Written by: Nate Tonsager

It’s increasingly looking like a soft-landing for the U.S. economy. While most people have been hesitant to give the Fed credit, I went a different direction and have been singing their praise for months.

If you’ve been following my posts, you’ll remember that at the end of September and in mid-November, I dove into the data to explain why I felt a soft-landing seemed likely. Fast forward to today and a soft-landing has arguably become the market consensus thanks in part to the recent data.

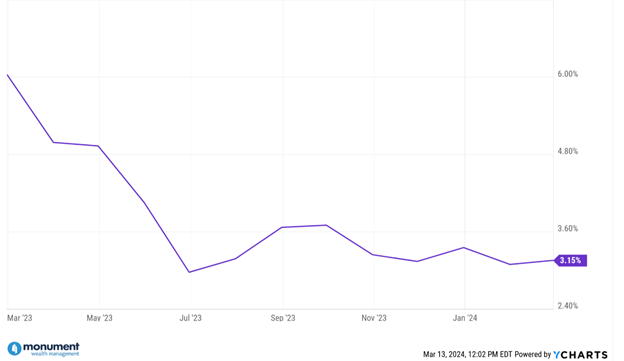

Let’s look at the inflation data from earlier this week:

The chart below shows that the annual CPI inflation rate is now down to 3.15% in February 2024 after clocking in at just over 6% this time last year.

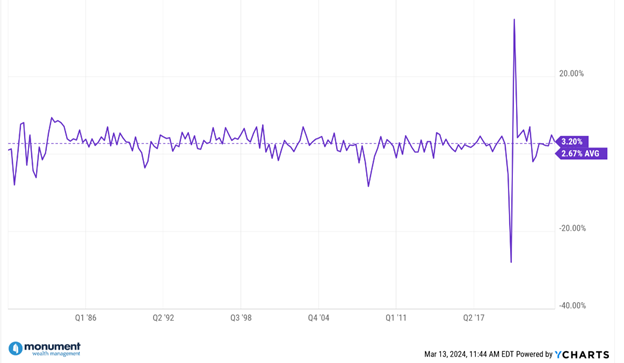

This next chart below shows how the decline in inflation coincided with a 3.20% real GDP growth rate for the U.S. in calendar year 2023. For context, the average GDP growth rate going back to 1980 is 2.67%, so 2023 experienced above average growth.

This is exactly what you’d expect to see in a soft-landing scenario: strong economic growth with a falling inflation rate. A true “chef’s kiss” moment for economists.

But when you think about it – this seems counterintuitive.

The Fed has been actively trying to slow down economic growth by aggressively hiking interest rates, which in theory should lead to lower inflation. Well, they got the lower inflation they wanted, but where are the negative economic effects that normally come from higher interest rates?

I’m confident the impacts from a restrictive Fed are being felt and parts of the economy are indeed slowing down, but overall, the U.S. GDP data has remained solid. Even though the most recent GDP report didn’t point towards an impending recession, some investors still feel like one is coming.

But to me it seems there are bigger forces out there contributing to our recent economic strength and our real GDP growth – notably productivity gains.

The Two P’s of GDP: Population and Productivity

There are numerous complex inputs that go into calculating a country’s real GDP, but if you’re trying to look at where its GDP is headed, I personally like to focus on a couple of key factors: #1. Population and #2. Productivity.

GDP measures the total value of goods produced and services provided in a country, and a healthy economy has sustainable GDP growth. To oversimplify, if you want to increase your GDP, you either need more people doing/making more stuff, or you need your current workforce to produce stuff/do work more efficiently. Again, for me it always comes back to the two P’s, Population and Productivity, when trying to quickly assess a country’s potential GDP.

A Productive 2023 for the U.S.

Strong, above-average productivity in 2023 seems to be a key reason why the economy has been so resilient in the face of higher rates and a restrictive Fed.

When you look at the U.S.’s 2023 real GDP report, the growth we saw was partly driven by large gains in productivity. There is an official productivity measure calculated by the U.S. Bureau of Labor Statistics (BLS) that attempts to measure the economic output per hour worked from a U.S. worker. You can check out the BLS methodology here, but in short, it’s best at helping investors track changes in worker output per hour over time and through history.

The most recent report came out last week and saw U.S. productivity increase by 2.6% in 2023, which was above both the recent 5-year average of around 1.8% and the historical average of around 2.1% going back to 1948.

Even with the drags from monetary policy, U.S. companies and workers were able to generate more output while using less resources in 2023. It’s impossible to pinpoint exactly where the increased productivity came from, but anecdotally I think it’s easy to explain: the AI revolution has begun.

The Productivity Benefits of AI

It’s no surprise that a major driver of productivity gains in the past have come from new technologies and innovations. Today we seem to be on the precipice of the next generational technology shift with AI. It’s likely going to take decades to truly maximize the benefits of AI—so buckle up.

For all the negative press the AI-boom has gotten, it seems like the benefits and efficiencies are finally starting to show up in the real economic data, and frankly, they are coming at a great time. They appear to be helping offset some of the negative impacts from Fed rate hikes and are supporting the soft-landing narrative.

Looking ahead I think there’s also the potential for continued productivity gains that would remain a tailwind for the U.S. especially since we appear to be in the early innings of the AI-era. There seems to be endless possibilities for even more widespread future productivity growth as each company and industry implements AI in their own unique way.

For example, here’s how AI has begun to affect the insurance industry. This clip is only talking about the changes for a single industry, but I feel confident in saying this is happening everywhere. In my opinion, every job, company, and country will become more efficient thanks to AI.

When used responsibly, AI can help you be a better problem-solver and be incredibly more productive. And, as I’ve written about before , it can boost collaboration between man and machine and enhance creativity.

Man & Machine Working Together

I’ve repeatedly called for the Fed to get some praise for what they’ve accomplished so far, but I think it’s time to spread the love.

AI and the efficiencies they create have helped make a soft-landing for the U.S. economy possible by providing a significant boost to worker productivity. I hope this trend continues – and I think it can.

Productivity gains like this will be a key driver in helping boost our economic growth into the future. A more efficient and productive economy is one poised for growth.

Related: Analyzing Market Movements: A Simple Examination of the 200-Day Moving Average