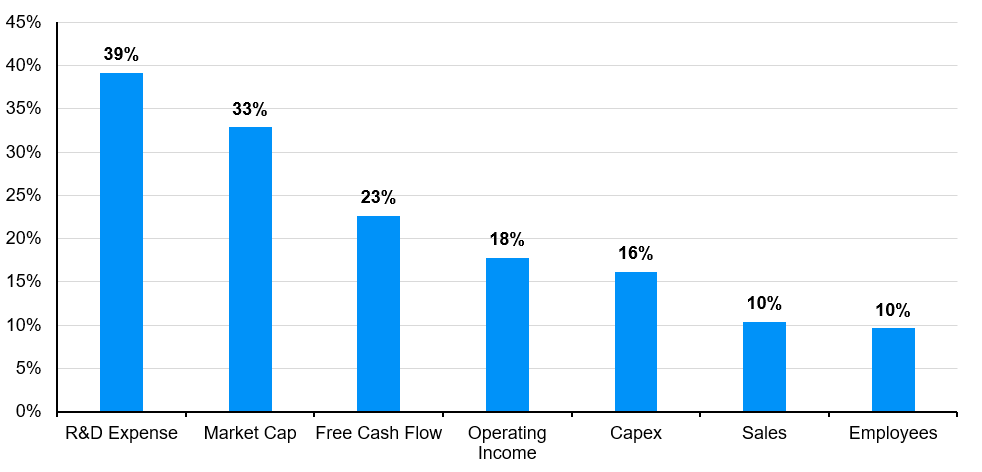

- Fundamentals. The Mag 7 account for a sizable 33% of market cap, but they also account for 39% of R&D spending, 23% of free cash flow and 16% of capex (see chart). The strongest are getting stronger, but they’re fueled on veggies and complex carbs, not short-term stimulants.

- Shareholder return. The recent boost in shareholder return can also be attributed to tech strength. Certain mega-cap tech companies have announced substantial share buyback programs or first-ever dividend payouts this year. These announcements have contributed to a 6% increase in S&P 500 shareholder payout in 1Q24, and the S&P return-on-common-equity stands at a solid 18.5%.

Still, there are reasons to be cautious. Markets have a tendency to over appreciate the near term and under appreciate the long term. We think AI will lead to all sorts of business transformation and productivity gains in the long term, but recent performance has been driven by significant upgrades in near-term AI demand projections. If demand cools off unexpectedly, perhaps because the economy deteriorates, geopolitics, or capacity constraints become a binding factor, such projections could be overly optimistic. Further, pricing discovery is in its nascency and the costs to run complex LLMs are still massive. Once ChatGPT becomes integrated to your iPhone, how much would you pay for the premium subscription? How much should a small business pay for Microsoft’s CoPilot suite? If we moved the 9 billion daily searches in Google onto Chat-GPT today, could we supply a 10x increase in electricity demand[4]?

The alarm bells may not be ringing like the dotcom bubble. Concentration today appears to showcase corporate resiliency and companies that are at the forefront of growth, but questions abound whether recent performance can be sustained. As such, investors can still enhance diversification by exploring overlooked areas of the market, within and outside of the AI value chain, that have strong fundamentals.

Market concentration is an issue of economic concentration.

Magnificent 7 stocks, % share of S&P 500 on specific metrics

Source: Bloomberg, J.P. Morgan Asset Management. Magnificent 7 includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA and TSLA. Data are as of June 21, 2024.

Related: Investment Implications of MORENA’s 2024 Landslide Victory

[1] 2024 Stanford AI Index Report. See Guide to Alternatives, page 61.

[2] In Bank of America’s latest Global Fund Manager Survey, investors were most bullish since Nov. 2021 and the most overweight stocks since Nov. 2022, but sentiment was not yet extreme. The Mag 7 is a very crowded trade at 69% but investors have been trimming exposure—tech allocations have fallen to 20% overweight, off a 36% peak in Feb. 2024.

[3] See Guide to the Markets, page 11.

[4] IEA, Electricity 2024 report.