Written by: David Lebovitz

Equity market volatility has picked up over the past few weeks, but the real story has been about the move in interest rates. The 10-year U.S. Treasury yield, which started the year at 3.79% and touched a low of 3.30% in April, recently hit its highest level since 2007 at 4.81%.

In general, the Federal Reserve (Fed) can control interest rates at the short end of the curve, but the global economy dictates the direction and level of long-term rates. Furthermore, changes in interest rates can be explained by changes in expected inflation and changes in real interest rates. Peeling back the onion a bit further, the term premium – which is meant to represent the additional income an investor would receive that cannot be explained by expected changes in monetary policy (i.e. changes in inflation, growth, fiscal policy, etc.) – has turned higher for the first time in two years.

Underpinning this move have been several factors, as economic growth has proven more resilient than expected in the face of higher interest rates, and the Federal Reserve has reiterated that yields are likely to stay higher for longer. More recently, the culprit of higher yields has been investors’ realization that structurally higher deficits are going to need to be financed at much higher rates, raising questions about debt sustainability. Furthermore, energy prices have moved sharply higher due to constrained supply, adding to uncertainty about the trajectory of growth, inflation and therefore interest rates.

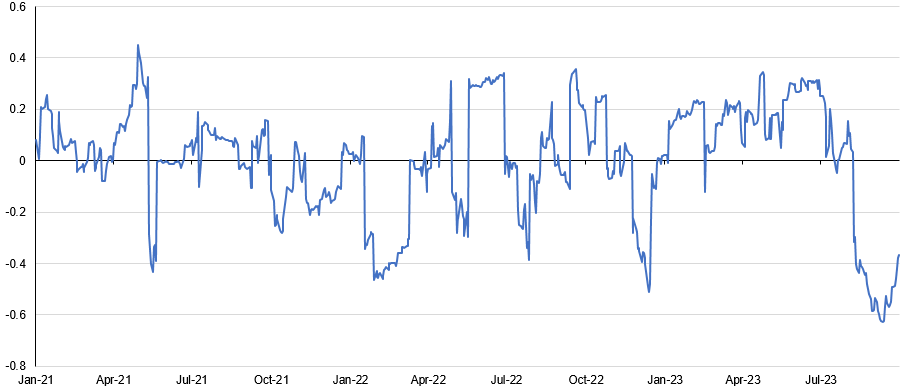

As rates have moved higher risk assets have found themselves under pressure, with the S&P 500 down more than 7% from its July 31st high of 4,589. To an extent, this price action has been driven by a shift in investor psychology whereby “good news” is now “bad news.” Put differently, better than expected economic data has forced investors to temper their expectations for Fed rate cuts next year; as shown in the chart below, the correlation between the S&P 500 and the Citi Economic Surprise Index (which measures whether economic data has been coming in above or below consensus estimates) has been in negative territory since the beginning of August.

Looking ahead, it seems reasonable to expect that volatility will remain elevated, and could potentially increase further, as investors try to determine what is in the cards for next year. The bottom line is that the distribution of potential outcomes is rising, suggesting a cautious approach to asset allocation may be warranted.

Good news is bad news

30-day rolling correlation between Citi Economic Surprise Index and S&P 500

Sources: Standard & Poor's, Citi, FactSet, J.P. Morgan Asset Management. Data are as of October 4, 2023.